Nov 2018 Q4 a&b

Jabesh Company limited inc ome statements for the years 2016 and 2017 are provided below:

The company directors at a meeting argued that the use of Economic Value Added as a measure of corporate performance is more relevant to current developments in financial markets and agreed to employ it in assessing its performance for year 2017 and 2016.

Additional information is as follows:

i) The allowance for doubtful debts was GH¢300,000 at 1 January 2016, GH¢250,000 at 31 December 2016 and GH¢350,000 at 31 December 2017.

ii) Research and development costs of GH¢500,000 were incurred during each of the years 2016 and 2017 on Project Z. These costs were expensed in the income statement, as they did not meet the requirements of financial reporting standards for capitalization. Project Z is not complete yet.

iii) At the end of 2015, the company had completed another research and development project, Project X. Total expenditure on this project had been GH¢1,500,000, none of which had been capitalised in the financial statements. The product developed by Project X went on sale on 1 January 2016, and the product was a great success. The product’s lifecycle was only two years, so no further sales of the product are expected after 31 December 2017.

iv) The company incurred non-cash expenses of GH¢15,000 in both years.

v) Capital employed (equity plus debt) per the statement of financial position was GH¢33,500 at 1 January 2016, and GH¢37,000 at 1 January 2017.

vi) The pre-tax cost of debt was 5% in each year. The estimated cost of equity was 12% in 2016 and 14% in 2017. The rate of corporate tax was 25% during both years.

vii) The company’s capital structure was 60% equity and 40% debt.

viii) There was no provision for deferred tax.

Required:

a) Explain what the directors meant by Economic Value Added (EVA). (2 marks)

View Solution

A successful performance measure evaluates how well an organisation performs in relation to its objectives. Since the primary objective of commercial organisations is normally assumed to be the maximisation of the wealth of its shareholders, it follows

that performance measures should evaluate this. In practice, many organisations use profit-based measures as the primary measure of their financial performance. Two problems relating to profit in this area are, profit ignores the cost of equity capital.

Companies only generate wealth when they generate a return in excess of the return required by providers of capital –both equity and debt. In financial statements, the calculation of profit does take into account the cost of debt finance, but ignores the

cost of equity finance. Profits calculated in accordance with accounting standards do not truly reflect the wealth that has been created, and are subject to manipulation by accountants. Economic Value Added (EVA) is a performance measurement system

that aims to overcome these two weaknesses. EVA was developed by the US consulting firm Stern Stewart & Co, and it has gained widespread use among many well-known companies such as Siemens, Coca Cola and Herman Miller.

EVA is based on the residual income technique that has been used since the early 20th century. Residual income is a performance measure normally used for assessing the performance of divisions, in which a finance charge is deducted from the profits of the division. The finance charge is calculated as the net assets of the division, multiplied by an interest rate – normally the company’s weighted average cost of capital. EVA is similar in structure to residual income. It can be stated as EVA =

NOPAT – (k x capital)

Where: NOPAT = Net operating profits after tax. (k x capital) is the finance charge, where k = the firms weighted average cost of capital and capital = equity plus long term debt of the company at the start of the period. EVA therefore is an estimate of

amount by which earnings fall short or exceed the required rate of return investors could achieve from alternative investment of similar risk.

b) Calculate the company’s Economic Value Added (EVA) for the years ended 2017 and 2016. (5 marks)

View Solution

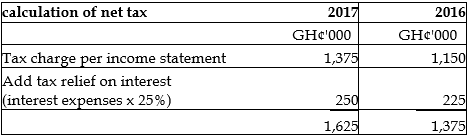

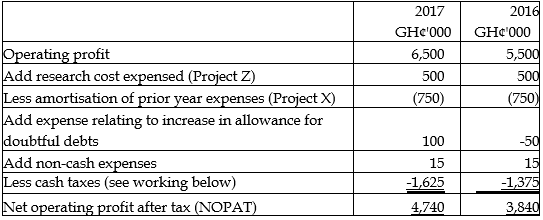

Step 1: Calculation of Net operating profit after tax (NOPAT)

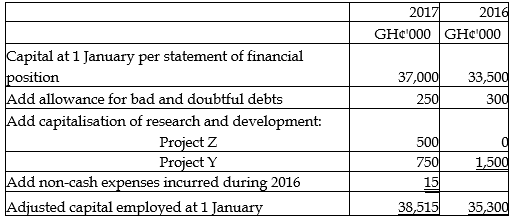

Step 2: calculation of adjusted capital employed at 1 January

Step 3: compute the weighted average cost of capital

2017: (60% x 14% ) +(40% x 5% x (1- 0. 25%) = 9.9%

2016 : (60% x 12% ) + (40% x 5% x (1 – 0.25%) =8.7%

Step 4: calculate the Economic Value Added (EVA)

EVA = NOPAT – (k x capital)

2017: 4,740,000 – (9.9% X 38,515,000) = 927,000

2016: 3,840,000 – (8.7% X 35,300,000) = 769,000

WORKINGS: