Nov 2018 Q7

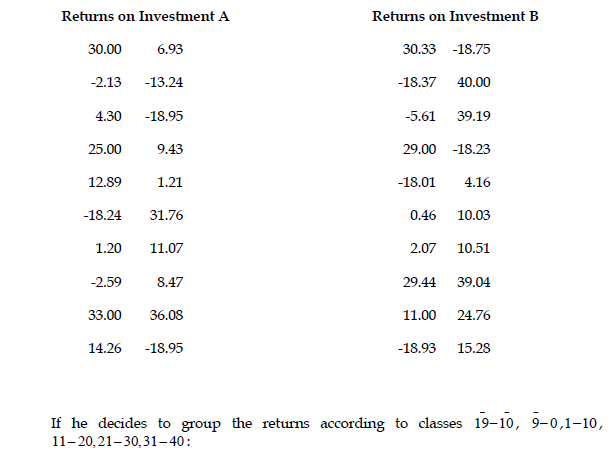

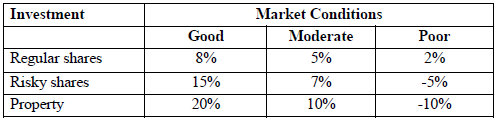

a) Royal Driving School is considering investing in a profitable project. The school is given the following investment alternatives and percentage rates of return.

Over the past 300 days, market conditions have been moderate for 150 days and good for 60 days.

Required:

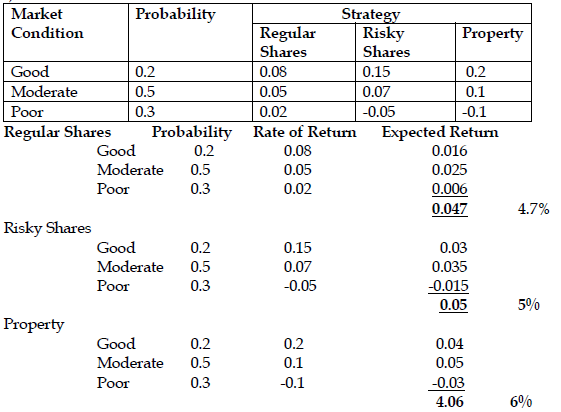

i) Calculate the expected return for each type of investment. (4 marks)

View Solution

ii) Determine the optimum investment strategy for Royal Driving School. (3 marks)

View Solution

Since the expected return of 6% is the highest and it is for property, the school should invest in Property.

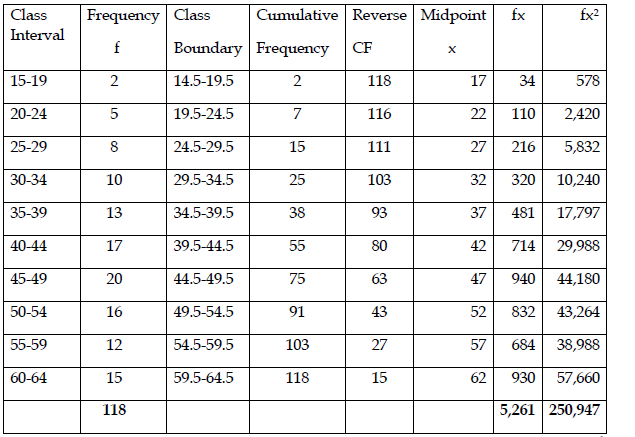

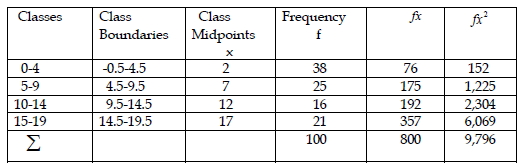

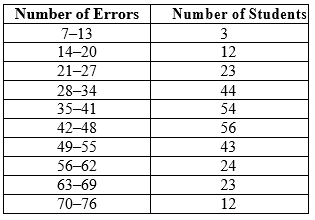

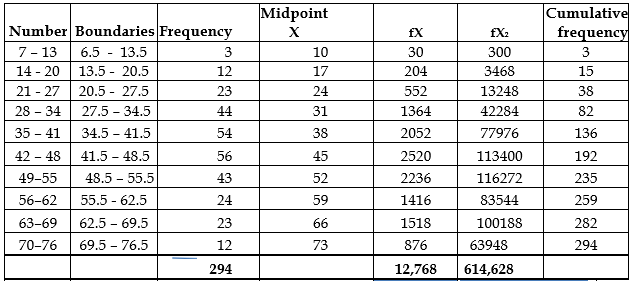

b) The number of errors made by 294 students of Royal Driving School in their first attempt at a driving test is grouped in the following frequency distribution:

Required:

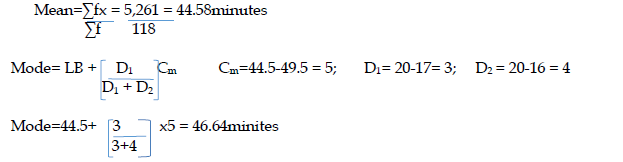

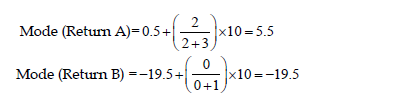

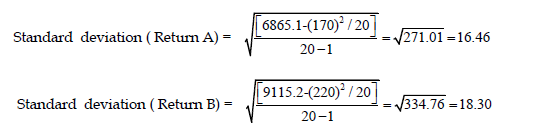

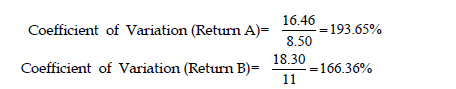

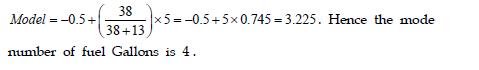

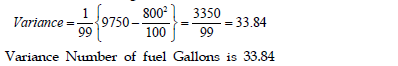

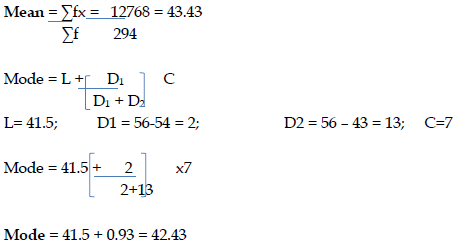

i) Compute an estimate of the mean and mode for the distribution. (3 marks)

View Solution

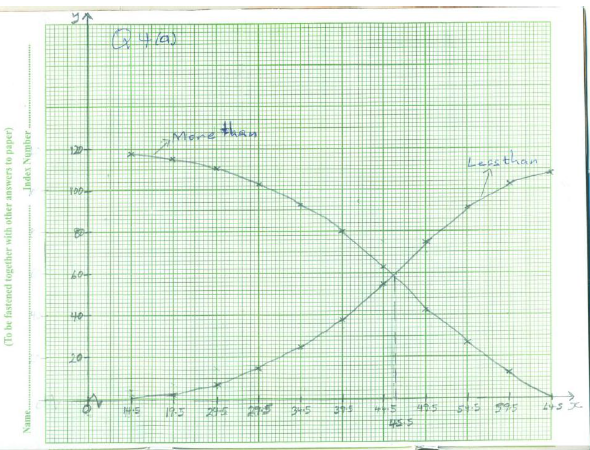

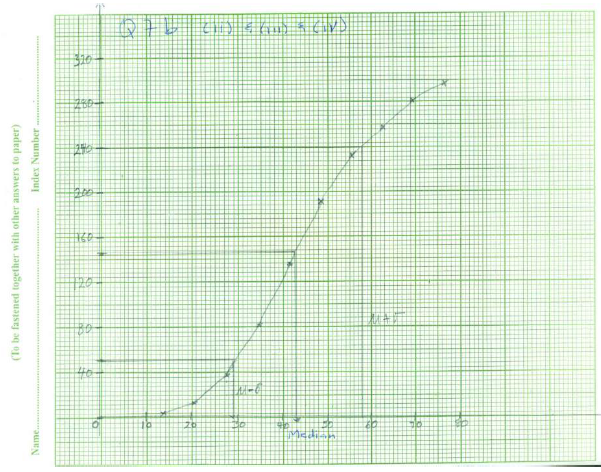

ii) Construct an ogive for the distribution. (4 marks)

View Solution

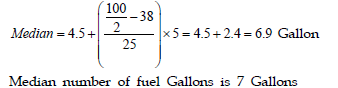

iii) Using the ogive in (ii) above estimate the median for the distribution. (3 marks)

View Solution

The median is at the 294/2 = 147th position. Thus from the graph the estimate of the median is 43.

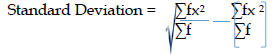

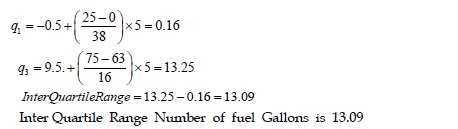

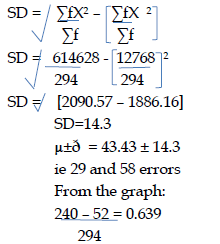

iv) Use the ogive in (ii) above to estimate the percentage of errors within one standard deviation of the mean. (3 marks)

View Solution

Thus percentage of errors within one standard deviation of the mean is 64%