Nov 2020 Q1 a.

The Director of Finance and the Principal Spending Officer of a Public Sector Organization are in disagreement as to which basis of accounting will provide the most useful information to the users. The Principal Spending Officer strongly believes that whether an entity applies cash basis or accrual basis, the effect is the same. The Director of Finance disagrees with him totally, arguing that different accounting treatment applies to both and therefore affect the level of disclosure in the financial report. The Director of Finance proceeded to illustrate his point by drawing on the basis of accounting on these items in the financial statement:

i) Motor vehicle donated to the entity

ii) Revenue due but not received by the entity

iii) Furniture acquired in the current year

iv) Electricity consumed for the year but not paid to Electricity Company.

Required:

The Director of Finance has tasked you to present a brief paper on how the two accounting bases would be applied in the treatment of items i) to iv). (8 marks)

View Solution

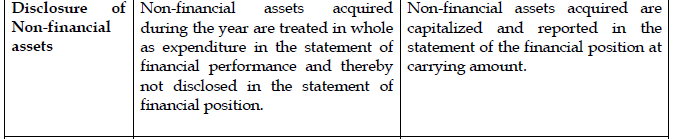

i) Motor vehicle donated to the entity

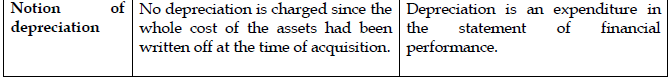

Under cash basis no cash is received and therefore no recognition will be made in the Statement of cash receipt and cash payment for the period. No information to reflect the operational capacity of the entity (Motor vehicle will not be reflected in the financial information).

Contrary, under the accrual basis of accounting the policy will be to recognize the donation in kind as revenue for the reporting period and disclose the vehicle at its market value. In addition, the cost of service will reflect the use of the vehicle (depreciation) within the reporting period and reporting the operational capacity at carrying amount.

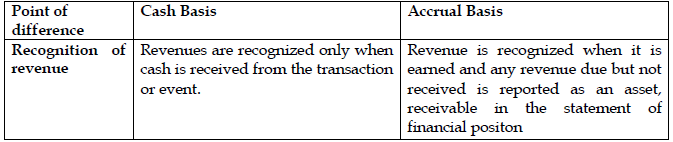

ii) Revenue earned but not received by the entity

Under cash basis, there will be no disclosed of the revenue in the statement of cash receipt and cash payment since such revenues were not received. However, information on the revenue receivable may be disclosed in the notes to the accounts. No allowance will be made for uncollectible revenues.

Under accrual basis, the accounting policy will be to recognize the revenue yet to be received as revenue for the period and treat the revenue receivable in the statement of financial position as asset. In addition, appropriate allowance will be made for uncollectible revenues to reflect the cost of service. No disclosure is required under

iii) Furniture acquired in the current year

Cash basis accounting policy is to charge the whole amount of the furniture to cost of service (payments) for the year without disclosing the value of the asset in the operational capacity. Consequently, no depreciation policy is required.

Under accrual basis, the furniture will be capitalized and depreciated over its useful life so as to fairly reflect the cost of service of the entity. The depreciation policy will be disclosed in the notes to the accounts, a part of accounting policies.

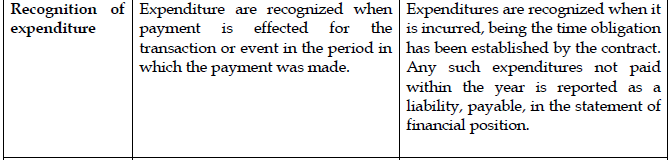

iv) Electricity consumed for the year but not paid to PDS

Electricity unpaid at the end of the year will not be included in the statement of cash receipt and cash payments for the period. No liability will be reflected in the financing capacity of the entity. Notwithstanding, the liability resulting from the electricity may be reported in the notes of accounts if it is material.

However, under the accrual accounting policy, the electricity expense will be reflected in the cost of service and the financial capacity will also indicate the liability. No disclosure is required in the notes of accounts