Nov 2018 Q3 b(iii&iv)

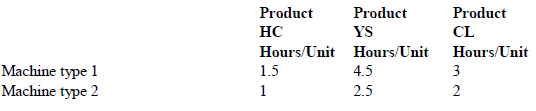

KYC Ltd makes three products Hand Chew (HC), Yogurt Swallow (YS) and Canned Lick (CL). All three products are sold as a package and so are offered for sale each month in order to be able to provide a complete market service. The products are fragile and their quality deteriorates rapidly once they are manufactured. The products are produced on two types of machine and worked on by a single grade of direct labour. Five direct employees are paid GH¢8 per hour for a guaranteed minimum of 160 hours each per month. All of the products are first moulded on machine type 1 and then finished and sealed on machine type 2. The machine hour requirements for each of the products are as follows:

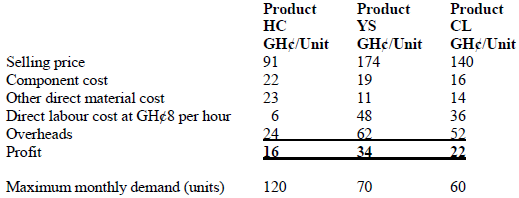

The capacity of the available machines type 1 and 2 are 600 hours and 500 hours per month respectively. Details of the selling prices, unit costs and monthly demand for the three products are as follows:

Although KYC Ltd uses marginal costing and contribution analysis as the basis for its decision making activities, profits are reported in the monthly management accounts using the absorption costing basis. Finished goods (inventories) are valued in the monthly management accounts at full absorption cost.

Required:

iii) Explain why throughput accounting might provide more relevant information in KYC’s circumstances. (4 marks)

View Solution

A major concept underlying throughput accounting is that the majority of costs, with the exception of material and component costs, are fixed. In KYC’s case it is clear that the labour cost, which is treated as a variable cost in traditional marginal costing, is indeed a fixed cost. Furthermore, given the perishable nature of KYC’s products, the throughput accounting approach to inventory minimisation and maximisation of throughput would be more appropriate.

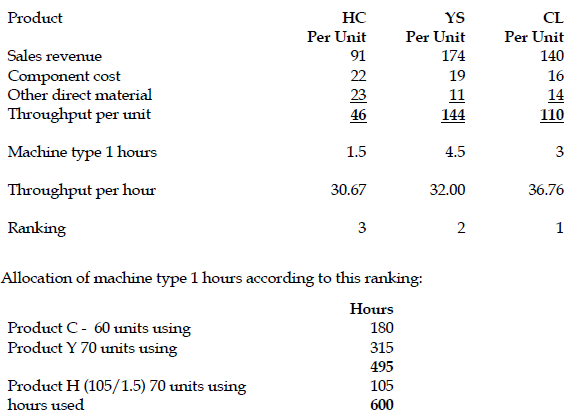

iv) Using a throughput approach, calculate the throughput-maximising monthly output of the three products. (5 marks)

View Solution