May 2019 Q2

a) Distinguish between Internal Rate of Return and Net Present Value. (4 marks)

View Solution

Net Present Value (NPV) is the difference between the discounted cash inflows and the discounted cash outflows. The Internal Rate of Return is the rate that will make the NPV zero.

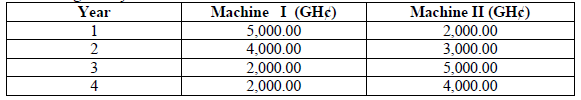

b) BonBone Company Ltd wants to make a decision on which of the two machines to purchase. Each will involve a GH¢10,000 investment. The expected net incremental cash flows are given by the table below:

Required:

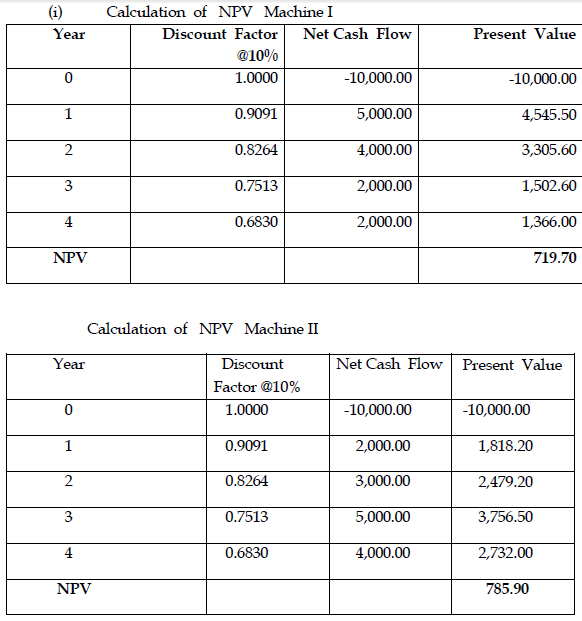

i) If the company’s cost of capital is 10%, calculate the Net Present Value (NPV) of Machine I and Machine II and determine which machine should be purchased for higher returns. (8 marks)

View Solution

Machine II earn more returns than Machine I and So Machine II should be purchased.

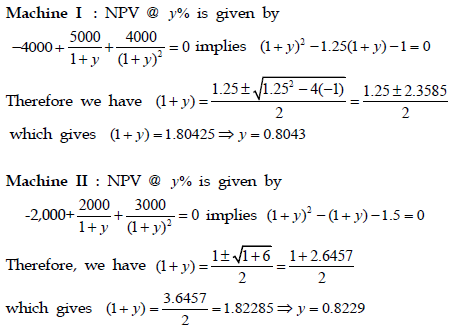

ii) If the initial investment for Machine I is changed to GH¢4,000 and Machine II is changed to GH¢2,000, calculate the Internal Rate of Return (IRR) for Machine I and Machine II. (6 marks)

View Solution

As Machine II has larger expected net increment cash flow than Machine I in year 3 and year 4, it suffices to determine and compare the internal rate of returns for years 1,2 and 3 as follows:

iii) If the IRR’s in (ii) above are to be used as the basis of selection, determine which machine should be purchased for higher returns. (2 marks)

View Solution

Machine II earn more returns than Machine I and So Machine II should be purchased.