May 2021 Q2

Oliso Private Company Ltd has been operating in the manufacturing sector for over a decade. One of its major products is manufacturing equipment, which can reduce toxic emissions in the production of chemicals. The company recently employed a new marketing manager who introduced series of marketing initiatives. This has resulted in significant growth of the company since the appointment of the marketing manager. One of the initiatives is the warranties that the company gives to its customers. The company guarantees its products for three years, and if problems arise within the period, it undertakes to fix them or provide a replacement for the product.

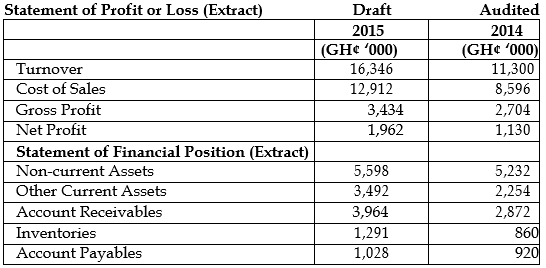

You are the Senior Manager recently engaged by Integrity Audit Consult responsible for Oliso Private Company Ltd’s audit. You are performing the final review as required by ISA 520 Analytical procedures for the audit and have come across the following issues.

Receivable balance due from Obey Company Ltd.

Oliso Private Company Ltd has a material receivable balance due from a customer named Obey Company Ltd. During the year-end audit, your team reviewed the ageing of this balance and found that no payments had been received from Obey Company Ltd for over eight months. Oliso Private Company Ltd however would not allow this balance to be included in the list of balances to be circulated. Instead, management has assured your team that they will provide a written representation confirming that the balance is recoverable.

Warranty provision

The warranty provision included in the statement of financial position is material. The audit team has performed testing over the calculations and assumptions, which are consistent with prior years. The team has requested a written representation from management confirming the basis and amount of the provision. Management is yet to confirm acceptance of the need to issue this representation.

Required:

a) Recommend THREE (3) audit procedures to validate the accounting estimates. (5 marks)

View Solution

Procedures the auditor should adopt in respect of auditing accounting estimates include:

- Inquire of management how the accounting estimate is made and the data on which it is based.

- Determine whether events occurring up to the date of the auditor’s report (after the reporting period) provide audit evidence regarding the accounting estimate.

- Review the method of measurement used and assess the reasonableness of assumptions made.

- Test the operating effectiveness of the controls over how management made the accounting estimate.

- Develop an expectation of the possible estimate (point estimate) or a range of amounts to evaluate management’s estimate.

- Review the judgments and decisions made by management in the making of accounting estimates to identify whether there are indicators of possible management bias.

- Evaluate overall whether the accounting estimates in the financial statements are either reasonable or misstated.

- Obtain sufficient appropriate audit evidence about whether the disclosures in the financial statements related to accounting estimates and estimation uncertainty are reasonable.

- Obtain written representations from management and, where appropriate, those charged with governance whether they believe significant assumptions used in making accounting estimates are reasonable.

(Any 5 points @ 1 mark each = 5 marks)

b) For each of the two issues above:

i) Evaluate the appropriateness of written representations as a form of audit evidence. (4 marks)

ii) Describe TWO (2) additional procedures the auditor should perform to conclude on the balances to be included in the financial statements. (6 marks)

View Solution

Receivables balance owing from Obey Company Ltd

i) The written representation proposed by management is intended to verify the valuation, existence and rights and obligations of a material receivables balance. However, as management has refused to allow the auditor to circularise the balance and there has been little activity on the account for the past eight months, then there is very little evidence that the auditor has obtained.

- This representation would constitute entity generated evidence, and this is less reliable than auditor generated evidence or evidence from an external source. However, if related control systems operate effectively, then this evidence becomes more reliable. In addition, if the representation is written as opposed to oral, this will increase the reliability as an evidence source.

- Overall this representation is a weak form of evidence, as there were more reliable evidence options available, such as the circularisation, but this was not undertaken. (2 marks)

ii) To reach a conclusion on the balance, the following procedures should be performed:

- Discuss with management the reasons as to why a circularisation request was refused.

- Review the post year-end period to identify whether any cash has now been received from Obey Company Ltd

- Review correspondence with Obey Company Ltd to assess reasons for the continued non-payment.

- Review board minutes and legal correspondence to assess whether any legal action is being taken to recover the amounts due.

- Discuss with management whether a provision or write down is now required.

- Consider the impact on audit opinion if balance is considered to be materially misstated. (3 points for 3 marks)

Warranty provision

i) In this case, the auditor has performed some testing of the provision to obtain auditor-generated evidence. The team has tested the calculations and assumptions. None of this is evidence from an external source.

The very nature of this provision means that it is difficult for the auditor to obtain a significant amount of reliable evidence as to the level of future warranty claims.

Hence the written representation, whilst being an entity generated source of evidence, would still be useful as there are few other alternatives. (2 marks)

ii) To reach a conclusion on the balance, the following procedures should be performed:

- Review the post year-end period to compare the level of claims actually made against the amounts provided.

- Review the level of prior year provisions with the amounts claimed to assess the reasonableness of management’s forecasting.

- Review board minutes to assess whether any changes are required to the level of the provision as a result of an increased or decreased level of claims by customers. (3 points for 3 marks)

c) The directors of Oliso Private Company Ltd have decided not to provide the audit firm with the written representation for the warranty provision as they feel it is unnecessary.

Required:

Explain the steps the auditor of Oliso Private Company Ltd should take to assess the impact of management’s refusal to provide a written representation on the auditor’s report. (5 marks)

View Solution

Steps to take if written representation on warranty provision is not provided

- ISA 580 Written Representations guides the auditor when written representations are requested from management, but they refuse to provide.

- If management does not provide the requested written representation on the warranty provision, the auditor of Oliso Private Company Limited should discuss the matter with management to understand why they are refusing.

- In addition, the auditor should re-evaluate the integrity of Oliso Private Company Limited’ management and consider the effect that this may have on the reliability of other representations (oral or written) and audit evidence in general.

- The auditor should then take appropriate actions, including determining the possible effect on the audit opinion.

Impact on the audit report - As the auditor cannot obtain sufficient appropriate evidence to conclude that the warranty provision is free from material misstatement, a modified audit opinion will be required.

- The warranty provision is material but not pervasive, and therefore a qualified opinion would be appropriate.

- The opinion paragraph will be amended to state ‘except for’ for the lack of evidence on the warranty provision, the financial statements show true and fair view.

- The audit report will require an additional paragraph known as the basis for the qualification paragraph after the opinion paragraph, which will describe the reason for the modification, namely that management refusal to provide a written representation in relation to the warranty provision and hence the reason for the except for opinion.

- The materiality of the warranty provision will be stated in the basis for the opinion paragraph.

(Any 5 points for 5 marks)