May 2016 Q3 a.

Strategy evaluation is a key aspect of the strategic management process. It allows management to assess the efficiency and effectiveness of the chosen strategies before their implementation.

Required:

Discuss the following criteria for evaluating corporate strategic options. (12 marks)

i) Suitability

View Solution

Suitability: Suitability relates to the strategic logic of the strategy. The strategy must be consistent with the company’s current strategic position and its operational circumstances. Suitability of strategic options can be viewed from many angles. For instance, a strategic option can be considered as suitable if it exploits company strengths and distinctive competences while rectifying internal weaknesses. Also, suitable strategies should neutralize or deflect environmental threats and help the firm to seize opportunities. They must fit with the company’s mission and objectives.

Other questions to ask in evaluating the suitability of strategic options bother on whether they fill the gap identified by gap analysis and whether they generate or maintain competitive advantage over competitors. Management must also ensure that the strategy or strategies involve an acceptable level of risk as well as suit the politics and corporate culture.

It is important for a company to also consider three overall important strategic issues when assessing the suitability of an option.

- Does the strategy fit with any existing strategies which the company is already pursuing, and which it wants to continue to pursue?

- How well does the option actually address the company’s strategic issues and priorities?

- Will the option contribute to a sustainable competitive advantage for the company, in the light of the competitive environment?

ii) Acceptability

View Solution

Acceptability: The acceptability of a strategy relates to whether the chosen strategy of the firm is acceptable to its stakeholders. The key stakeholders will be those with high power and high interest in an organization or a strategy. It is particularly important that any potential strategy is acceptable to these key stakeholders.

The level of risk and return associated are with the strategy are likely to be critical in determining how acceptable it is. Some considerations in terms of evaluating the acceptability of strategy are discussed below:

Financial considerations: Strategies will be evaluated by considering how far they contribute to meeting the dominant objective of increasing shareholder wealth. The financial considerations of a chosen strategy would usually evaluated using investment appraisal ratios and other benchmarks such as return on investment, profits, growth, earnings per share, cash flow, price/earnings and market capitalization.

Customers: It is important that the chosen strategy fulfills the expectations of customers. In other words, the strategy must produce value for customers at reasonable prices for it to succeed. Customers may object to a strategy if it means reducing service or raising price but, on the other hand, they may have no choice but to accept the changes.

Staff has to be committed to the strategy for it to be successful. If staff are unhappy with the strategy – or with any organisational which result from it – they could either resist the strategy, or else leave the organisation completely.

Suppliers have to be willing and able to meet the input requirements of the strategy for the strategy to be considered as acceptable.

Government: A strategy involving a takeover may be prohibited under legislation designed to prevent anti-competitive behaviour (e.g. the creation of monopoly). It is important to evaluate the chosen strategy in terms of whether it is acceptable within the framework of the law or government policy. Government regulations and policy may stem from tax laws, employment law, environmental laws, competition laws, etc.

The public: The environmental impact may cause key local stakeholders to protest. Will there be any pressure groups who oppose the strategy?

Risk: Different shareholders have different attitudes to risk. A strategy which changes the risk/return profile, for whatever reason, may not be acceptable.

iii) Feasibility

View Solution

Feasibility: Feasibility is a criterion that is used to evaluate whether the potential strategic option can in fact be implemented. It helps to answer the question, ‘Is the strategy doable?’ In this regard, it is important to assess whether there is enough money as well as the ability to deliver the goods/services specified in the strategy. Management should also assess whether it has the ability to deal with the likely responses that competitors will make. Other questions that need answering in terms of assessing feasibility relates to whether the company has access to technology, materials and resources to carry through the strategy and whether there is enough time to implement the strategy.

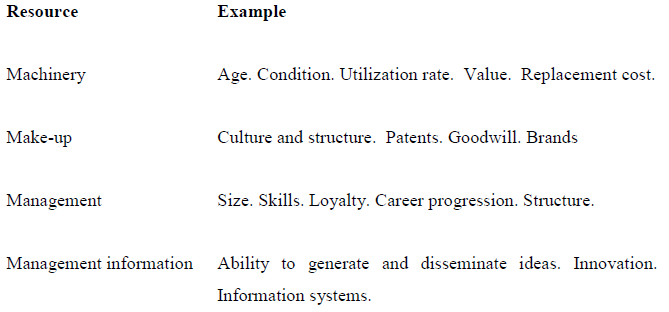

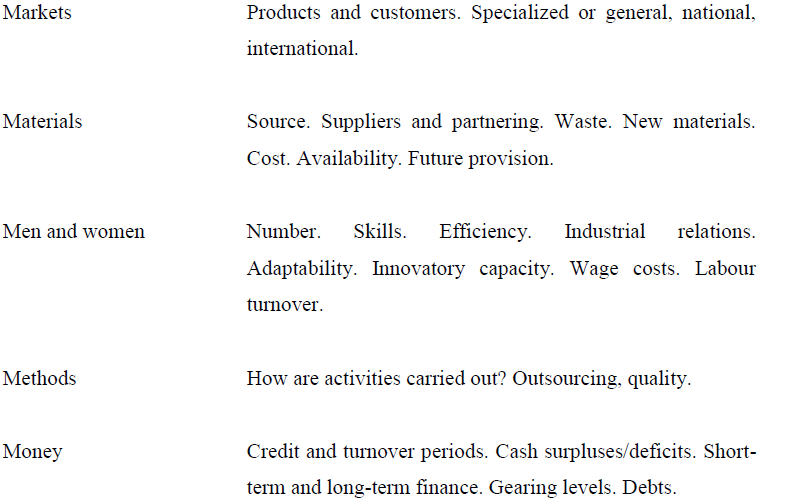

Feasibility must be assessed using both quantitative and qualitative analysis. Quantitative approaches include funds flow analysis and breakeven analysis. Resource deployment analysis is a qualitative analysis that helps the organisation to make a wider assessment of feasibility in terms of resources and competences. The resources and competences required for each potential strategy are assessed and compared with those of the firm. In this regard, a two stage approach may be followed. The first is to find out whether the firm has the necessary resources and competences to achieve the threshold requirement for each strategy and secondly, whether the firm has the core competences and unique resources to maintain competitive advantage.