May 2018 Q1

As the Senior Audit Manager in MNO & Co, a firm of Chartered Accountants, you have just had a meeting with a Senior Partner at the firm, in which he informed you that you have to carry out an investigation requested by the Management of ECO Ltd.

FACTS

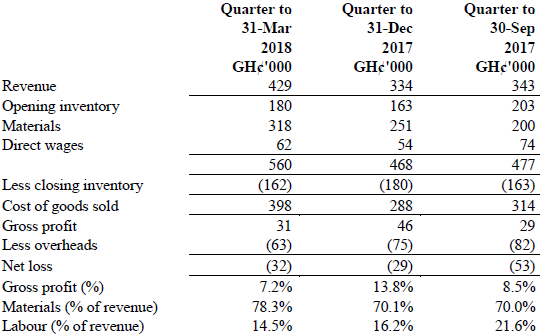

i) One of ECO Ltd’s subsidiaries, PQR Ltd, has been making losses for the past year. ECO Ltd’s management is concerned about the accuracy of PQR’s most recent quarter’s management accounts. The summarised statements of profit or loss for the last three quarters are as follows:

ii) ECO Ltd’s management board believes that the high material consumption as a percentage of revenue for the quarter to 31 March 2018 is due to one or more of the following factors.

- Under-counting or under-valuation of closing inventory

- Excessive consumption or wastage of materials

- Material being stolen by employees or other individuals

iii) PQR Ltd has a small number of large customers and manufactures its products to each customer’s specification. The selling price of the product is determined by:

- Estimating the cost of materials;

- Estimating the labour cost and

- Adding a mark-up to cover overheads and provide a normal profit.

iv) The estimated costs are not compared with actual costs. Although it is possible to analyse purchase invoices for materials between customers’ orders this analysis has not been done.

v) A physical inventory count is carried out at the end of each quarter. Items of inventory are entered on inventory sheets and valued manually. The company does not maintain perpetual inventory records and a full physical count is to be carried out at the financial year end, 30 June 2018.

vi) The direct labour cost included in the inventory valuation is small and should be assumed to be constant at the end of each quarter.

vii) Historically, the cost of materials consumed has been about 70% of revenue. The management accounts to 31 March 2018 are to be assumed to be correct.

Required:

a) Identify and describe the matters that you should consider and the procedures you should carry out in order to plan an investigation of PQR Ltd.’s losses. (10 marks)

View Solution

- Whether our firm has the necessary resources and experience to carry out the investigation of PQR Ltd’s losses.

- What reliance is to be placed on the report that we produce as a result of the investigation and whether it will be relied upon by any third parties such as lenders

- What type of report it is to be and what level of assurance will be given

- Whether any potential independence issues exist with other clients that our firm has and therefore potential conflicts of interest

- What level of detail is required in terms of the work to be undertaken Procedures to carry out

- Review staff availability and timings to assess whether sufficient resource for the investigation exists.

- Discuss with the management of ECO Ltd the scope of the investigation and its purpose (eg whether any third parties will be relying on it or whether it is an internal report only) and other issues such as expected timing, fees etc.

- Clarify the terms of reference of this engagement in writing from the management of West.

- Draft an engagement letter for this investigation and obtain agreement of terms in writing from the management of ECO Ltd. (Any 5 points)

b) Explain the matters you should consider to determine whether closing inventory at 31 March 2018 is undervalued. (3 marks)

View Solution

- Inventory will be undervalued if cut-off has not been appropriately applied therefore particular focus needs to be on this area of the quarter-end count.

- Inventory will be undervalued if not all inventory items have been included in the count therefore the investigation should focus on the procedures in place for the quarterly counts.

- Inventory will be undervalued if the valuation methods are incorrect. Inventory is valued manually so the investigation should examine how items of inventory, such as scrap are valued.

c) Describe the tests you should plan to perform to quantify the amount of any undervaluation. (3 marks)

View Solution

- Obtain inventory counting instructions in place at PQR Ltd and review to make an assessment of their adequacy for the quarterly counts, together with discussion with appropriate staff at ECO Ltd.

- Perform analytical procedures using figures from the quarterly management accounts, such as comparisons between 31 March 2018 and 31 December 2017.

- Discuss scrap and wastage policy with warehouse staff.

- Examine details of scrap and discuss figures with appropriate staff to establish whether there are any reasons for wastage being higher in this quarter.

- Test cut-off is correct by tracing the last goods delivery notes and despatch notes to the invoices.

- Recast additions on inventory sheets to verify accuracy. (Any 3 points)

d) Identify and explain the possible reasons for the apparent high materials consumption in the quarter ended 31 March 2018. (2 marks)

View Solution

- If closing inventory has been undervalued or undercounted, this could explain a high materials consumption in this quarter. It could also be due to excessive consumption or wastage of materials. If recorded inventory has been stolen from production areas this could be another contributory factor to a high materials consumption in this quarter.

- If cut-off was incorrectly applied, then this would affect the materials consumption, ie if goods delivered after the year end were incorrectly included as purchases in the quarter then this would give rise to a higher materials consumption.

- Also if revenue is understated due to incorrect cut-off, then materials consumption as a % of revenue will be overstated. (Any 2 points)

e) Describe the tests you should plan to perform to determine whether materials consumption, as shown in the management accounts, is correct. (2 marks)

View Solution

- Test cut-off of purchases and sales has been done correctly by matching purchase invoices to goods received notes and matching despatch notes to invoices raised around the quarter-end date.

- Compare value of inventory identified as obsolete or damaged at the quarter-end to the previous quarter-end, discussing discrepancies with appropriate staff.

- Discuss levels of scrap and wastage with warehouse managers to ascertain normal levels and understand how it arises.

- Review a sample of credit notes received after the quarter-end to identify any returned materials.

- Inspect scrap materials to confirm it is not suitable for manufacture and therefore is not included in inventory. (Any 2 points)