May 2016 Q2 a.

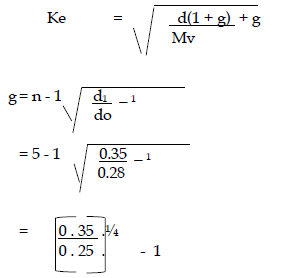

Joebel Limited is a diversified company operating in different industries on the African Continent. The shares of the company are widely traded on the stock exchange and currently has a market of GH¢3.20 per share. The company’s dividend payment over the last five years are as follows:

Year Dividend Per Share (DPS)

. (GH¢)

2015 0.35

2014 0.32

2013 0.30

2012 0.29

2011 0.28

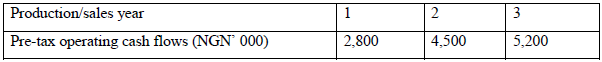

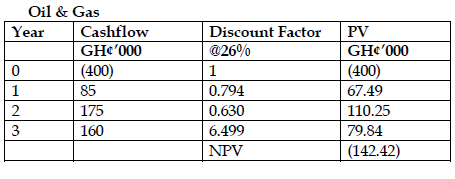

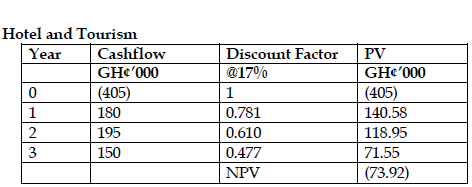

The Board of Directors of Joebel Limited are currently considering two main investment opportunities: one in Oil and Gas sector and the other in the Hotel and Tourism Sector. Both projects have short lives and their associated cash flows are as follows;

Year Oil & Gas Hotel & Tourism

. GH¢’000 GH¢’000

1 85 180

2 175 195

3 160 150

The investment in Oil and Gas would cost GH¢400,000 while that in Hotel and Tourism would cost GH¢405,000.

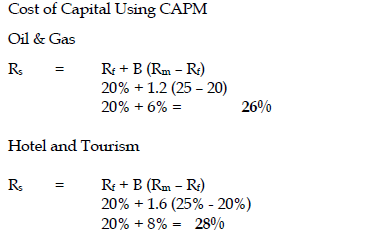

The Management of the Company has identified the industry beta of Oil and Gas and Hotel and Tourism as 1.2 and 1.6 respectively. However, a research conducted by management revealed that Joebel Limited’s beta is 1.5. The average return on the companies listed on the stock exchange is 25% and the yield on Treasury bill is 20%.

Required:

i) Compute the Net Present Values (NPV) of both projects using the company’s weighted average cost of capital as a discount rate. (5 marks)

View Solution

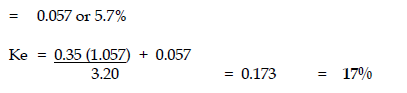

Computation of NPV for both projects Using WACC

WORKINGS:

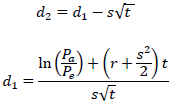

Cost of Capital Using WACC

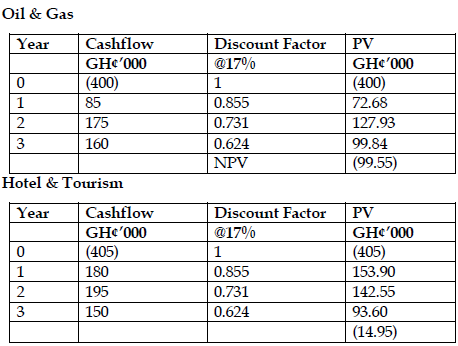

ii) Compute the NPV using a discount rate which take into account the risk associated with the individual projects. (5 marks)

View Solution

Computation of NPV for both projects Using CAPM

WORKINGS:

iii) Advise Management regarding the suitability and acceptability of the projects (1 mark)

View Solution

In view of the high risk inherent in the Oil and Gas Project, the Hotel and Tourism project should be selected.