Nov 2019 Q1 b&c.

b) The only tool for communicating a tax liability to a tax payer is through a notice of assessment.

Required:

What are the elements of a notice of tax assessment? (8 marks)

View Solution

Where the Commissioner-General makes an assessment, the Commissioner-General is required to serve a written notice of the assessment on the taxpayer. In addition to any requirement of the tax law in question, the notice of assessment should contain:

- The name of the taxpayer.

- The Taxpayer Identification Number of the taxpayer.

- The assessment by the Commissioner-General of the tax payable by the taxpayer for the period, event or matter to which the assessment relates.

- The amount of tax remaining to be paid after any relevant credits, reductions or pre-payments.

- the manner in which the assessment is calculated

- The reason why the Commissioner-General has made the assessment

- The date by which the tax is to be paid; and

- The time, place and manner of objecting to the assessment.

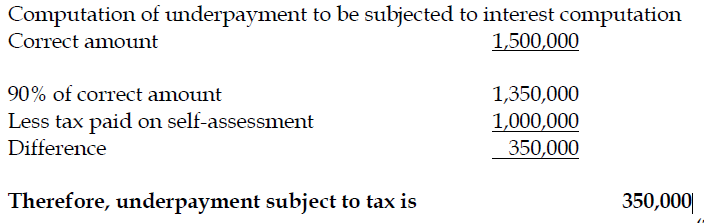

c) The following data is relevant to Naab Ltd tax affairs for 2018 year of assessment:

Self –assessment returns submitted:

Tax paid on self-assessment GH¢ 1,000,000

Chargeable income GH¢ 4,000,000

Actual Returns submitted:

Chargeable Income GH¢ 6,000,000

Correct amount-Tax payable GH¢ 1,500,000

Required:

What is the amount of tax underpayment to be subject to interest computation? (2 marks)

View Solution