May 2021 Q2 d.

Odwira Ltd operates in the mining industry with a financial year end 31 December, 2020. On 1 January, 2020, Odwira Ltd began to lease a group of machines that were used in the production process. The lease was for five years, and the total annual rental (payable in arrears) was GH¢8 million. The lessor paid GH¢30 million for the machines on 31 December 2019. The lessor has advised Odwira Ltd that the interest rate implicit in the lease can be taken as 10%. The estimated useful economic life of the machines were five years.

Required:

In accordance with IFRS 16: Leases, show the accounting treatment of the above transaction. (4 marks)

View Solution

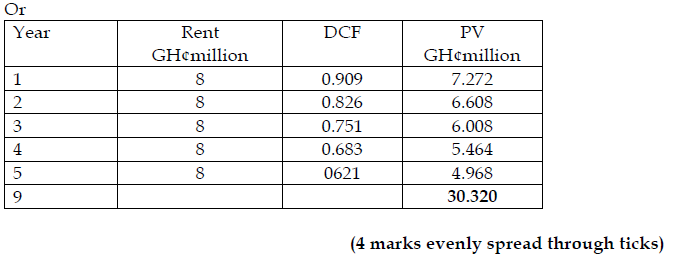

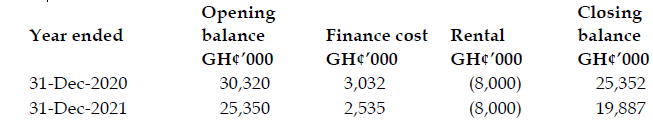

The lessee is required under IFRS 16 to recognise a right-of-use asset and a corresponding liability. Accordingly, GH¢30.320 million is to be included both as asset and lease liability on initial recognition. The lease liability is treated as shown below:

The statement of profit or loss in the first year will include a finance cost of GH¢3.032million with a depreciation charge of GH¢6.064 million.

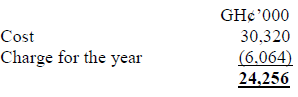

The statement of financial position will include closing lease liability in the current year, GH¢25.352 million, of which GH¢19.887 million is a non-current liability and GH¢5.465 million is a current liability. The right of use asset of GH¢30.320 million will be depreciated over five years (GH¢30.320 ÷ 5 years) = GH¢6.064 million. Therefore, the asset will be recognised in the statement of financial position at GH¢24.256 million (.i.e. GH¢30.320 – 6.064) million.

Alternatively, the current lease liability GH¢5.465 million (GH¢8 million-GH¢2.535) million) and the non-current lease obligation is GH¢19. 887 million (GH¢25.352 million- GH¢19.887 million).

Workings:

Lease liability = 3.971 x GH¢8 million) = 30.320 million