May 2016 Q1

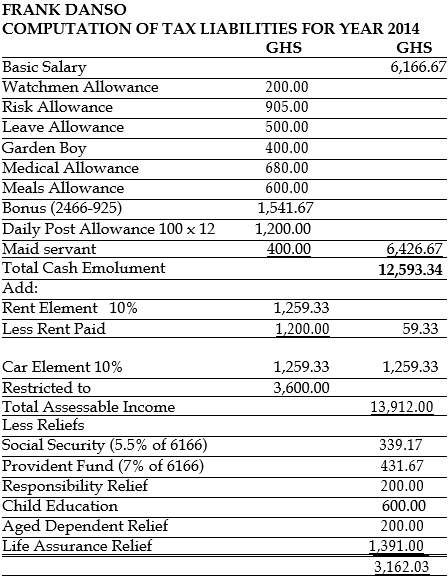

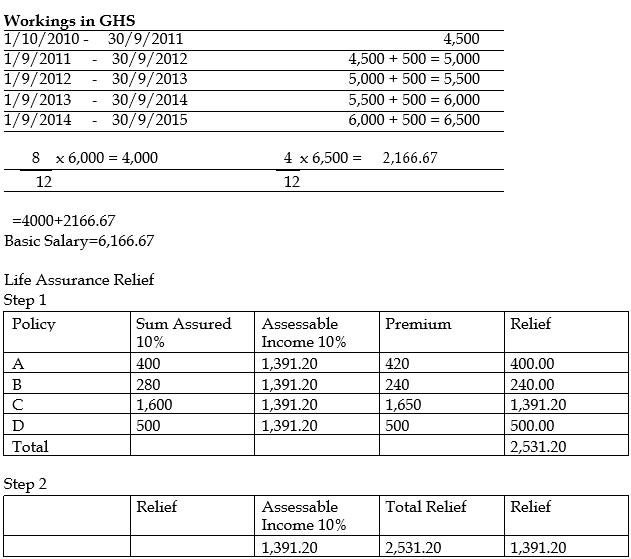

Mr. Frank Danso was employed by Ghana Trust Ltd on 1st September 2010 on salary scale of GH¢4,500 x 500-7,500 as the financial controller of the company. He is provided with the following as part of his conditions of service for 2014 Year of Assessment.

i) Well-furnished rented flat by his employers in respect of which he pays GH¢100 per month as rent by way of deductions at source.

ii) Watchman allowance of GH¢200 per annum, paid directly to Mr. Frank Danso.

iii) Risk allowance of GH¢905 per annum

iv) Leave allowance of GH¢500 per annum

v) Garden boy allowance of GH¢100 per quarter paid directly to Mr. Frank Danso.

vi) Medical allowance of GH¢680 per annum

vii) Meals allowance of GH¢50 per month

viii) Two maidservants each on wages of GH¢200 per annum. The amount is paid to the maid servants directly by the company.

ix) Bonus of 40% on annual basic salary

x) Entertainment allowance of GH¢400 a year ( accountable)

xi) Duty post allowance of GH¢100 per month.

xii) He has Life Assurance Policies with EIC ltd. Below are the details:

Policy Sum Assured (GH¢) Annual Premium (GH¢)

A 4,000 420

B 2,800 240

C 16,000 1,650

D 5,000 525

xiii)He is entitled to a company car and fuel for both official and private use.

xiv) He has two wives and ten children; four of whom are in SHS in Accra, and the rest are gainfully employed; he caters for 3 of his aged relatives.

xv) He contributes 7% of his salary towards the company’s Provident Fund which has been approved by the National Pension Authority, he also contributes 5.5% of salary to the SSNIT.

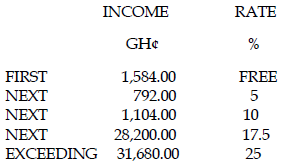

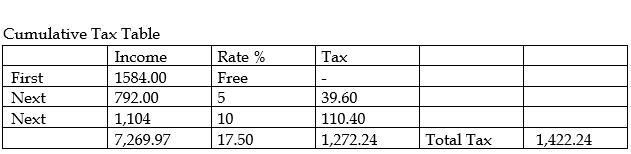

TAX RATES :

Required:

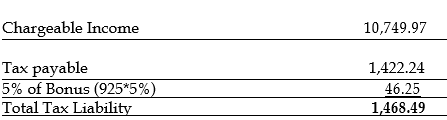

a) Compute his tax liabilities for 2014 Year of Assessment using 2014 rates. (15 marks)

View Solution

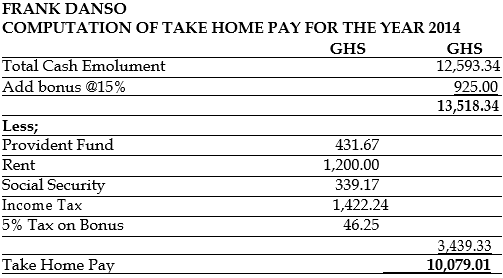

b) Determine his take home pay for the 2014 Year of Assessment. (5 marks)

View Solution