May 2019 Q2

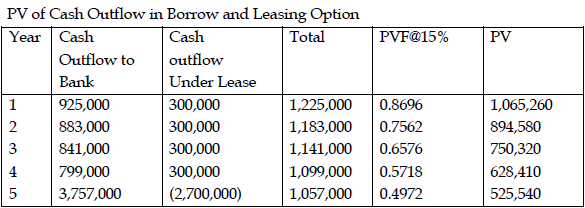

a) Rahim Ltd requires a machine for 5 years. There are two alternatives, either to take it on lease or buy basis. The company is reluctant to invest initial amount for the project and approaches their bankers. The Bankers are ready to finance 100% of its initial required amount at 15% rate of interest for any of the alternatives.

Under lease option, upfront security deposit of GH¢5,000,000 is payable to the lessor which is equal to cost of machine. Out of which, 40% shall be adjusted equally against annual lease rent. At the end of life of the machine, expected scrap value will be at book value after providing depreciation at 20% on written down value basis.

Under the buying option, loan repayment is in equal annual installments of principal amount, which is equal to annual lease rent charges. However, in case of bank finance for lease option, repayment of principal amount equal to lease rent is adjusted every year, and the balance at the end of 5th year.

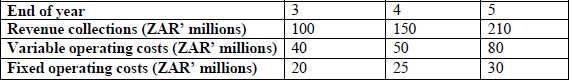

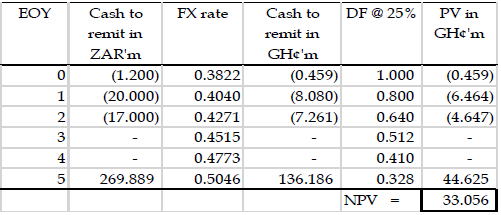

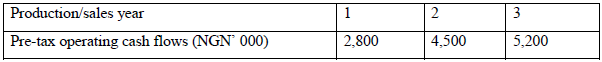

Assume income tax rate is 30%, interest is payable at the end of every year and discount rate at 15% p.a. The following discounting factors are given:

![]()

Required:

Recommend the most viable option on the basis of net present values. (10 marks)

View Solution

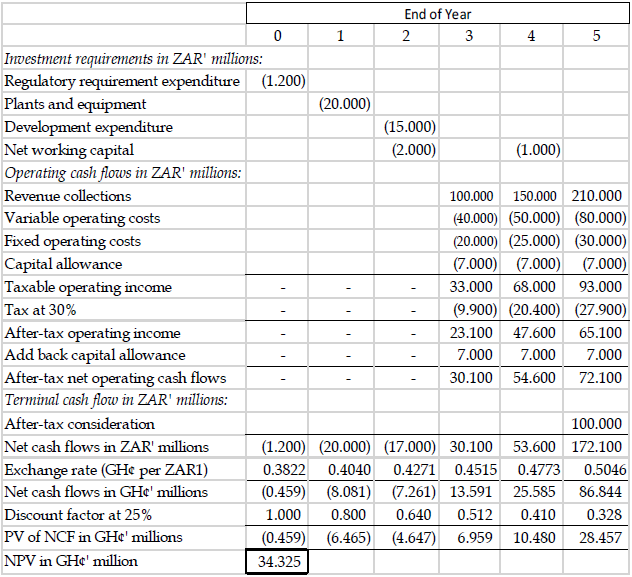

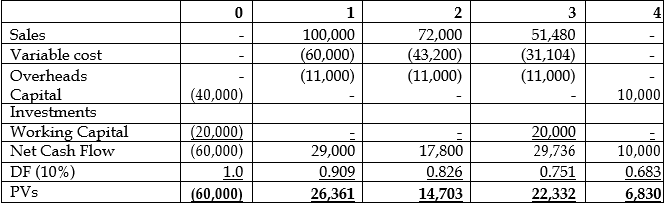

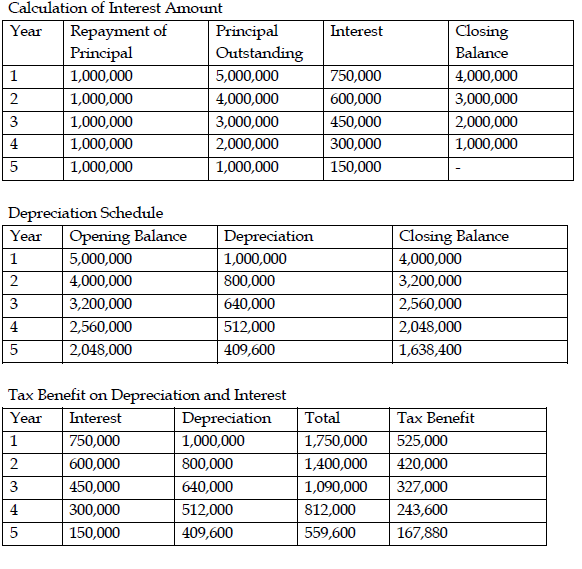

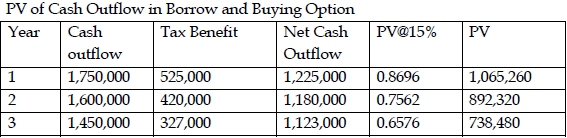

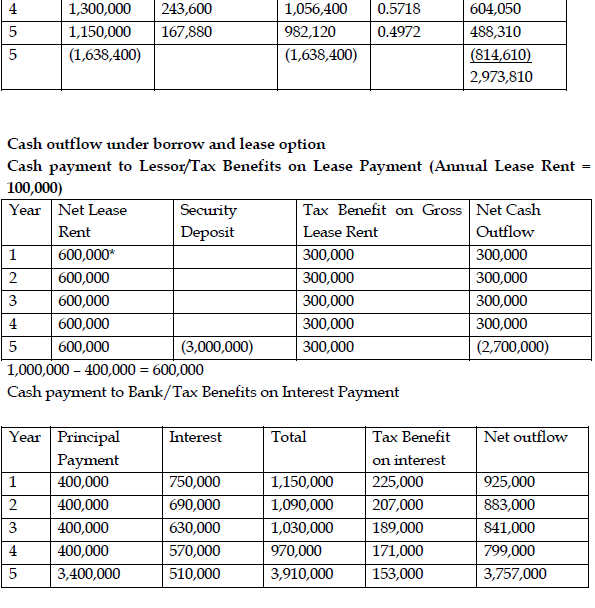

Cash flow under borrow and buy option

All Working in GH¢:

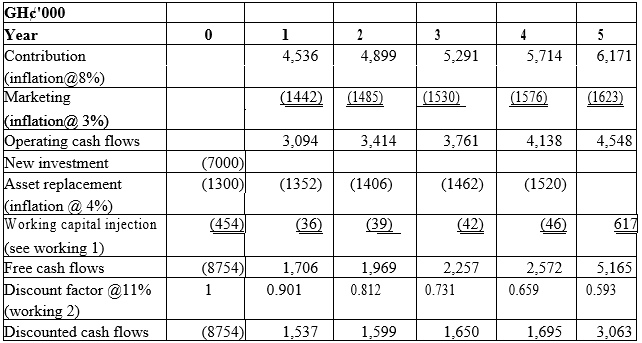

![]()

Since PV of cash outflow is least in case of borrow and buying option it should be opted for.

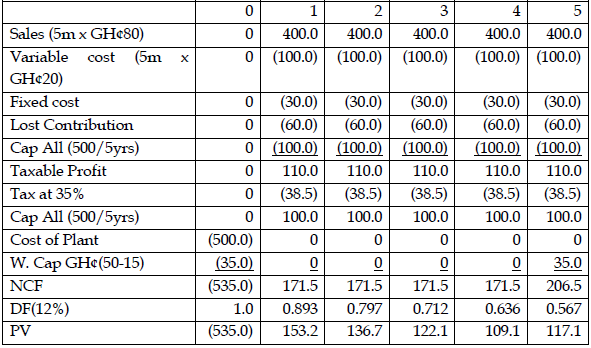

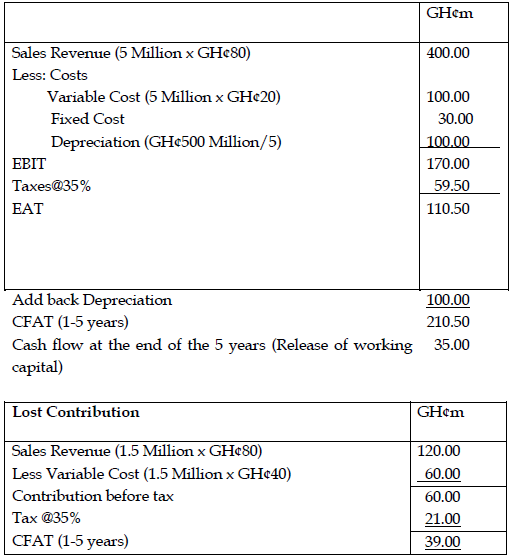

b) A Multinational Company (MNC) is planning to set up a subsidiary company in Ghana (where hitherto it was exporting) in view of growing demand for its product and competition from other MNCs. The initial project cost (consisting of Plant and Machinery including installation) is estimated to be GH¢500 million. The net working capital requirements are estimated at GH¢50 million. The company follows straight line method of depreciation. Presently, the company is exporting two million units every year at a unit price of GH¢ 80, its variable cost per unit being GH¢40.

The Chief Finance Officer has estimated the following operating cost and other data in respect of the proposed project:

i) Variable operating cost will be GH¢20 per unit of production.

ii) Additional cash fixed cost will be GH¢30 million p.a. and project’s share of allocated fixed cost will be GH¢3million p.a. based on the principle of ability to share;

iii) Production capacity of the proposed project in Ghana will be 5 million units;

iv) Expected useful life of the proposed plant is five years with no salvage value;

v) Existing working capital investment for production & sale of two million units through exports was GH¢15 million;

vi) Exports of the product in the coming year will decrease to 1.5 million units in case the company does not open subsidiary company in Ghana. This would be as a result of competing MNC’s that are in the process of setting up their subsidiaries in Ghana;

vii) Applicable Corporate Income Tax rate is 35%, and

viii) Required rate of return for such project is 12%.

ix) Assume that there will be no variations in the exchange rate of the two currencies and all profits will be repatriated, as there will be no withholding tax.

Required:

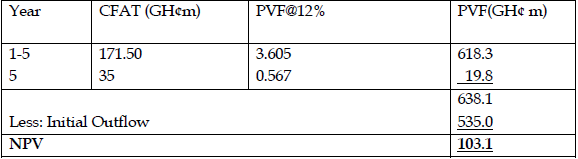

Calculate Net Present Value (NPV) of the proposed project in Ghana and advise Management. (10 marks)

View Solution

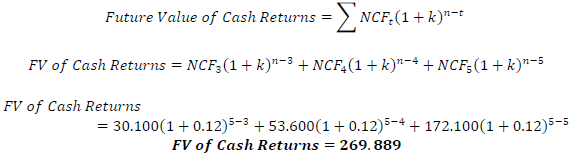

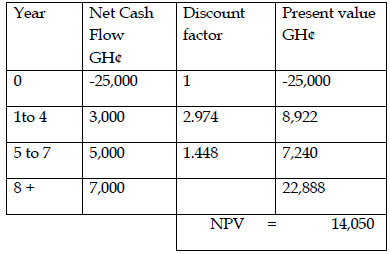

NPV = GH¢103.2m

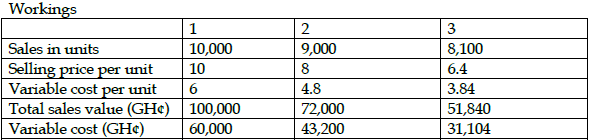

An alternative financial Analysis whether to set up the manufacturing units in Ghana or not may be carried using NPV technique as follows:

Incremental Cash Outflows

. GH¢m

Cost of Plant and Machinery 500.00

Working Capital 50.00

Release of existing Working Capital (15.00)

. 535.00

Incremental Cash inflow after Tax (CFAT)

Generated by investment in Ghana for 5 years

. GH¢m

Through setting up subsidiary in Ghana 210.50

Through Exports in Ghana 39.00

CFAT (1-5 years) 171.50

(10 marks evenly spread using ticks)