Nov 2016 Q3 a.

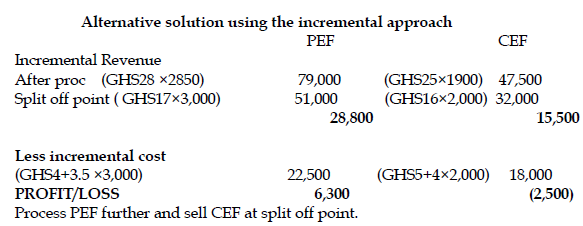

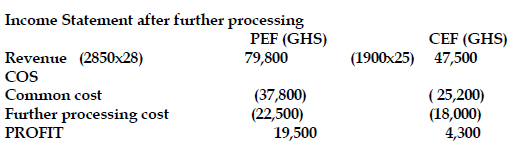

Pinto company Limited processes materials into finished products. After process one, two main products PEF and CEF are turned out. The production processes allow for 10% normal loss at process one and 5% for each product if it is to be processed further. The scrap at process one can be sold for GH¢6.60 per unit. The standard prices of the products are as follows; PEF to be sold at split off point GH¢17 per unit but can be sold for GH¢28 per unit after further processing. A unit of CEF can also be sold for GH¢16 at split off point or GH¢ 25 after further processing. Further processing costs are; PEF; direct materials GH¢4 per unit and conversion GH¢3.50 per unit. The materials and conversion costs per unit for CEF are GH¢5 and GH¢4 respectively.

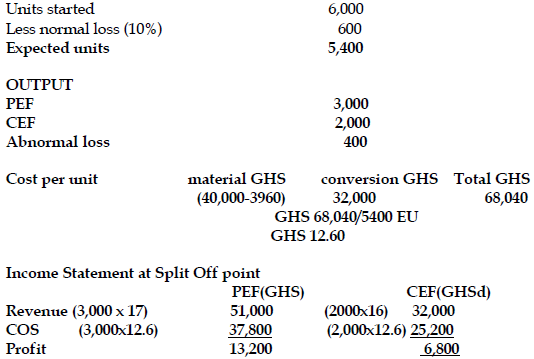

In the month of August 2016 6,000 units were processed through process one at the following costs; direct materials GH¢40,000, conversion GH¢32,000. The output at the end of process one were 3,000 units for PEF and 2,000 units for CEF.

Required:

Advise management which of the products should be processed further and which should be sold at split off point if volume is used to share common cost. (12 marks)

View Solution

The question seeks to test students understanding of how to treat normal and abnormal losses with scrap value and also advise on the decision to sell or process further where joint products are involved.

Accounting for units processed

DECISION: Process PEF and Sell CEF at split off point.

NOTE: units turned out after further processing should make provision for normal loss of 5% but the input cost will be based on units processed.