Nov 2018 Q3

After the collapse of a Savings and Loans Company, depositors who were able to recover funds lodged with the company are seeking alternative avenues of investment. You have been called upon to advise the following clients on investment decisions they have to make.

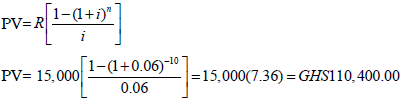

a) Kwabena was able to recover GH¢150,000 out of GH¢200,000 invested in the Savings and Loans Company. How much money should he invest at a return of 6% per annum so as to earn an annual income of GH¢15,000 for a period of 10 years? (10 marks)

View Solution

Using the present value formula, we have:

b) Kasuli, a Marketing Executive who could not recover any amount out of his investment decided to take a mortgage at an interest rate of 15% over a 20 year term. If his income is enough to enable him to pay GH¢1,400 per month, what is the maximum amount he can borrow? (10 marks)

View Solution

![]()