May 2019 Q5 a.

Edi Ltd, based in Accra Ghana, is a multinational company with two wholly-owned subsidiaries: Gil Plc based in Nigeria and Zep Ltd based in South Africa. Until recently, the Edi group has been doing well, returning a stable level of dividends to its shareholders. The financial performance of the Edi group has dipped in the past two years. In the last quarter of last year, the directors approved the establishment of a central treasury department based at the group’s headquarters in Accra. It is believed that the central treasury function will help boost effectiveness and efficiency in the group’s liquidity management, currency risk management, dividend remittances and borrowing.

Intragroup Currency Transfers:

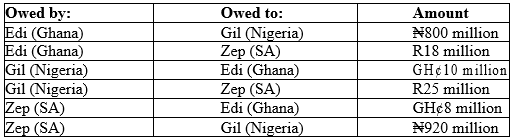

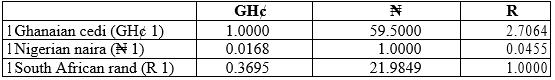

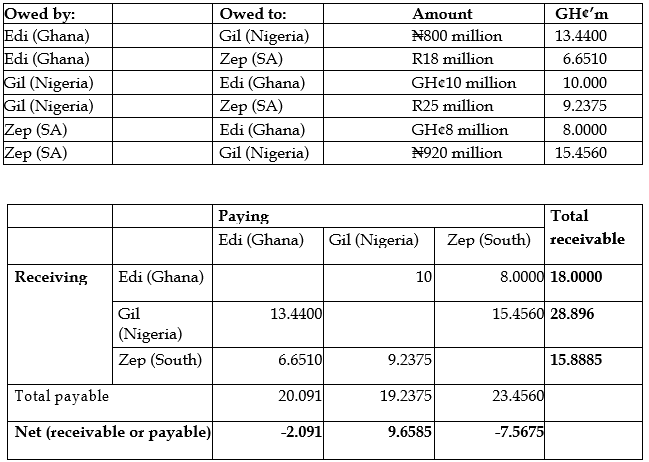

There are a lot of intragroup credit transactions which are often settled independently between the parties involved. This year, the treasury department has been tasked to manage settlement of intragroup indebtedness through netting to reduce the volume of currency transactions. It has been agreed that all settlements will be made in the Ghanaian cedi at the prevailing spot mid-market exchange rate.

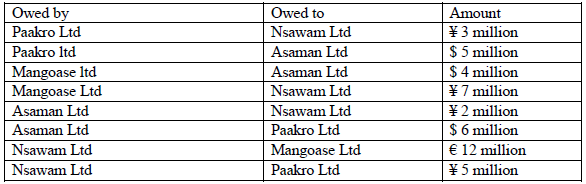

Below is a list of intragroup indebtedness at the end of the first quarter to be settled today:

Today’s mid-market cross currency spot exchange rates are as follows:

Group Dividend Policy:

Edi Ltd owns all the equity shares in each of the two subsidiaries; and so, has the power to determine the level of dividend paid by the two subsidiaries. Considering the high level of competition faced by the subsidiaries in the host countries, the directors of Edi Ltd have granted managers at the subsidiaries the discretion of reinvesting earnings as appropriate and remit the residual income to Edi Ltd. In consequent, dividend remittances from the foreign subsidiaries have averaged around 20% of subsidiaries’ after-tax earnings.

The dividend payment policy of Edi Ltd is GH¢1.5 per share. For the past two years, Edi Ltd has not been able to meet its promised dividend payment to its shareholders due to insufficient cash flows from its foreign subsidiaries.

Required:

i) Suppose the currency netting is implemented. Calculate the intragroup company currency transfers that will be required for settlement by each member of the Edi group. (6 marks)

View Solution

Intragroup currency netting

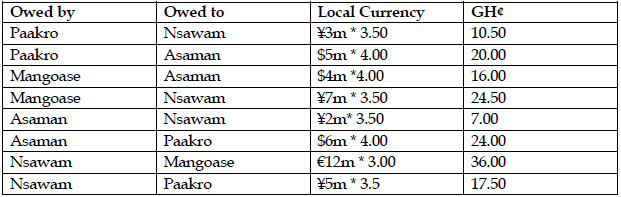

Conversion of indebtedness to netting currency (GH¢):

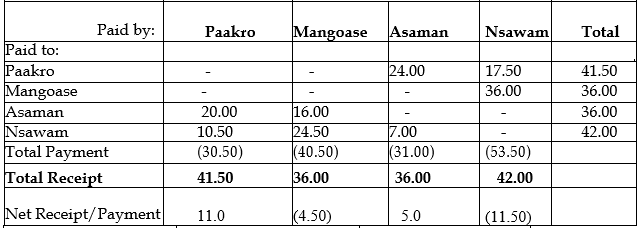

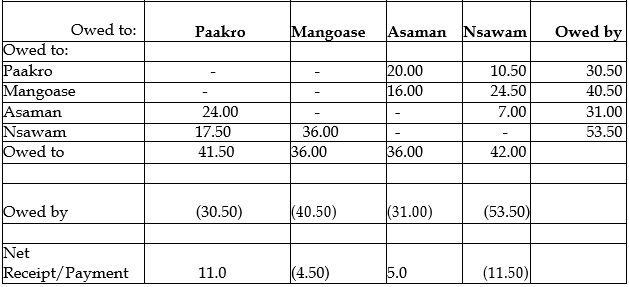

Transfer plan:

Gil (Nigeria) receives GH¢2.091 million from Edi (Ghana) and GH¢7.5675 million from Zep (South Africa)

ii) Suppose the treasury department is recommending the use of currency futures to hedge net currency exposures. Discuss the advantages and disadvantages of the Edi group using currency options instead of currency futures in hedging net currency exposures. (4 marks)

View Solution

Advantages of hedging currency risk with options rather than futures

- The main advantage of hedging with currency options over currency futures is that options present relatively lower risk. This is because with options hedge comes with the flexibility of enjoying gains in the upside whilst avoiding losses in the downside. In the case of futures, however, trading is obligatory even in the downside.

- Besides, several strike prices are available to choose from. This thus present an opportunity to use varied strategies in hedging the currency option. (2 points for 2 marks)

Disadvantages of hedging currency risk with options rather than futures

- The main disadvantage of hedging with an option the requirement to pay a nonrefundable premium upfront. In the case of futures, the margin deposit is refundable once losses are covered.

- Another disadvantage of options is that premiums vary as volatility changes. Futures, however, comes with fixed upfront margin requirements which have be same for many years. (2 points for 2 marks)