May 2019 Q3 a.

Bobich Ltd manufactures plastic containers for the pharmaceutical industry. The factory, in which the company undertakes all its production has two production departments namely: Cutting and Shaping and two service departments- Stores and Maintenance.

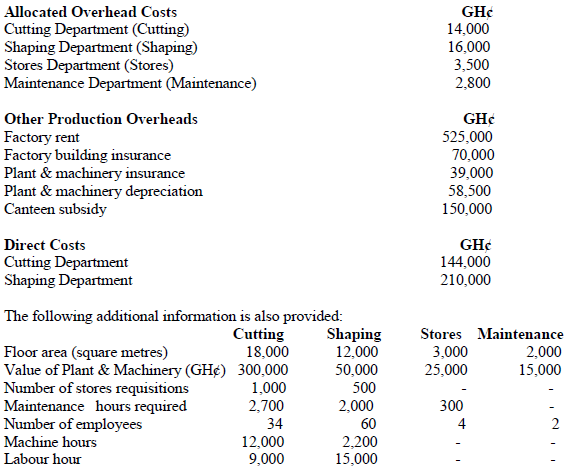

The information below was extracted from the company’s budget for its financial year ended 31 March 2019.

Required:

i) Explain what is meant by the term “blanket overhead rate”. (2 marks)

View Solution

Blanket overhead rates are where a company calculates one overhead rate for the company as a whole. Example; A company budgets that its production overheads will be GH¢ 200,000 in the forthcoming year and total budgeted machine hours are 50,000 and total budgeted labour hours are 25,000. The company’s pre-determined overhead rate will equal [GH¢ 200,000/ 50,000 M/H] GH¢ 4 per machine hour if the company decided to absorbed based on machine hours than labour hour. This method is not as accurate as using individual departmental overhead rates.

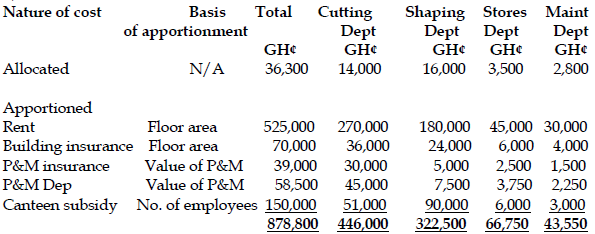

ii) Prepare an overhead analysis sheet based on the above information. You must clearly state the basis used for any apportionments. (7 marks)

View Solution

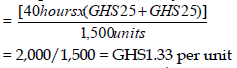

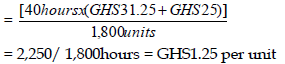

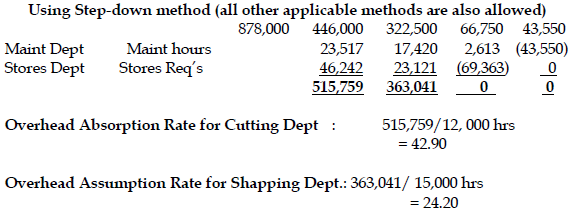

iii) Re-apportion the service department costs and calculate the most appropriate overhead rate for each department. (Rate should be calculated to two decimal places). (3 marks)

View Solution

iv) State THREE (3) reasons why companies calculate pre-determined overhead absorption rates. (3 marks)

View Solution

- In order to establish selling prices.

- For inventory valuation purposes.

- Facilitates the control process within an organisation.