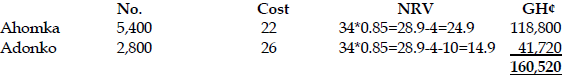

Nov 2018 Q2 a.

Saboba Ltd (Saboba) manufactures plastic water tanks for the farming industry. On 31 May 2018, its closing inventory consisted of 950kg of plastic resin raw material, and also 250 finished units (plastic water tanks). Further information is provided as follows:

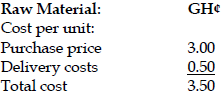

i) Plastic: The purchase price of plastic resin was GH¢3 per kg throughout the year to 31 May 2018, plus an additional GH¢0.50 per kg of delivery cost. Saboba has a policy of always keeping plenty of plastic resin in inventory, as its supply can be unreliable. However, close to the year-end, the price of plastic resin reduced due to supply exceeding demand. The purchase

price of Saboba’s raw material is now GH¢2.10 per kg plus the GH¢0.50 per kg delivery charge. The existing inventory of plastic resin can be sold in the market for GH¢1.80 per kg net of all costs.

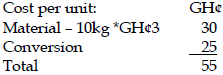

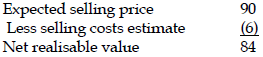

ii) Tanks: Each tank requires 10 kg of plastic to manufacture, and each unit incurs GH¢25 in conversion costs (labour and overhead). Saboba sells the tanks for GH¢100. It is expected that this price will drop to GH¢90 as a result of the fall in the market price of plastic. All completed units sold by Saboba incur a GH¢6 selling and distribution cost.

Required:

Calculate the value of closing inventory in the books of Saboba Ltd at 31 May 2018 applying the principles of IAS 2: Inventories. (5 marks)

View Solution

The inventory of Saboba Ltd should be valued as follows:

Finished goods:

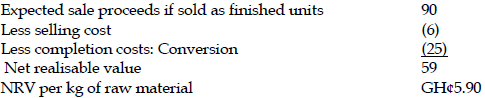

Net realisable value:

As the Net Realisable Value exceeds the cost, the finished goods are valued in the books at cost. Hence a value of 250 *GH¢55 =GH¢13,750 will be entered into the books as closing inventory of finished goods.

Net realisable value:

Expected sale proceeds if sold as inventory 1.80

The NRV of the raw material if sold as raw material is lower than the cost. However the NRV if processed into finished units is higher than cost. Therefore the inventory should not be written down, and should be recorded in the books at cost. Hence a value of 950 *GH¢3.50 =GH¢3,325 will be entered into the books as closing inventory. Total closing inventory = 3,325 + 13,750 =GH¢17,075. (Maximum 15 ticks @ 0.33 = 5 marks)