Nov 2015 Q1 a.

Ahomka Fruity Ltd (Ahomka), a listed company based in Ghana, produces fresh pineapple juice packaged in bottles and cans. The company has been exporting to Nigeria for many years, earning an annual after-tax contribution of NGN5 million. The company wants to establish a wholly-owned subsidiary in Nigeria to produce and sell its pineapple juice products over there. If a subsidiary is established and operated in Nigeria, Ahomka will cease exporting pineapple juice products to Nigeria. However, Ahomka plans to sell some raw materials and services to the subsidiary for cash.

Acquiring a suitable premises, required plant and equipment, and installing the machinery will take the next two years to complete. Production and sales will commence in the third year and indefinitely.

Capital expenditure is estimated to be NGN10 million at the start of the first year and NGN5 million at the start of the second year. Ahomka will have to make working capital of NGN2 million available at the start of the third year, and this is expected to be increased to NGN2.5 million at the start of the fifth year.

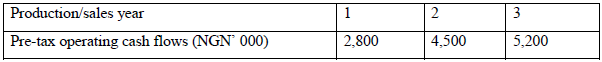

The proposed Nigerian subsidiary will produce the following pre-tax operating cash flows at the end of each of the first three years of production and sales:

The tax rate in Nigeria is 30% and tax is paid in the same year the profit is earned. Capital allowance is granted on capital expenditure at the end of each year of production/sale at the rate of 30% on reducing balance basis.

After the first three years of production and sales, post-tax incremental net operating cash flows will grow at the rate of 4% every year to perpetuity.

Ahomka plans to finance the project entirely with loans raised from Ghana at an after-tax cost of 18%. The maximum post-tax operating cash flows possible will be remitted to the parent company at the end of each year to help pay off the loans. Nigeria does not restrict fund remittance to a parent company outside of Nigeria and there are no taxes on funds remittance.

The Naira- Ghana Cedi exchange rate is currently NGN55.40/GHS. Annual inflation is expected to be 18% in Ghana and 20% in Nigeria.

Required: (Note: Professional marks will be awarded for presentation)

(a) Perform a financial appraisal of the project using the net present value and the modified internal rate of return (MIRR) methods, and recommend whether Ahomka should proceed with the project. (10 marks)

View Solution

Financial appraisal of proposed subsidiary in Nigeria

As funds will be remitted to the parent company at end of each year, an appropriate approach to appraising the project is to –

- Forecast foreign currency cash flows.

- Forecast exchange rates.

- Convert foreign currency cash flows to home currency cash flows using spot or forecast exchange rates as appropriate at the end of the year.

- Discount home currency cash flows at the parent company’s domestic cost of capital to obtain project NPV in home currency.