May 2020 Q1 & 3

The beginning of Customer Focused Ltd

Customer Focused Ltd was registered to begin trading on 1 January 2017. It opened a retail food store near one of the key malls in Accra with the promise to customers to provide: ‘Low prices, great value, and high quality – every day’. The founding investors were three Ghanaians Kpakpo Armah, Akwasi Boateng and Mary Acquah. The business owners are actively involved in the management of the store. The initial equity capital of the business was provided by them. Additional debt capital was also raised at the same time.

A retail unit was rented near one of Accra’s leading malls for an initial period of five years and provided sufficient retail space to offer a range of food products. Initially, the focus was mainly on selling packaged and processed food so that customers could buy food that was convenient to cook at a time when it suited the busy Ghanaian office worker.

The business owners had all previously worked for the food retail stores in managerial roles and knew much about food retailing. However they had never consider what it meant to run a business in terms of attracting customers and dealing with the new commercial environment they faced. Even though competition was tough, the business owners realised that store location was paramount to the business’ success and in this, they had proved to be correct.

Owners

Kpakpo Armah: Age 43. Has 20 years of experience in the retail food sector, working across all functions, beginning in a large store on the outskirts of Accra.

Akwasi Boateng: Age 37. Worked first in education but later changed to a business career originally in banking operations and later in food retail in Kumasi before being invited by Kpakpo Armah to work with him in Customer Focused Ltd.

Mary Acquah: Age 25. She graduated with a degree in business and this is her second job in food retailing. She is keen and committed to developing the marketing function of Customer Focused Ltd and provides better customer relations to help grow the business.

Customer Focused Ltd has traded successfully and profitably since its launch although there are challenges ahead.

Food retail market in Ghana

The food retail market has three subsectors and the market share of total retail sales in Ghana for each subsector is estimated as follows:

Supermarkets 5%

Convenience stores 40%

Traditional markets 55%

There is tension in Ghana and many African countries between the growth of supermarkets/convenience stores and traditional markets. When incomes rise, consumers look for convenience in their food purchases, and they are able to pay more for food that is sold in expensive retail outlets that are close to other traditional retail outlets. This means that some traditional markets are losing customers.

The competition between supermarkets/convenience stores and traditional markets often breaks down into income levels and purchasing power when a noticeable division in consumers arises. The competitive struggle has often been characterised along the lines of price, quality, and convenience.

Supermarket retailers, whilst facing higher rents, due to location, higher standards of fitting-out and presentation, are able to buy in bulk and also engage in loss leader selling and other marketing activities which are attractive to the modern consumer. Traditional markets rely on social networks and long relationships with customers to underpin their continued existence. However, an important question arises: how far does loyalty to traditional methods to sell product stretch in the face of price competition, wider product choice of high quality, and convenience in terms of hours of trading and location? Traditional markets are under pressure to sell more and have been responding by an increasing focus on fresh produce. They also ensure that their remaining customers get the choice they need rather than perhaps offering products they cannot afford.

Traditional markets have a long history in Ghana. They appear in most towns, some are open every day and offer mostly local produce. They cannot offer cold storage facilities and, so, market traders must have a very keen knowledge of their customers in order to develop a sense of what to stock and sell. For consumers, the social network that a market provides will be important as will be the low prices and local convenience. Indeed, the traditional markets may be the only source of fresh produce that is available. However, the rapid urbanisation of Ghana and growth in income is presenting a challenge to traditional markets that, conversely, supports the development of food retailers that are concentrated in the major population centres, particularly in the south of Ghana. Increases in household income growth have been associated with a reduction in spending on staple products.

Wider economic and social forces are at play in Ghana. Two are worth mentioning. Diet changes are arising from the effect of greater disposable income thus encouraging food retailers to venture into a healthier range of products, at higher prices. Health awareness concerning diets is also having an impact on what is demanded by consumers, particularly as a response to the widespread obesity crisis. The second force concerns the shift in demand towards processed foods. A processed food is any food that has had an element of treatment: for example, part-cooked, added ingredients, and even packaging. A key element of processing is designed to support food safety and the lengthening of shelf-life so that food remains edible for a longer period. However, increased consumption of processed food, throughout the world, has been associated with weight gain and has been linked to the obesity crisis.

Convenience in shopping becomes a priority in the large population centres. For example, traffic congestion can dictate that shopping frequency should fall and hence a location that offers a wide range of produce can be attractive to individuals who are substantially time-constrained. Additionally, increased urbanisation and the centralisation of business activity has led to greater employment opportunities for women who have typically been responsible for food purchases. Add child responsibilities and it becomes clear that shortage of time becomes an important factor in choosing where to shop.

Technology developments have been an important driver in retail food growth and have often under-pinned competitive advantage of one retailer over another. It has also addressed some of the issues surrounding the pressure of time that consumers face and the demand for convenience. For stores, technology provides information and can create loyalty in a market-place where competition cannot always be judged on price attractiveness alone. For consumers, the development of online ordering and even delivery has the potential to change the face of food retailing.

New methods of food retailing have developed rapidly for modern stores, particularly in the use of technology. E-commerce, digital marketing, and technology-based management of the business have become common in many stores especially the food retail sector where rapid change takes place. Moreover, increased competition means that customer loyalty cannot be taken for granted.

Loyalty schemes operated by food retailers have now become part of the landscape of shopping. There are two parts to loyalty schemes. For the consumer, loyalty schemes allow for discounted purchases either immediately or in the future. They enable direct marketing such that discounting offers are targeted to consumers according to their purchasing activity. For the business, gathering information on purchasing activity allows it to see patterns in purchasing at the store, by time, by product, and by consumer. All of this is vital in maintaining knowledge about what products should be offered and when. It facilitates flexible business operations such as inventory management and it reinforces budgeting practices if retailers can discover regularity patterns in purchasing. Loyalty schemes are offered by many retailers in Ghana and, to be without one, might place a particular store at a significant competitive disadvantage. That is, loyalty cards are likely to be essential to sustain a business as they have become embedded in retail operations in much the same way that effective inventory management is a key requirement.

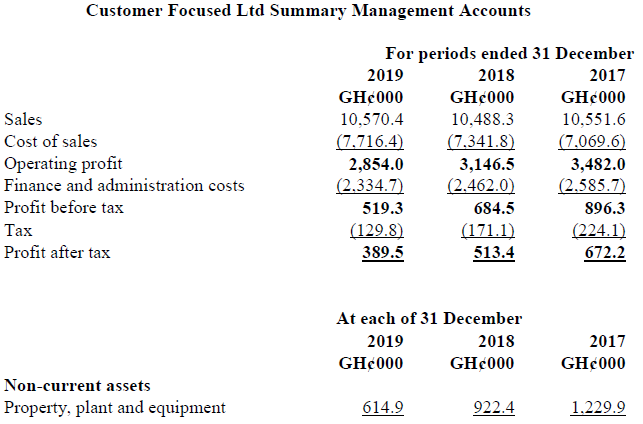

Customer Focused Ltd Performance and Position

The development of supermarkets in Ghana over 30 years ago coincided with the growth of incomes and the increase in purchasing power. International food retail chains launched branches in Ghana (such as Shoprite which is South African owned) alongside the rapid development of home-grown stores and chains such as MaxMart. The building of new shopping malls across Accra and elsewhere altered the pattern of shopping and changed expectations about what was demanded from store retailers in terms of the range of products offered and the convenience of the shopping experience. For example, one key aspect of Koala’s positioning is to make available a diversity of products. There are other examples concerning differing commercial approaches to food retail such as a substantial online presence (for example, Melcom) to the very larger hypermarket run by Palace Hypermarket.

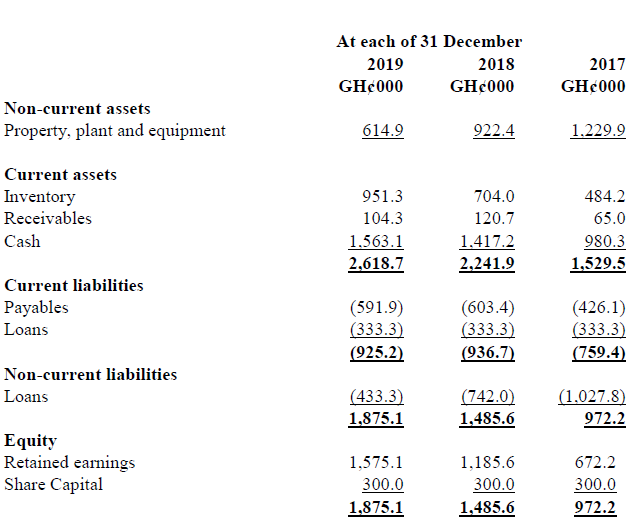

In this context Customer Focused Ltd began trading on 1 January 2017. Initial capital was created with 100,000 ordinary shares and the Share Capital amounted to GH¢300,000. The shares were owned in the proportions: Kpakpo Armah: 70%, Akwasi Boateng: 20%, Mary Acquah: 10%. Debt capital was also introduced. Customer Focused Ltd raised loan finance of GH¢100,000 which was repayable in full after five years unless renewed, subject to negotiation. The loan carried a variable interest charge which was reviewed on the anniversary of taking out the loan. The loan carried a range of covenants associated with it and these are detailed below in the summary loan documentation.

Customer Focused Ltd leased premises in Accra. The lease agreement required the company to pay a rental at the start of each year and the high expense of the agreement reflected the store’s proximity to one of Accra’s leading malls. The lease agreement was to run for five years, with the possibility of renewal.

The leased unit size was sufficient for Customer Focused Ltd to offer a range of goods to attract high spending customers who prioritised convenience over price. All the initial funding was spent on creating product lines in sufficient quantity to attract these customers. Additionally, the store unit required substantial amounts to be spent on re-fitting and purchasing of refrigeration units and cash desks that were capable of maintaining inventory records and of using loyalty cards.

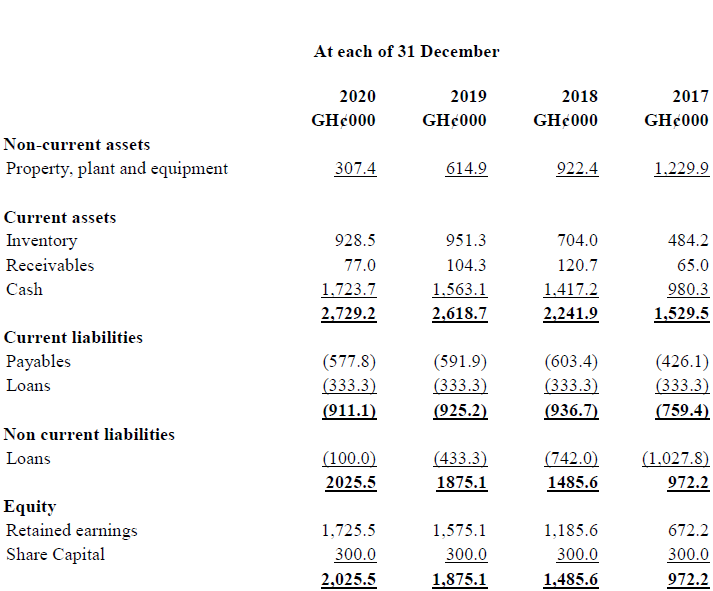

The owners forecast profitability from the onset and had, initially, carried out an investment appraisal that indicated that the store would make money over a five year period. There was an expectation that the business would continue after the five year period but only after a substantial appraisal was undertaken shortly before that time about whether the business was likely to be viable in the longer term. Discussions had taken place, at the beginning, concerning how the owners would exit the business should they wish to dispose of their investments in five years. The owners agreed that they would not take any dividends out of the business.

Summary loan documentation: Agreement between Customer Focused Ltd and Accra Business Bank (ABB)

Loan amount GH¢100,000

Interest rate Standard variable rate of ABB

Repayable in full 31 December 2021

Security Fixed charge on personal property of signatories

Conditions: Customer Focused Ltd agrees to meet the following as a condition of the loan

1) Repayment interest rate, repayment schedules and final date of repayment can be altered by ABB if covenants are not met.

2) Customer Focused Ltd agrees to maintain the following covenants:

- To maintain monthly cash balances sufficient to pay the following month’s interest payment

- To maintain net working capital always at a positive amount, defined as Inventories plus Receivables less Payables

- To maintain gearing at no higher than 50%. Gearing is defined as (debt/(debt plus equity plus retained earnings)).

Notes

1) The accounts are summarised and extracted. They are used for management review purposes. Statutory accounts, which are fully compliant with reporting standards, are produced separately.

2) Within the management accounts, the company had capitalised the lease on the property to record more accurately the asset base that the company was using.

3) Accruals and prepayments are negligible and are combined into payables and receivables, respectively.

4) The business owners took only a minimal salary from the business.

Business Objective, Business Model and Product Profile

The objective of the business is to ensure sustainability by meeting customer demand in a profitable manner.

The business model is the means by which the objective is achieved. The following description of the key aspects of Customer Focused Ltd’s business model is provided by Kpakpo Armah. Customer Focused Ltd aims to:

- maintain reliable supply arrangements and good distribution to the store,

- keep adequate inventory for all product lines and sufficient storage capability, including cold storage,

- provide a small choice of perishable goods. Customer Focused Ltd concentrates on the sale of processed and dry foods that are not perishable. It stocks a small range of perishable goods that are focussed on daily needs and are therefore frequently bought,

- ensure that shelving, including refrigerated units, and presentation are good enough to deliver customer needs,

- put in place adequate staffing to monitor supplies inwards and keep the presentation of inventory at appropriate levels,

- maintain high quality staff at customer check outs (there are no self check-out registers)

- provide convenience in terms of opening hours to accommodate passers-by who can arrive at all times. The store is open from 6am to 11pm,

- gather marketing and other information collection to support business objectives. This is needed to provide information and intelligence on customers. Traditional markets gather such information based on personal relationships,

- establish and maintain a bulk-order business line. Whilst Customer Focused Ltd mostly relies on individual customers for its sales, it has a smaller additional income stream acting as a supplier for a range of events, and to other businesses for bulk orders. This is not likely to be a growth business for Customer Focused Ltd, and

- ensure adequate financing for both investment and operations. Financing is needed but such needs are supported by the business which is planned to have a strong cash flow.

The main product areas on offer at the store are as follows:

- Food and provisions: packaged or tinned goods (milk, some meats and fish, cheese, cookies, coffee, tea, sugar, salt, biscuits)

- Grains, rice and various pastas

- Breakfast cereals

- Fresh produce: milk, a small selection of vegetables and eggs

- Ready-made meals

- Soft drinks and juices

- Sweets and chocolates

The business owners plan not take any dividends from the business and hope to either sell the business after five years or continue the business and sell at a subsequent date.

Problems, Plans and Proposals

Customer Focused Ltd was approaching its fifth anniversary and the business owners had begun discussions concerning the next steps. There were a number of areas that were discussed. The business owners recognised that there were some unresolved problems with the business that required attention. They also recognised that their planning processes were inadequate and that this had led to some underperformance of the business, but they were unsure how to respond. At some point soon the business owners agreed that a decision should be made, and a firm proposal adopted either to exit the business completely or to alter its operations or direction in some manner.

Problems

A number of problem areas had emerged which the business owners recognised would need to be addressed if they were to restore the profitability of the business to the levels they expected.

Risk management

The business owners had never introduced a risk management policy, largely because they had never identified the risks to the company. They were now concerned that this should be addressed, largely as a response to the declining profitability of the business and the business owners were concerned that they could see the value of their investments declining.

The risk areas they were most concerned with were:

- Competition: the market is highly competitive and new entrants are frequently emerging. There is a particularly challenging risk arising in the possibility of discount retailers entering the market aggressively.

- Changing preferences of customers: retailers are constantly challenged to anticipate what new trends will arise. Marketing is a vital activity in this respect since it is essential that the company knows its customers and what their changing preferences might be.

- New product lines: the capacity to respond to changing preferences by the development or offering of new products is important and so is the capacity of the business to be able to respond. Capacity constraints may be physical, financial or may arise from operational restrictions.

- Uncertainty: uncertainty is not the same as risk. With risk, key parameters of the problem are understood. With uncertainty, even these key parameters are not known. For example, uncertainty may arise because of product developments – currently unknown by Customer Focused Ltd – that are taking place by competitors which can affect how customers shop.

- Supply arrangements: it is vital that store shelves are stocked to meet customer demand. Any reduction in supplies is a risk along with the potential for price increases on those supplies.

- Customer switching: unless the business builds loyalty, the company is always at risk from customers who will shop where prices are lowest.

Marketing and Digitisation

The business owners were aware that they did not have enough information about their customer base to develop effective marketing campaigns. They had fallen behind their competitors in developing data capture systems that would allow them to collect and utilise information on customer spending habits. The feeling amongst the business owners was that they lacked the expertise to develop this and that funding restrictions meant that no new major initiatives were likely to take place in the short term.

Customer demographics

The business owners were unsure if they had correctly anticipated the changing profile of customers, and this is related to the fact the Customer Focused Ltd does not gather information on its customers. Younger customers have noticeably been shopping at the store, particularly during early evening, and many of them have asked for products that have been unavailable, either because they are not stocked by Customer Focused Ltd or because they product line had been sold. A number of areas had opened up as further possibilities for Customer Focused Ltd to sell, including cosmetics, toiletries, and other personal hygiene products, but these had never been a priority for what started out as a food retailing store.

If footfall was important to the business, and it unquestionably was, then Customer Focused Ltd was not servicing the needs of many of its potential customers.

Best sellers and inventory

One of the best sellers in-store were ready-made meals. However, these had limited shelf-life and, at the end of the day, the store had always sold-out. The business owners were not sure how long some of the other, non-perishable, lines had been on the shelves and it was not immediately clear to them which products were selling well and which products did not sell. Inventories were managed by staff but inventory information was neither gathered nor studied.

Plans

It was recognised by the business owners that a five year appraisal was due but that they should bring-forward some efforts immediately since a number of the problems facing Customer Focused Ltd required immediate attention.

The following notes represented the discussion that took place at a meeting held on 30 April 2020:

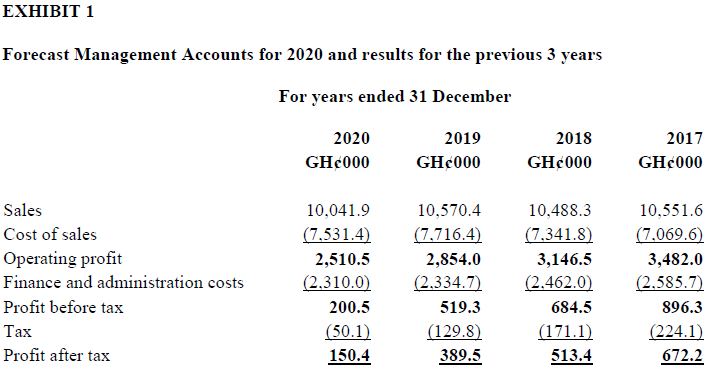

Kpakpo Armah: ‘I am concerned about the continued decline in our profitability even though our sales for the last 3 years have looked good. I think we should prepare forecast accounts to the end of the year to see what our position is.’

Akwasi Boateng: ‘I think we all know what the position is, but it will be useful to get the facts and forecasts. We would need to think about an appraisal of the accounts to try and understand the key areas which might need our attention.’

Kpakpo Armah: I’ll arrange to get the forecast accounts prepared but we should be ready to begin making some tough decisions, along the lines that we have already made. In addition, it is about time we started considering alternative courses of action for the company. If we wait for the five year anniversary then it may be too late to take any effective action.’

Mary Acquah: I’ve already sketched out some ideas (contained below in ‘Proposals’). They are undeveloped and we would need to work through the implications and to develop detailed plans if they were to be implemented. I fully appreciate that financing will be an issue and the prospects of our continuing in business may not be very good if we cannot arrange adequate financing for the period after the five year anniversary.’

Akwasi Boateng: That much is pretty obvious, but which of your plans is likely to be successful? Do we perhaps need another investing partner? I’m not sure that I am clear about where we go from here….’

The meeting adjourned with nothing more being said.

Proposals

The proposals tabled by Mary Acquah consisted only of a number of headline items as follows:

- Company should launch a loyalty card and develop a marketing programme

- Reduce costs: look for more secure supply arrangements at a reduced price

- Seek a further equity partner, already running a business, to make an alliance and to secure funding

- Seek an additional major investment and possibly relocate to a cheaper premise and launch either

o a companion store in another location, or

o increase the product range - Exit the business with an attempted sale as a going concern.

SECTION A

Customer Focused Ltd has updated its management accounts (Exhibit 1) to produce a forecast for the year 2020 and these have indicated some significant problems. The business owners are unsure what to do next.

Required:

You are acting as an advisor to the company and they ask you to:

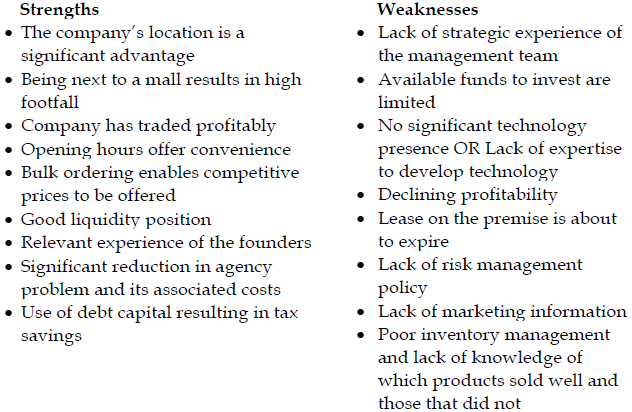

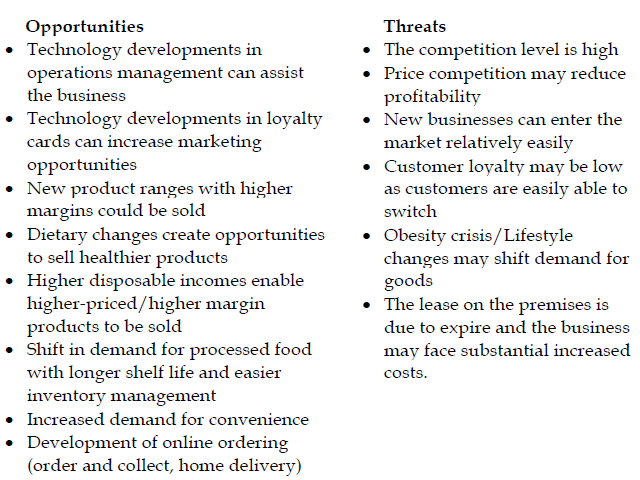

1) Prepare a SWOT analysis of Customer Focused Ltd.

You should list the strengths, weaknesses, opportunities and threats in the SWOT analysis of Customer Focused Ltd. You should then select from your list the key strengths, weaknesses, opportunities and threats and explain why they are important. (20 marks)

View Solution

Key areas:

Key strengths

- The business’ location is a key strength but this is presumably costly in terms of the lease agreement.

- The company has traded profitably and, hence, knows how to run a convenience store profitably.

- The company has substantial liquidity and this provides flexibility in making decisions.

Key weaknesses

- Lack of technology development is hindering the marketing and development of the business

- Whilst the business has substantial liquidity there will be demands on those funds in terms of investments required and renewing the lease

- Management weaknesses in terms of strategy development and inventory management may prove costly in terms of the potential mistakes that could be made when important decisions are imminently required

Key opportunities

- Technology developments in marketing and inventory management will support better marketing and operations

- Product offering, particularly with respect to higher margin products, such as healthy ranges of foods can be expanded thus securing business sustainability

Key threats

- Declining profitability could have resulted from competition and/or lack of product development

- Customer loyalty is low and emphasises the need for better market intelligence

- The expiry of the lease will be a key issue possibly affecting location and sustainability.

Overall, the business has started well and was profitable but declining profitability has presented challenges to the owners about what they should do to address the sustainability of the business.

. (1 mark for each explained point from each of the four quadrants)

. (Max 2 marks for each quadrant = 8 marks)

3) Based on your work in Q1 and Q2, identify and explain three key factors which must be addressed for Customer Focused Ltd to be sustainable over the short term. (9 marks)

View Solution

COMPANY VIABILITY – THREE KEY FACTORS

- Declining sales and profitability: if this continues at the rate identified in b) then business value is in danger of becoming negligible and the room for manoeuvre by the partners in their 5 year review becomes very limited. They may not be able to sell the business.

- Further investment: There appears to have been no investment in PPE in the period since launch. Whilst the company has a large cash balance, there will be funding requirement for further investment in possibly one or both of the following areas:

*store update and technology implementation

*possible relocation and associated costs - Lease renewal: The store is at risk of not being able to complete a lease renewal, which is due. This is always a possibility when leases expire. If relocation becomes a likelihood then the business loses one of its biggest drivers of profit.

Other issues might include:

- Lack of experience/expertise in marketing and strategy. The current management are over-reliant on location as the key business driver and perhaps lack focus on the opportunities and threats that the business faces

- Staffing and the monitoring of business operations. There appears to be insufficient management oversight of inventories.

- Lack of assessments of new products and monitoring of sales and stocking by product line. There appears to be insufficient use of managerial information that are key to retail food store operations.

- Proper collection and management of customers’ data.

. (Any three points well explained @ 3 marks each = 9 marks)