May 2019 Q3 a.

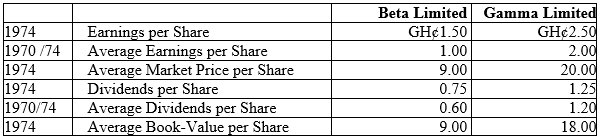

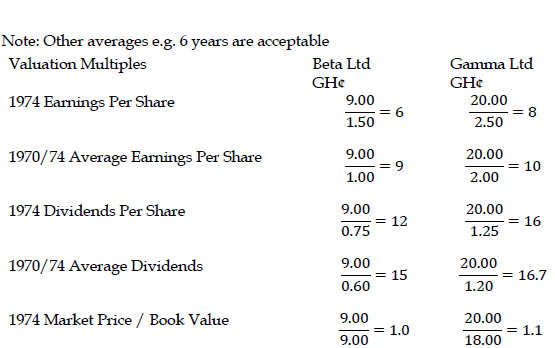

At a meeting of the Directors of the Alpha Company Limited – a privately owned company- in May 1975 the recurrent question is raised as to how the company is going to finance its future growth and at the same time enable the founders of the company to withdraw a substantial part of their investment. A public quotation was discussed in 1974 but because of the depressed nature of the stock market at that time consideration was deferred. Although the matter is not of immediate urgency the Chairman of the company – one of the founders- produces the following information which he has recently obtained from a firm of financial analysts in respect of two publicly quoted companies Beta Limited and Gamma Limited which are similar to Alpha Limited in respect to size, asset composition, financial structure and product mix.

On the basis of the above information, the Chairman asked of your opinion on what Alpha Ltd was worth in 1974. The only information you have available at the meeting in respect of Alpha Limited is the final accounts for 1974 which discloses the following:

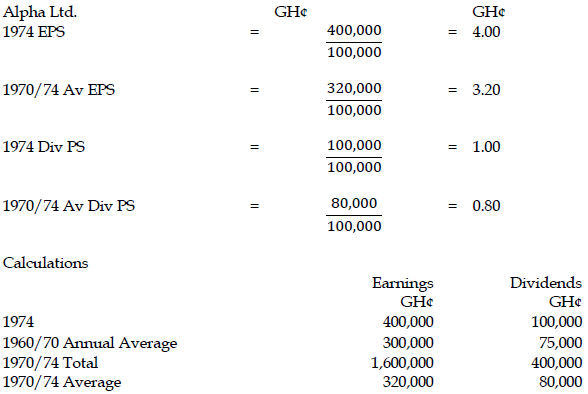

. Alpha Limited

Share Capital (no variation for 8 years) 100,000 Ordinary GH¢1 Share

Post-Tax Earnings GH¢400,000

Gross Dividends GH¢100,000

Book Value GH¢3,500,000

From memory, you are of the view that the post-tax earnings and gross dividends for 1974 were at least 1/3rd higher than the average of the previous five years.

Required:

Make full use of the information above to:

i) Answer the question from the Managing Director and (11 marks)

View Solution

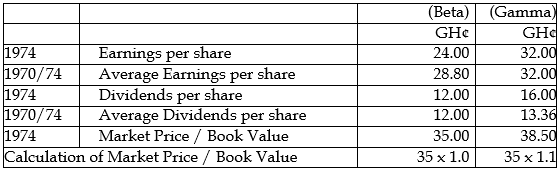

Valuation of Alpha Ltd. Based on multiples for Beta and Gamma Ltd.

Points to note

- Price per share ranges from GH¢12.00 to GH¢38.50.

- Low-range prices due to low div / earnings ratio on going public indication of improvement in this might nullify low value.

- Following on from (3) ignoring dividend ratios the range is from GH¢24.00 to GH¢38.50. Market price/book-value gives the highest prices but unless something special about asset mix e.g. high proportion currently values property or investments, then given differences in accounting treatment book value probably least reliable measure.

- On earning price range GH¢24.00 –GH¢32.00 – average GH¢28.00 1974. Figures low reflecting depressed stock-market situation. (11 marks evenly spread using ticks)

ii) Discuss FOUR (4) factors to be taken into account in trying to assess the potential market value of shares in a private company when they are first offered public subscription. (4 marks)

View Solution

- Opportunity cost (alternative yields)

- Risk perceived by investors

- Marketability

- Imperfect information