May 2021 Q5 a.

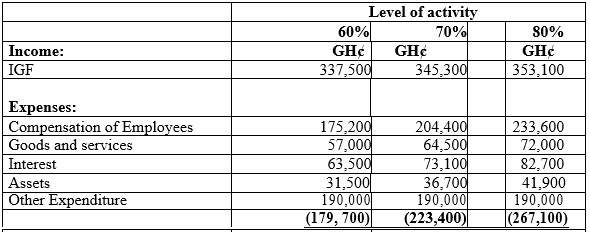

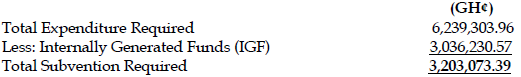

Since the creation of Atuum District Assembly (ADA) in 2011, inadequate revenue mobilisation has been its major challenge making the Assembly unpopular. The newly appointed District Chief Executive (DCE) is concerned about the effectiveness of the revenue budget system of the Assembly.

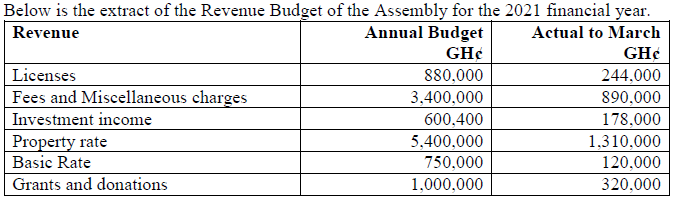

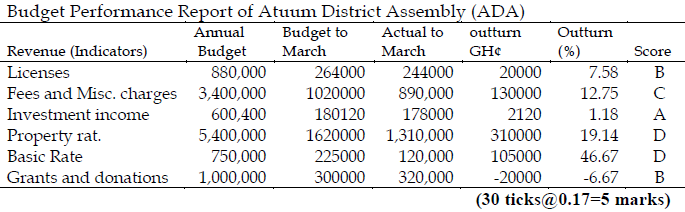

The budget allocation over the various items over the quarters is in the ratio of 3:3:2:2. The DCE indicates that the budget reliability measures of Public Expenditure and Financial Accountability (PEFA) are ideal for assessing the budget performance of the Assembly. In the framework, the following interpretation is given to budget outruns:

- Outturn/variance not greater than 5% is scored as A, indicating very good budget reliability

- Outturn higher than 5% but not exceeding 10% is scored B, indicating good budget reliability.

- Outturn higher than 10% but not exceeding 15% is scored C, indicating average budget reliability.

- Outturn higher than 15% is scored as D, indicating poor budget reliability.

Note that each revenue item is treated as an indicator under the PEFA framework.

Required:

i) As the Budget Officer, prepare the statement of budget performance for the first quarter of the 2021 financial year, indicating clearly the outturn percentage and the respective scores. (5 marks)

View Solution

ii) Write a report to the DCE on the budget performance of the Assembly and suggest ways of improving the budget reliability of the Assembly. (6 marks)

View Solution

Budget Performance Report of ADA to the District Chief Executive

Introduction:

This report provides you with the revenue budget performance analysis for the first quarter of 2021 and some suggestions for improving the budget reliability of the Assembly.

Revenue Performance for the period

The performance assessment relates to the revenue budget and execution for the first quarter of 2021. In all, it is only grants/donations that recorded a favourable budget outturn of GH¢20,000 more than the budget, resulting in an outturn percentage of 6.67% with a budget reliability score of B under the PEFA framework. This shows that donors lived up to their promises during the period. All IGF revenue lines recorded adverse variance, that is, below budget. However, in terms of PEFA Reliability score, the performance was good. This implies, there was a high-level accuracy in the revenue estimates for the Assembly. On the other hand, the budget reliability in terms of property rates and basic rates were poor, all scoring a D. The budget outturn of property rate was as high as GH¢310,000 and that of Basic Rate is GH¢105,000. This indicate that the Assembly must pay attention to its revenue generation efforts in these regards.

In conclusion, revenue performance of internally generated revenues is not encouraging and therefore, the following strategies were recommended:

- There should be effective registration and identification of immovable properties in the jurisdiction to make the mobilisation of property more effective and less cumbersome.

- An effective register of basic rate payers should be maintained electronically to help in levying and collecting basic rates. This will also help in ensuring the collection of arrears on basic rates from defaulting ratepayers.

- An effective internal control system over revenue should put in place to check and avoid leakages resulting in malfeasance and operational inefficiencies.

- Outsourcing of difficult-to-collect revenues to private firms to increase the commercial motivation to improve collection.

- Revenue collectors should be well motivated and given clear budget targets to achieve.

Introduction = ½ mark

Body= ½ x4 = 2 marks

Suggestion=3 points @1 mark = 3 marks

Conclusion= ½ marks

Total =6 marks

iii) Discuss FOUR (4) benefits of effective revenue budgeting in the Assembly. (4 marks)

View Solution

- Revenue source identification and planning.

- It offers the opportunity to the Assembly to review its existing revenue sources and identify the potential revenue sources. This will help to improve the revenue net of the Assembly.

- Set target

- Revenue budgeting provides targets for implementation, and this target may motivate the responsible officer to achieve those targets.

- Communication

- It set out the revenue policies and strategies of the Assembly, which may serve as effective communication to the citizens.

- Proper cash management

- It enables the Assembly to plans and manages its cash need for the period, as the budget provides the total revenue that will be available for spending in the budget period.

- Performance measurement

- It provides a performance management tool that can assess the performance of responsible officers in executing the revenue budget.

(Any four points @ 1 mark each = 4 marks)