May 2020 Q3 b.

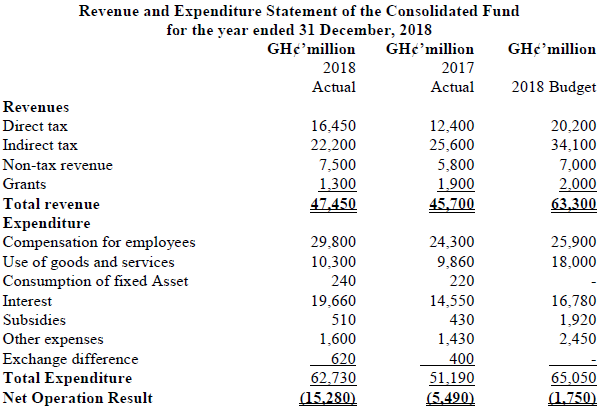

Presented below is the Statement of Financial Performance of the Consolidated Fund of Ghana.

Required:

Based on a Common Size Statement of Financial Performance, write a report discussing and analysing the financial performance of the Consolidated Fund in line with the Recommended Practice Guide 2, Financial Statement Discussion and Analysis. (10 marks)

View Solution

REPORT ON FINANCIAL PERFORMANCE OF CONSOLIDATED FUND FOR THE YEAR ENDED 31ST DECEMBER 2018

Introduction

The report provides an analysis and discussion of the financial performance of the Consolidated Fund in line with the Recommended Practice Guide (RPG). The analysis and discussions are based on the common size statement of Revenue and Expenditure of the Fund for the period.

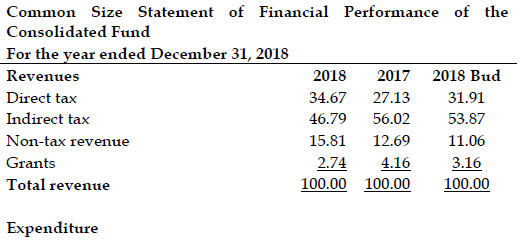

Revenue Performance

The Fund performance in terms of direct taxes and non-tax revenues exceeded the previous year’s results and that of the budget for the period. Direct tax revenue constituted 34.7% of the total revenue of the year as against 27.1% and 31.9% of the prior year and budget totals respectively. This may be attributed to massive tax education and technology applications introduced in to the tax administration system during the period. However indirect taxes performed below the budget and prior year performance likely due to sharp economic decline caused by external factors. Grants has also seen a downward trend over the period, indicating that donor support is decreasing over the years.

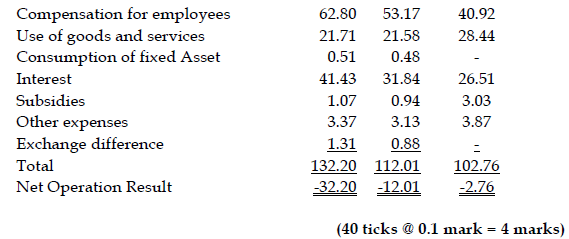

Expenditure performance

Compensation of employees remain the biggest expenditure of the fund for the year with over 60% of the total revenue generated spent on it. This exceed the expenditure level of 2017 and even the budget of the year. The fund was expected to spend 40.9% of total revenues of the year on compensation but ended spending 62.8% on it, showing clearly a budget over run in excess of 29%. This may result from employment without establishment warrants or increase in wage due the labour unrest during the period. There is a budget under run in goods and services during the year. The fund budgeted to spend about 28% on goods and services during the year but spent only 21,7% during the year. This may affect efficient delivery of public services as input are likely to be lacking due to failure to release budget allocation to the departments. Interestingly, over 41% of total revenue was spent on interest expense, far in excess of the budgeted proportion of 26.5%. This results from huge public debt during the period. Governments should ensure that debt levels are controlled so as to create fiscal space for spending on goods and services.

Conclusion

The net operating result of the Fund was deficit 32% compared to deficit 12% in 2017 and budget deficit of 2.8%. This shows that financial performance of the Fund was not good enough. Drastic measures should be taken to increase revenues from indirect revenues sources and to reduce spending on compensation of employees and interest on debt.

(6 marks)