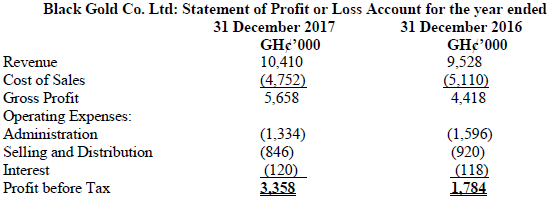

Nov 2019 Q2 b.

Retail Specialist Co. Ltd (RSCL) is a large company, operating in the retail industry, with a year ended 31 December, 2018. You are a manager in Jen & Co, responsible for the audit of Retail Specialist Co. Ltd (RSCL), and you have recently attended a planning meeting with Olivia Danso, the finance director of the company. As this is the first year that your firm will be acting as auditor for Retail Specialist Co. Ltd (RSCL), you need to gain an understanding of the business risks facing the new client. Notes from your meeting are as follows:

Retail Specialist Co. Ltd (RSCL) sells clothing, with a strategy of selling high fashion items under the RSCL brand name. New ranges of clothes are introduced to stores every eight weeks. The company relies on a team of highly skilled designers to develop new fashion ranges. The designers must be able to anticipate and quickly respond to changes in consumer preferences. There is a high staff turnover in the design team.

Most sales are made in-store, but there is also a very popular catalogue, from which customers can place an order on-line, or over the phone. The company has recently upgraded the computer system and improved the website, at significant cost, in order to integrate the website sales directly into the general ledger, and to provide an easier interface for customers to use when ordering and entering their credit card details. The new on-line sales system has allowed overseas sales for the first time.

The system for phone ordering has recently been outsourced. The contract for outsourcing went out to tender and Retail Specialist Co. Ltd (RSCL) awarded the contract to the company offering the least cost. The company providing the service uses an overseas phone call centre where staff costs are very low.

Retail Specialist Co. Ltd (RSCL) has recently joined the Ethical Trading Initiative. This is a ‘fair-trade’ initiative, which means that any products bearing the RSCL brand name must have been produced in a manner which is clean and safe for employees, and minimises the environmental impact of the manufacturing process. A significant advertising campaign promoting Retail Specialist Co. Ltd (RSCL)’s involvement with this initiative has recently taken place. The RSCL brand name was purchased a number of years ago and is recognised at cost as an intangible asset, which is not amortised. The brand represents 12% of the total assets recognised on the statement of financial position.

The company owns numerous distribution centres, some of which operate close to residential areas. A licence to operate the distribution centres is issued by each local government authority in which a centre is located. One of the conditions of the licence is that deliveries must only take place between 8 am and 6 pm. The authority also monitors the noise level of each centre, and can revoke the operating licence if a certain noise limit is breached. Two licences were revoked for a period of three months during the year.

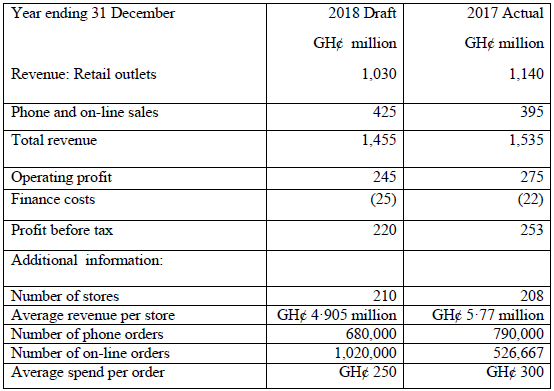

To help your business understanding, Olivia Danso has e-mailed to you extracts from the draft statement of comprehensive income, and the relevant comparative figures, which are shown below.

Extract from draft Statement of Comprehensive Income

Required:

Using the information provided, identify and explain FIVE (5) risks of material misstatements that may affect the financial statements you are going to audit. (10 marks)

View Solution

Valuation of inventory

High fashion product lines are likely to become out-of-date and obsolete very quickly. Retail Specialist Co. Ltd (RSCL) aims to have new lines in store every eight weeks, so product lines have only a short shelf life. Per IAS 2 Inventories, inventory should be valued at the lower of cost and net realisable value, and could be easily overvalued at the year-end if there is not close monitoring of sales trends, and necessary mark downs to reflect any slow movement of product lines. The decline in revenue could indicate that the RSCL brand is becoming less fashionable, leading to a higher risk of obsolete product lines.

Orders made over the phone or by the internet are prone to higher levels of returns than items purchased in a store, as the customer may find that the item is not the correct size, or they do not like the item when it arrives. The risk is insufficient provision has been made in the financial statements for pre year-end sales being returned post year-end.

Completeness/existence of inventory

Retail Specialist Co. Ltd (RSCL) has 210 stores and numerous distribution centres. It may be hard to ensure that inventory counting is accurate in this situation. There may be large quantities of inventory in-transit at the year-end, which may be missed from counting procedures, meaning that the inventory quantities are incomplete. Equally, it may be difficult for the auditor to verify the existence of inventory if it cannot be physically verified due to being in-transit at the year-end. Inventory could be the subject of fraudulent financial reporting, as it would be relatively easy for management to ‘inflate’ quantities of inventory to increase the amount recognised on the statement of financial position. The clothing items could also be at risk of theft, making inventory records inaccurate.

Unrecorded revenue

The on-line and phone sales systems could contribute to a risk of misstated revenue figures. Firstly, the on-line sales system is integrated with the general ledger, so sales made through the system should automatically be recorded in the accounting system. However, the system is new, and it is possible that the integration is not functioning as expected. The scenario does not state whether the phone sales system is integrated, but it is unlikely given that the function is outsourced, so a similar risk of unrecorded transactions may arise here.

Sales made in store will include a proportion of cash sales. The risk is that the cash could be misappropriated, and the revenue unrecorded.

Over-capitalisation of IT/website costs

The on-line sales system has been upgraded at significant cost. There is a risk that costs have been incorrectly capitalised. SIC 32 Intangible Assets – Website Costs states that only costs relating to the development phase of the project should be capitalised, but costs of planning, and all costs when the website is operational should be expensed. Software development costs follow similar accounting principles. Hence there is a risk of overvalued assets and unrecognised expenses.

Overvaluation of the brand name

The RSCL brand name is recognised as an intangible asset, which is the correct accounting treatment for a purchased brand. The risk is that the asset is overvalued, for two reasons. Firstly, if no amortisation is being charged on the asset, management are assuming that there is no end to the period in which the brand will generate an economic benefit. This may be optimistic, and there is a risk that the brand is overvalued, and operating expenses incomplete if there is no annual write-off. An intangible asset which is not being amortised should be subject to an annual impairment review according to IAS 38 Intangible Assets. If no such review has been conducted, the asset could be overvalued. The falling revenue figures could indicate that the asset is overvalued.

Secondly, a significant amount has been spent on promoting the brand name during the year. This amount should be expensed, and if any has been capitalised, the brand is overvalued, and operating expenses incomplete.

Overvaluation of properties

There are two indications from the scenario that properties may need to be tested for impairment, and so could be overvalued. The first is the potential for distribution centres’ operating licences to be revoked. If this were to occur, the asset would cease to provide economic benefit, triggering the need for an impairment review. Secondly, the average revenue per store has fallen. IAS 36 Impairment of Assets suggests that worse economic performance than expected is an indicator that an asset could be impaired. For these reasons, both stores and distribution centres have the potential to be overvalued.

Unrecognised provision/undisclosed contingency

The revocation of an operating licence could lead to a fine or penalty being paid to the local authority. Two licences have been revoked during the year. The risk is that Retail Specialist Co. Ltd (RSCL) has not either provided for any amount payable, or disclosed the existence of a contingent liability in accordance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

Opening balances and comparative figures

As this is our first year auditing Retail Specialist Co. Ltd (RSCL), extra care should be taken with opening balances and comparative figures, as they were not audited by our firm. Additional audit procedures will need to be planned.