May 2020 Q1 c&d

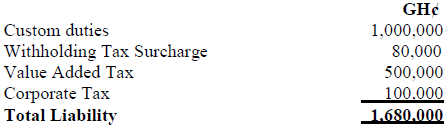

Knaah-Shormeh Ltd has to settle Ghana Revenue Authority on the following tax liabilities:

Additional Information:

50% of the Value Added Tax relates to imports.

The above came about from adjusted assessment through an audit conducted and a report submitted on 31 January, 2019.

The company has engaged Miracle Consultants, a firm of Tax Practitioners to help it object to the assessment. It claims it is excessive and erroneous based on its facts and circumstances.

Required:

What conditions must be met by Knaah-Shormeh Ltd before the Commissioner-General makes a determination on the objection. (8 marks)

View Solution

Knaah-Shormeh Ltd will have to object to the assessment within 30 days upon the receipt of the notice of the tax decision if it is not satisfied with the Commissioner-General’s tax decision. The objection shall be in writing, stating precisely the grounds on which the objection is made.

The Commissioner-General may grant an application for extension when Knaah-Shormeh Ltd before the expiry of the 30 days apply for the extension.

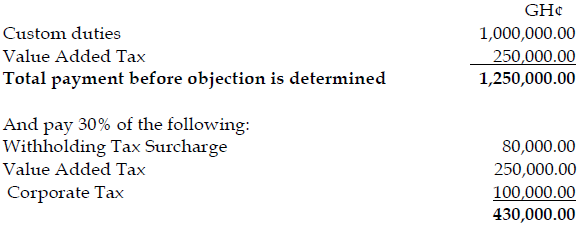

An objection of Knaah-Shormeh ltd shall not be entertained unless:

- Import duties and taxes associated with the import duties are fully paid including the taxes in disputes and

- In the case of other taxes, paid all outstanding taxes including 30% of the tax in dispute.

The Commissioner-General may waive, vary or suspend the above payment pending the determination of the objection or take any other action including the deposit of security.

If the objection is not done within 30 days, the tax decision is final.

In summary, it will pay the custom duty fully and 50% of the value added tax before the determination:

Total payment before the objection is determined is 30% of GH¢ 430,000 which is GH¢ 129,000.00

d) What constitutes a Tax Return? (2 marks)

View Solution

It is an official statement that contains the income of the person and any allowable deduction for any year of assessment from employment, business and or investment. It is statutory.