May 2021 Q1 b.

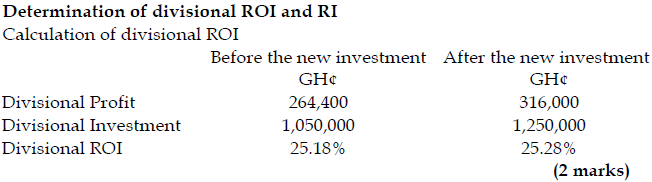

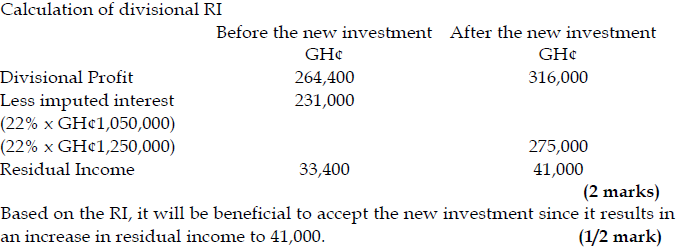

Peah is a divisional manager of Monrovia Ltd. He is paid a bonus of 5% on the division’s residual income after charging the bonus. The division is currently considering an additional investment of GH¢200,000 with 10 years useful life but nil residual value. The investment is expected to yield a profit after depreciation of GH¢51,600. This will augment the existing capital employed of GH¢1,050,000 that currently offers GH¢264,400 profit after depreciation annually. The company’s policy is to accept investment projects that provide a return of at least 22%.

Required:

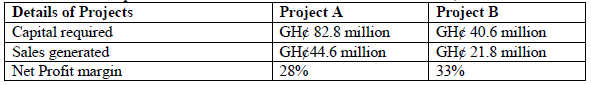

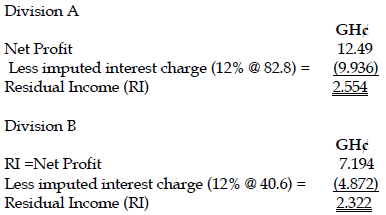

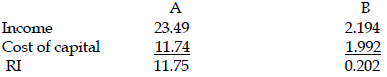

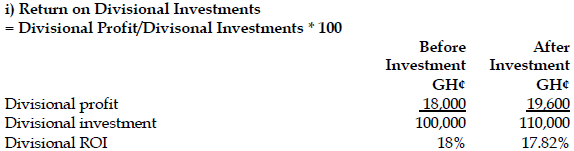

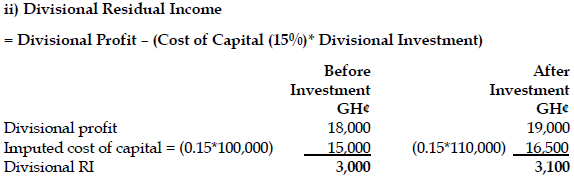

i) Calculate the Return on Investment and Residual Incomes of the division before considering the new investment. (2 ½ marks)

View Solution

It will be marginally beneficial in the short term, based on the ROI, to accept the new investment. (1/2 mark)

ii) Advise the division on whether the new investment should be taken or not. (2 ½ marks)

View Solution

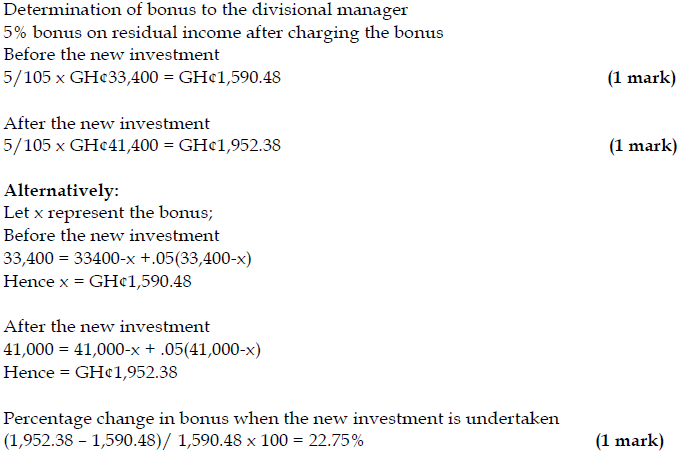

iii) What will be the percentage change in the bonus of Peah if the new investment is added to the division’s existing operations? (3 marks)

View Solution