Nov 2020 Q1 a & b

Esther Naah, a Ghanaian by birth, has spent most of her life in the United Kingdom. She has made a lot of savings and would want to invest in Ghana. She has heard of Ghana Free Zone Authority and been told that the rationale behind the free trade zone is the development of disadvantaged regions. You work in a Tax Consulting firm and your Managing Partner has called on you to brief Esther, on the following issues during her next appointment to the Tax Consulting firm.

Required:

Draft a report that will incorporate the following:

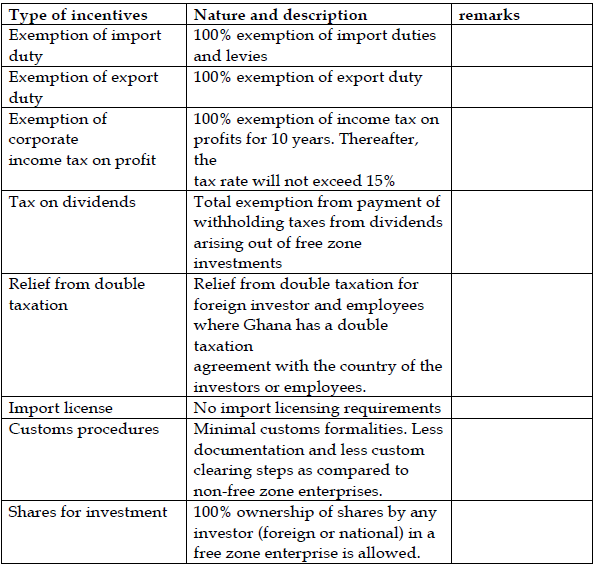

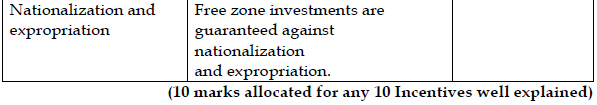

a) Tax incentives and benefits for Free Zone Enterprises. (10 marks)

View Solution

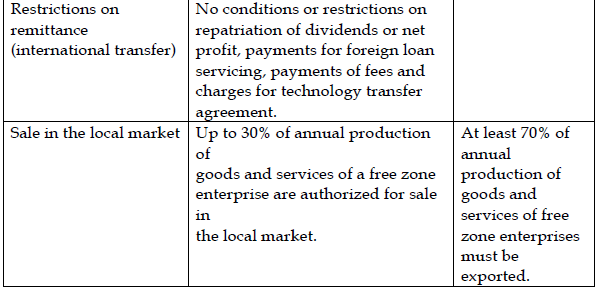

b) What will be the tax implication if the Free Zone Enterprise sells into the local markets? (4 marks)

View Solution

The free zone enterprises are required to export all their produce or products. However, the law allows the free zone enterprises to obtain permission to sell up to 30% in the local market that is in Ghana.

When that happens, they are required to pay the following taxes:

- Pay duties on the products or produces as duty was not paid at the time of importation

- Pay all VAT on those goods

- Pay National Health Insurance levies and

- Pay all Get/funds on the goods

- Chargeable income of the goods sold locally shall be subject to corporate tax at the rate of 25%