May 2017 Q4 b.

There are many possible reasons why management would wish to restructure a company’s finances. A reconstruction scheme might be agreed when a company is in danger of being put into Liquidation.

Required:

i) Distinguish between a leveraged buy-out and leveraged recapitalisation. (4 marks)

View Solution

A leveraged buy-out is a transaction in which a group of private investors uses debt financing to purchase a company or part of a company. In a leveraged buy-out, like a leveraged recapitalization, the company increases its level of leverage, but unlike the case of leveraged capitalisations, the company does not have access to equity markets any more.

Leveraged recapitalization is a corporate strategy in which a company takes on significant additional debt with the intention of paying a large cash dividend to shareholders and/or repurchasing its own stock shares. A leveraged recapitalization strategy typically involves the sale of equity and the borrowing or refinancing of debt.

A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The purpose of leveraged buyouts is to allow companies to make large acquisitions without having to commit a lot of capital.

ii) What are the THREE main types of reconstruction and describe them briefly. (3 marks)

View Solution

- Financial reconstruction: involves changing the capital the capital structure of the firm.

- Portfolio reconstruction: involves making additions to or disposals from companies’ businesses eg. through acquisition or spin-offs.

- Organisational restructuring: involves changing the organizational structure of the firm.

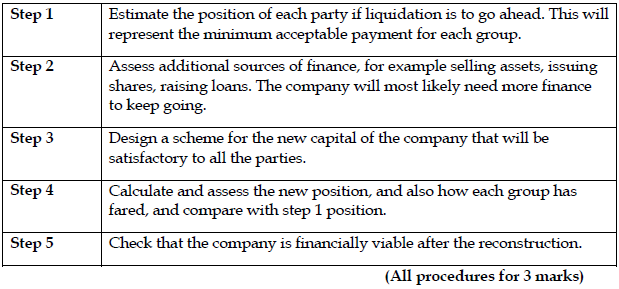

iii) Describe the procedures that should be followed when designing a financial reconstruction scheme . (3 marks)

View Solution