May 2020 Q2 a,b,c&d

a) Pamela Noi Ltd is a non-resident person. The Company’s Procurement Officer came down to Ghana to buy Ten (10) Toyota Vehicles manufactured by Safo Kantanka to be delivered in Mali. The vehicles are going to be used in Mali. The management of Pamela Noi Ltd requested that the vehicles be serviced in Ghana by High Class Mechanic, a popular mechanic in Accra-Ghana.

Required:

i) What is the Value Added Tax (VAT) implication on the vehicle to be acquired by Pamela Noi Ltd? (2.5 marks)

View Solution

Value added tax is tax on value addition through the production and supply chain. The VAT is charged on goods, services and imports. The VAT is on the destination principle. Charge VAT if the goods and services are going to be consumed in Ghana and do not charge VAT if the goods and serviced are going to be consumed outside Ghana.

Pamela Noi Ltd being a non-resident person and with the purchase of 10 pickups to be used in Mali will not attract VAT in line with destination principle.

ii) What is the VAT implication of the servicing of the vehicle in Ghana? (2.5 marks)

View Solution

The VAT is charged when service is consumed in Ghana. Given that the vehicles will be service in Ghana by Ghanaian Mechanic, the service will attract VAT.

The servicing to be performed of the 10 picks in Ghana is a taxable activity and consequently, will attract VAT in line with destination principle.

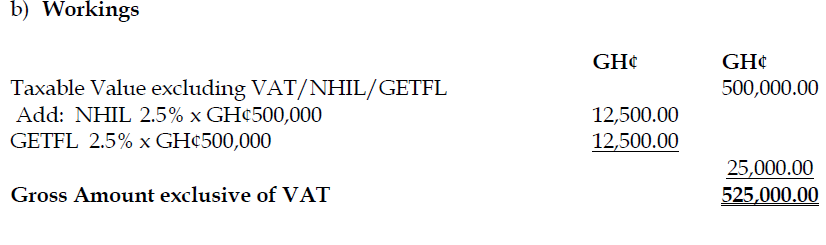

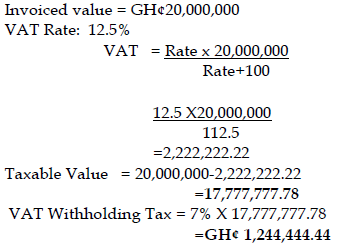

b) Mutumna Ltd is a manufacturer and invoiced goods valued GH¢20,000,000 to Lamlam Ltd, a resident company located in the Western Region of Ghana. Lamlam Ltd has been appointed as a Value Added Tax Withholding Agent.

Required:

Compute the VAT withholding taxes. (3 marks)

View Solution

c) The introduction of Withholding Value Added Tax was widely celebrated by tax administrators and tax practitioners as it is believed the benefits to be raked by the Ghana Revenue Authority would be enormous.

Required:

What purpose does Withholding Value Added Tax seek to achieve? (2 marks)

View Solution

Withholding VAT is not a new tax but a compliance measure to ensure that all VAT due government is paid. It involves the declaration of VAT by both the supplier and the withholding agent. It is to help check the abuse by the non-filers of the VAT after charging VAT without accounting for the VAT.

d) Abah Enterprise is a small business but intends to bid for government contracts. It has a very small cash flow, with turnover unable to be registered under the compulsory registration arrangement for Value Added Tax. The proprietor of Abah Enterprise, feels that if the enterprise is not registered for Value Added Tax, it will be difficult to be able to bid for government contracts.

Required:

Under what condition can Abah Enterprise apply to Ghana Revenue Authority for Value Added Tax Registration without meeting the threshold registration requirements under section 6 of the Value Added Tax Act 2013 (Act 870)? (5 marks)

View Solution

Abah Enterprise can apply for VAT registration provided the following conditions are met:

- It has a fixed place of abode or business

- Has reasonable ground to believe that that person may:

- Keep proper accounting records related to any business activity carried on by that person

- Submits regular and reliable tax returns as required

- Is fit and proper person to be register