May 2019 Q5 b.

Lease and hire purchase are very popular options of financing assets. These options vary from each other in many aspects: ownership of the asset, depreciation, rental payments, duration, tax impact, repairs and maintenance of the asset and the extent of finance.

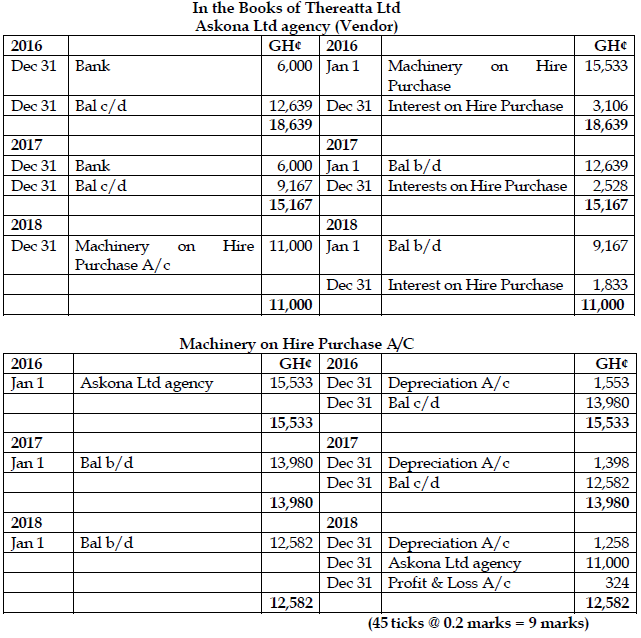

Thereatta Ltd is a listed advertisng company operating in Ghana. The Board of Thereatta Ltd (Thereatta) were contemplating on the most suitable option to finance one of its machinery before settling on Hire Purchase. On 1 January 2016, Thereatta acquired a machinery on hire-purchase basis from Askona Ltd agency. The terms of the Hire Purchase agreement requires Thereatta to make four annual installments of GH¢6,000 each payable at the end of each year. There is no down payment. Interest is charged at 20% per annum and is included in the annual installments.

Because of financial difficulties, Thereatta after having paid the first and second installments respectively could not pay the third yearly instalment due on 31 December 2018, whereas the vendor repossessed the machinery. Thereatta provides depreciation on the machinery at 10% per annum according to the written down value method.

Required:

Show the accounting treatment of the Machinery account and the account of Askona Ltd agency in the books of Thereatta. (All workings must be shown). (12 marks)

View Solution

Calculation of interest and cash price

Suppose cash price instalment is = 100

Add: Interest = 20

Hire Purchase Instalment = 120

Interest on Hire Purchase Instalment = 20/120 =1/6

Since the cash price is not given, interest will be calculated on the 4 instalments, 4th and then on 3rd, 2nd and 1st respectively

Interest on 4th Hire Purchase Instalment

= GH¢6,000 * 1/6 = GH¢,1000

4th cash price instalment = GH¢6000-GH¢1,000 = GH¢5,000

Interest on 3rd Hire Purchase Instalment

=1/6 * 11,000 (6,000+5,000) = GH¢1,833

3rd cash price instalment = GH¢6,000-GH¢1,833 = GH¢4167

Interest on 2nd Hire Purchase Instalment

=1/6 * GH¢15,167 (6,000 + 4,167 + 5,000) = GH¢2,528

2nd cash price instalment = GH¢6,000-GH¢2,528 = GH¢3,472

Interest on 1st Hire Purchase Instalment

= 1/6 * GH¢18, 639 (6,000+3,472+4,167+5,000) =GH¢3,106

1st cash price instalment = GH¢6,000-GH¢3,106 =GH¢2,894

Total cash price = GH¢2,894+GH¢3,472+GH¢4,167+GH¢5,000= GH¢15,533