May 2020 Q2 a.

Ejura Ltd (Ejura) is a Manufacturing and retail company which prepares financial statements in accordance with International Financial Reporting Standards (IFRS) up to 31 December each year.

In order to generate or improve sales on one of its older products, Ejura offered a promotion named ‘something for free’. The promotion included free maintenance services for the first two years. On 1 October 2019, under the promotional offer, Ejura sold goods to a supermarket chain for GH¢4.4 million. A two-year maintenance contract would normally be sold for GH¢0.5 million, and the list price of the product would normally be GH¢5 million. The transaction has been included in revenue at GH¢4.4 million.

Required:

In accordance with IFRS 15: Revenue from Contracts with Customers, justify the appropriate accounting treatment for the above transaction in the financial statements of Ejura for the year ended 31 December 2019. (7 marks)

View Solution

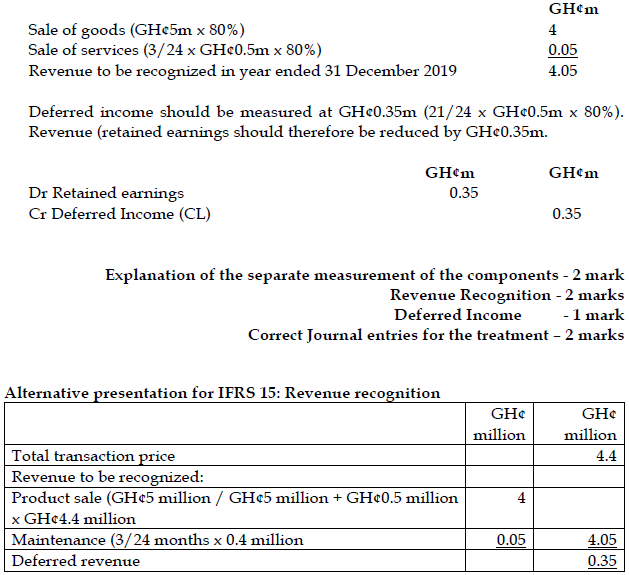

Under (IFRS 15), each component should be measured separately. As only three months of the maintenance service has been provided, we should only recognize 3/24 of the maintenance fee as revenue in the year ended 31 December 2019. The remainder should be treated as deferred income and recognized as the service is being provided.

The sale of goods, however, should be recognized immediately. As the total of the fair values exceeds the overall price of the contract, a discount has been provided.

As we do not know what has been discounted, it would seem reasonable to apply the same discount percentage to each separate component.

The discount is 20% based on listed prices (i.e. [4.4m/(5m + 0.5)] – 1).

Five (5) point criteria for recognition of revenue

Step 1: Identify contract with the customer

Step 2: Identify the performance obligations within the contract

- Sale of product

- Maintenance contract

Step 3: Determine the transaction price – the transaction price is GH¢4.4 million

Step 4: Allocate the transaction price among the performance obligations within the contract

- Based on the standalone selling price of the individual obligations

- Where the standalone selling price are not available, use expected cost plus %

- Where the above is not available, use the residual approach.

In this case, the scenario provides the standalone selling prices and hence, these shall be used to allocate the price. Allocation of transaction price to:

Sale of products (GH¢5 million / GH¢5 million + GH¢0.5 million x GH¢4.4 million = GH¢4

Maintenance: GH¢0.5 million/ GH¢5 million + GH¢0.5 million x GH¢4.4 million =

Step 5: Recognise the revenue over time or at point in time

- Revenue from the product would be recognize during the contract period as control over the product is transferred to the customer.

- Revenue from the maintenance contract would be earned over a period of 24 months. Therefore, for the current period, 3/24 months would be recognised as revenue, and the remainder would be deferred.