Nov 2018 Q1 a.

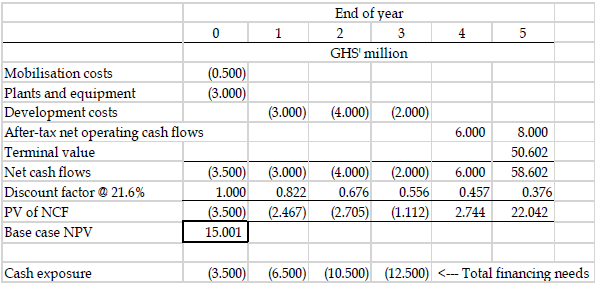

One-Village Water Resources Ltd (One-Village) is considering a damming and irrigation project that will supply water to tomato farms around the Oti River. One-Village plans to commence the construction and installation phase of the project immediately and complete it in three years’ time. One-Village will invest GH¢3 million in new plants and equipment now. Mobilisation to the project site will cost GH¢0.5 million now. Development costs are expected to be GH¢3 million in the first year, GH¢4 million in the second year and GH¢2 million in the third year.

The commercial phase of the project will commence in the fourth year and run indefinitely. The project will generate after-tax net cash flows of GH¢6 million in the fourth year and GH¢8 million in the fifth year. Beyond the fifth year, cash flows will grow by 5% every year to perpetuity.

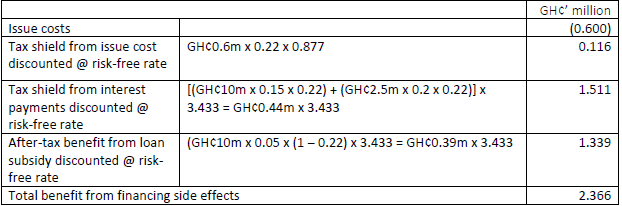

One-Village has 10 million shares outstanding, which are currently trading at GH¢3.5 each. The total value of its debt stock is GH¢20 million. One-Village plans to finance the investment requirements of the construction and installation phase of the project with new debt. Its borrowing cost is 20% while its cost of equity is 25%. Currently, the Government of Ghana is

promoting large-scale farming to provide food and jobs. The Government of Ghana is encouraged by this project, and so is willing to give a subsidised loan of up to GH¢10 million at 15% annual interest to One-Village to help finance the project. One-Village plans to take up the maximum of the subsidised loan from the Government of Ghana and finance the balance with a bank loan. Issue costs, which are tax-deductible outgoings, are expected to be GH¢0.6 million. Both loans will be repaid in five years’ time.

One-Village falls into the 22% corporate income tax category. The risk-free interest rate is 14% and the return on the market portfolio is 18%.

Required:

Evaluate the project using the adjusted present value technique and recommend whether it should be implemented or not. (12 marks)

View Solution

Appraisal of Irrigation Project in Ghana using Adjusted present value (APV)

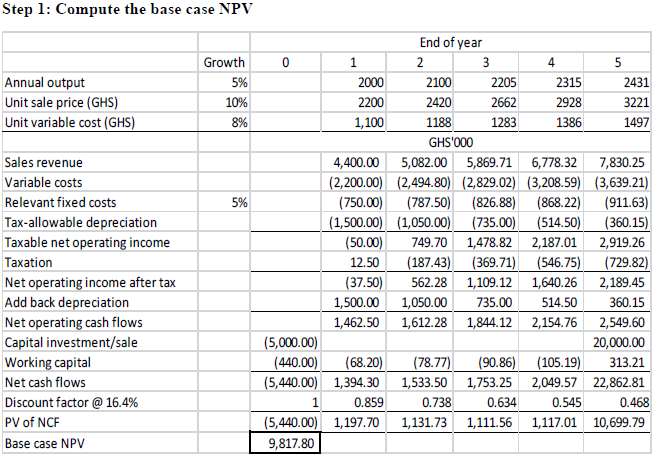

Step 1: Computation of the base NPV

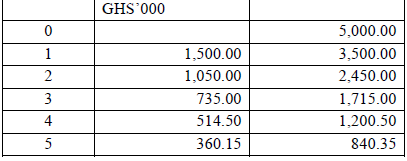

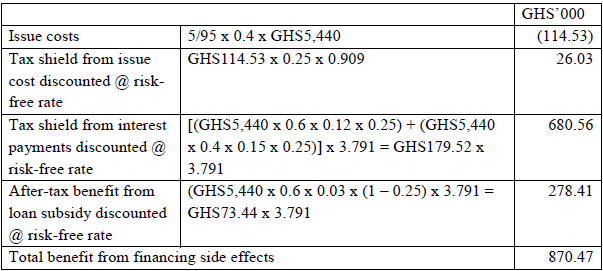

Step 2: Calculation of PV of financing side effects

Financing side effects that apply in this case are –

**the issue cost and its associated tax shield

**annual interest payments on debt financing

**benefit from subsidized loan from the government

Necessary adjustments for the financing side effects follow.

Notes:

**It is assumed that the entire issue costs will be expensed in the first year.

**PV of tax shield and subsidy benefit are based on the risk-free interest rate. It may be discounted at the company’s cost of debt.

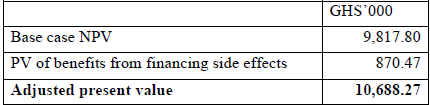

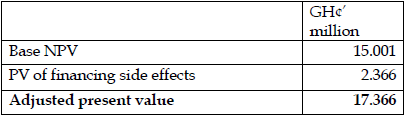

Step 3: Compute APV by adjusting base case NPV for financing side effects

Conclusion: As the APV is positive, the value of One-Village will increase if the proposed damming and irrigation project is implemented. It should be implemented.

Workings:

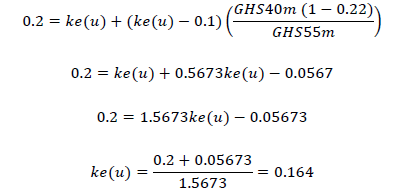

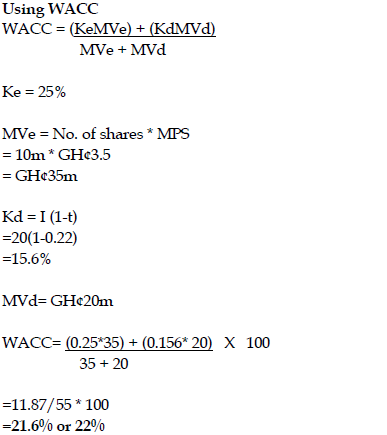

1. Ungeared cost of equity

The ungeared cost of equity may be estimated based on MM Proposition II with tax or the CAPM.

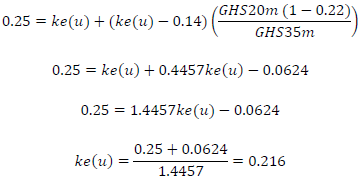

Using MM Proposition II with tax:

![]()

One-Village’s geared cost of equity, ke(g) = 25%

Value of One-Village’s equity = 10m x GH¢3.5 = GH¢35m

Value of One-Village’s debt = GH¢10m

One-Village’s tax rate, t = 22%

Cost of debt, kd = 14% (taken to be the risk-free interest rate as per MM view)

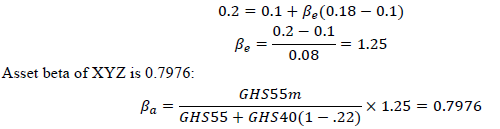

Using the CAPM:

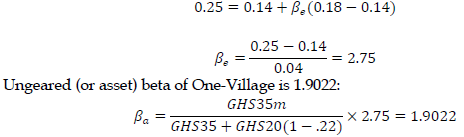

With CAPM, obtain ungeared (or asset) beta of One-Village and put it into CAPM to obtain ungeared cost of equity as under:

Equity beta of One-Village is 2.75:

Putting ungeared (or asset) beta into CAPM yields an ungeared cost of equity of 21.6%:

𝑘𝑒(𝑢) = 0.14 + 1.9022(0.18 − 0.14) = 0.216

Note: The ungeared cost of equity may be rounded to 22% to read present value interest factors from interest factor tables.

2. Terminal value

As after-tax operating cash flows will grow at a constant rate of 5% every year after year five to perpetuity, the terminal value at the end of the fifth year is computed using the Gordon’s growth model as under:

![]()