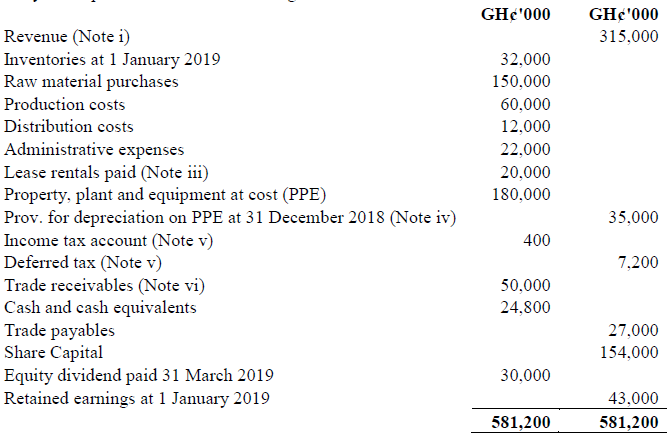

May 2021 Q3

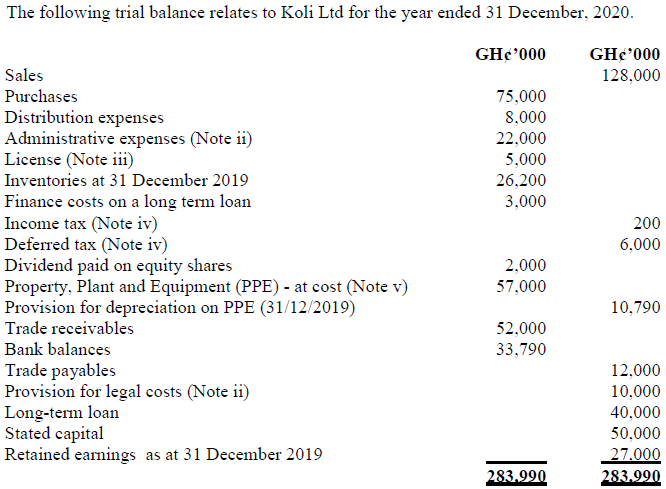

Additional information:

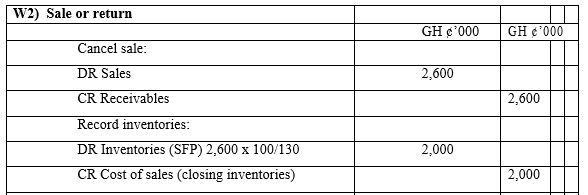

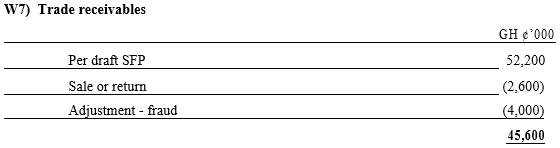

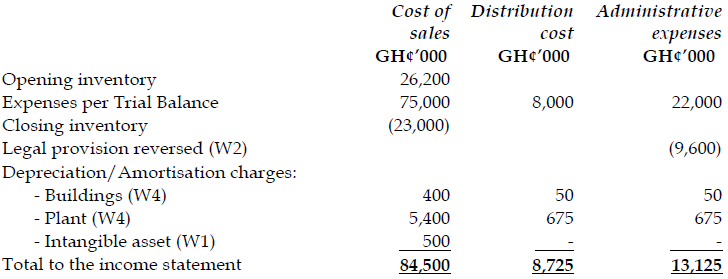

i) The carrying value of inventories on 31 December 2020 was GH¢23 million.

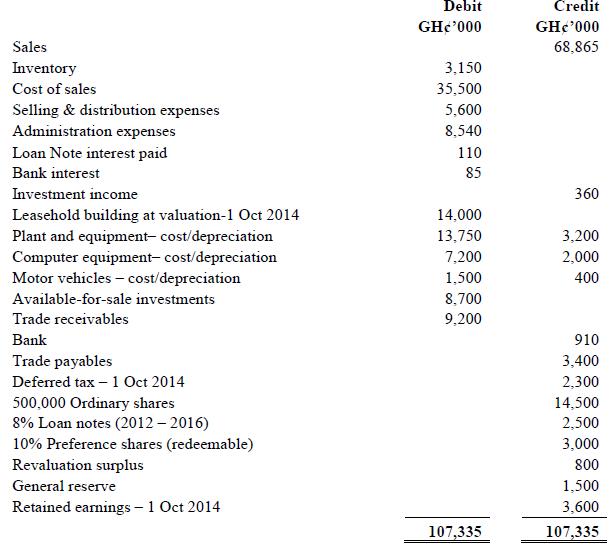

ii) Administrative expenses include a provision of GH¢10 million for the possible costs of a legal claim lodged against Koli Ltd by one of its customers before 31 December 2020. The directors of Koli Ltd consider that it is probable that Koli Ltd can successfully defend the case, but they are providing for the worst possible outcome on the grounds of prudence. The provision of GH¢10 million is for the amount sought by the customer (GH¢9.6 million) plus the directors’ best estimate of the legal costs incurred in defending the case. If Koli Ltd successfully defends the case, then based on the outcomes of similar cases in the past, it is likely (but not sure) that the customer will be required to reimburse Koli Ltd for its legal costs.

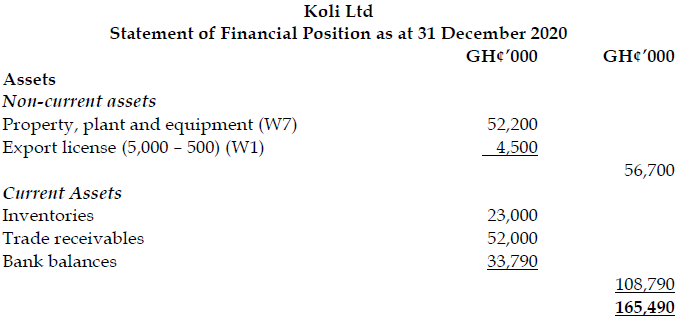

iii) On 1 January, 2020, Koli Ltd paid GH¢5 million for a ten-year export license.

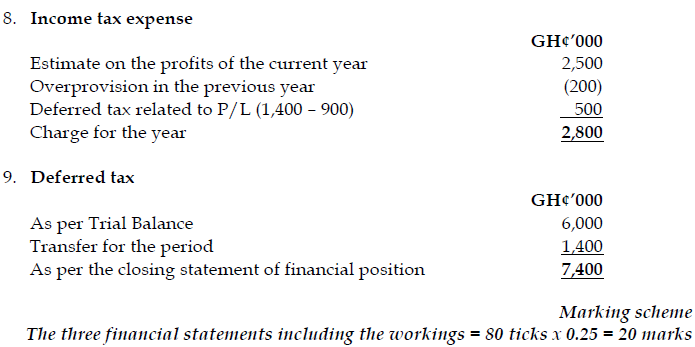

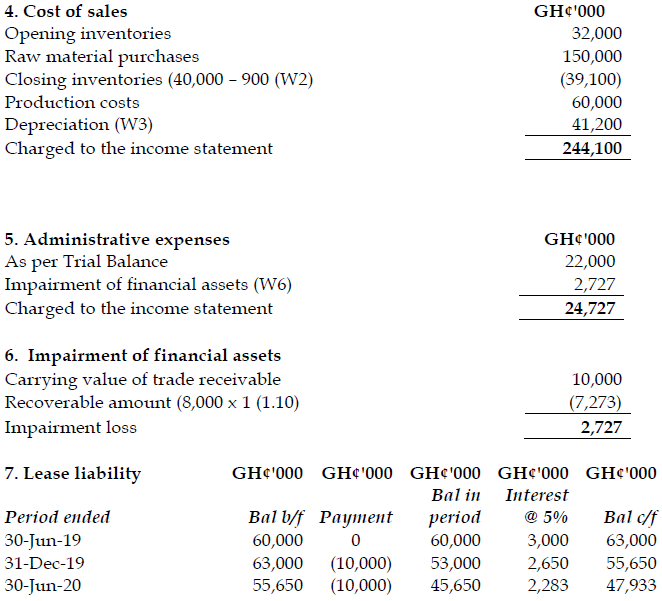

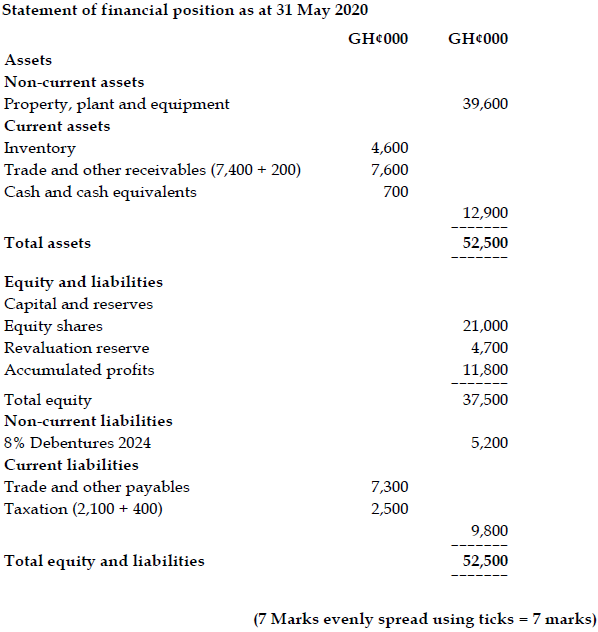

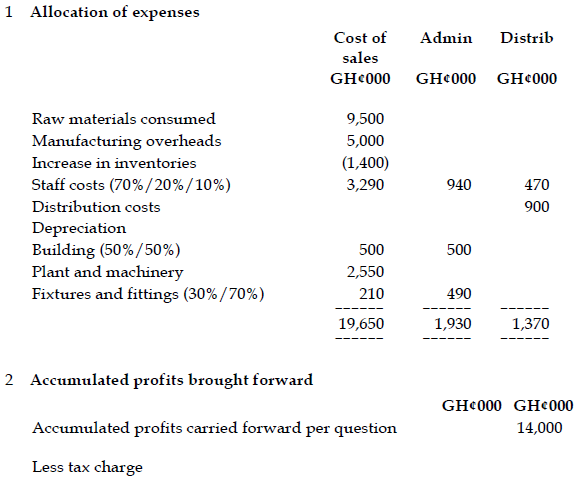

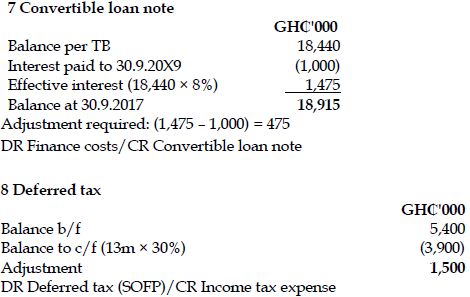

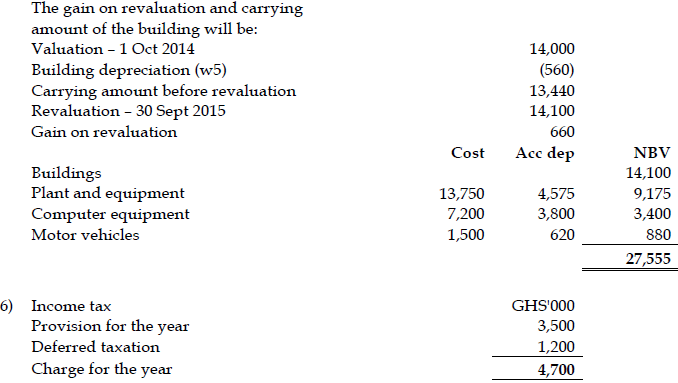

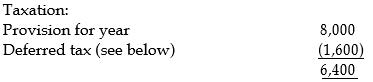

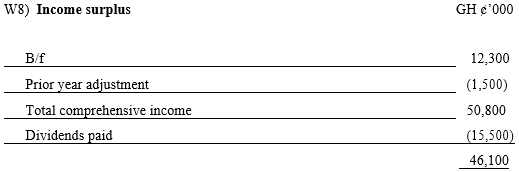

iv) The estimated income tax on the profits for the year to 31 December 2020 is GH¢2.5 million. During the year, GH¢2.2 million was paid in full and in the final settlement of income tax on the profits for the year ended 31 December 2019. The statement of financial position on 31 December 2019 had included GH¢2.4 million in respect of this tax liability.

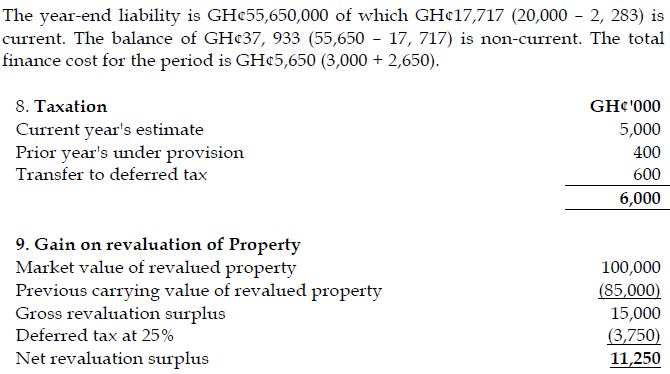

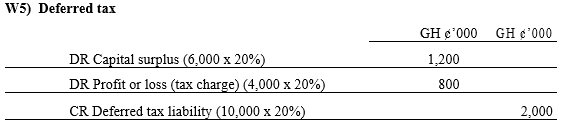

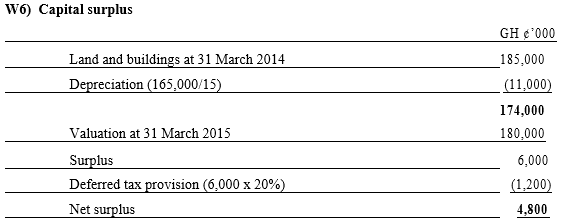

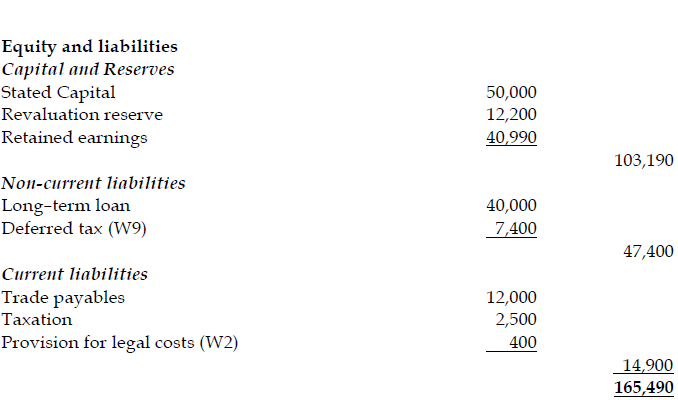

A transfer of GH¢1.4 million is required to increase the deferred tax liability in the statement of financial position; GH¢900,000 of this amount was necessary due to the taxable temporary difference caused by the property revaluation (see note v below).

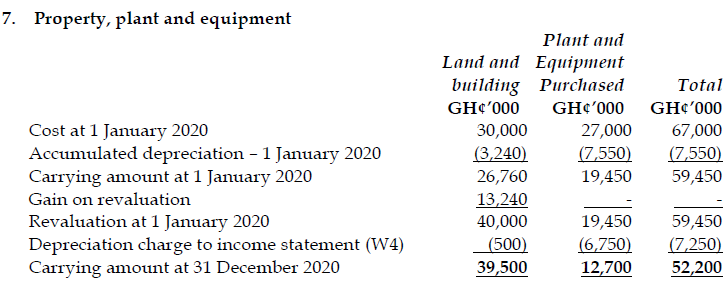

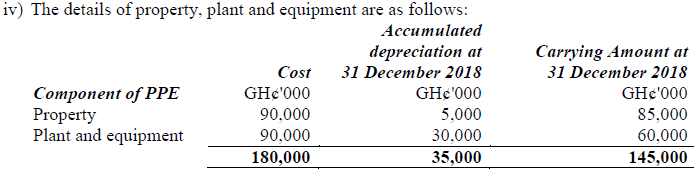

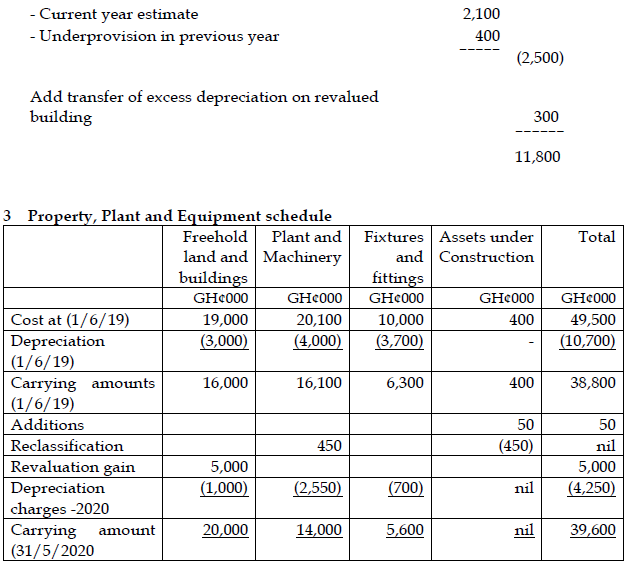

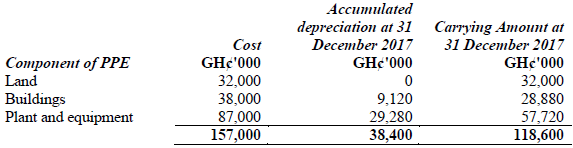

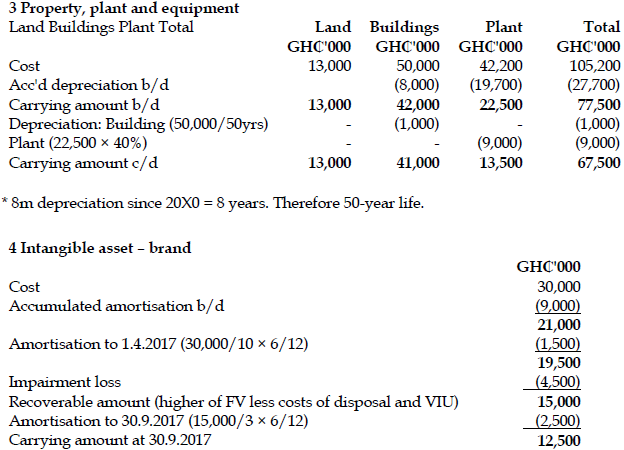

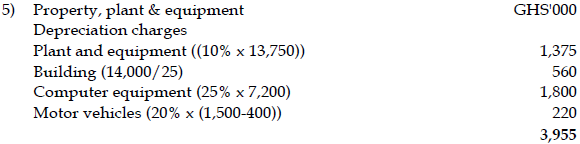

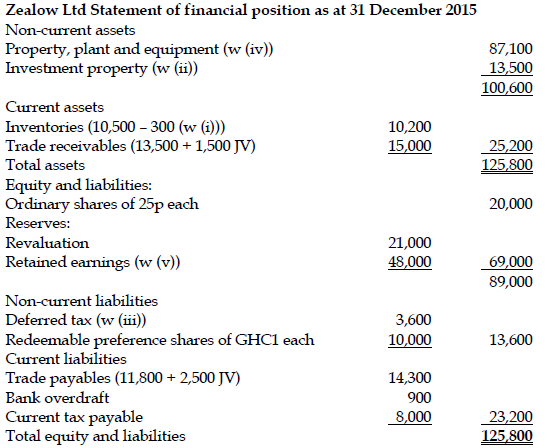

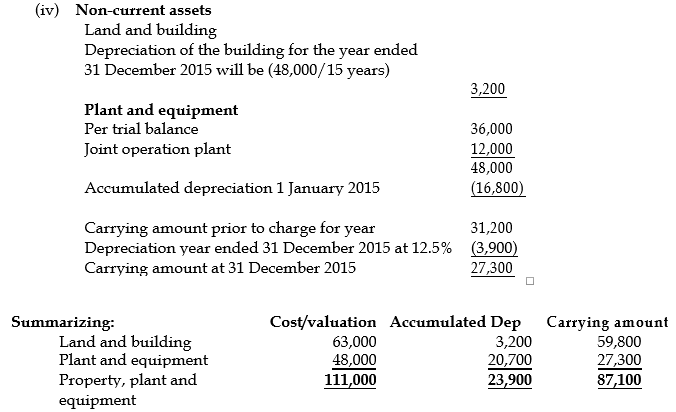

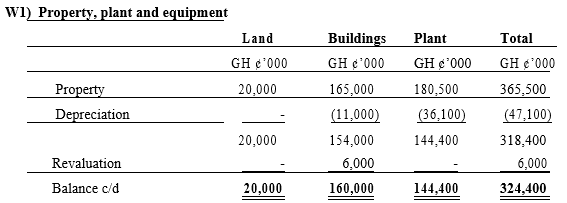

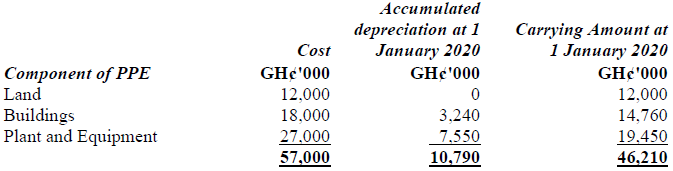

v) The details of property, plant and equipment are as follows:

Estimate of useful economic life (at the date of purchase) of PPE components:

Land – nil (infinite life)

Building – 50 years

Plant and Equipment – 4 years

Depreciation of property, plant and Equipment is allocated as follows:

80% to cost of sales

10% to distribution expenses

10% to administrative expenses

The above allocation relates to only owned tangible assets. All other depreciation or amortisation charges should be fully charged to the cost of sales.

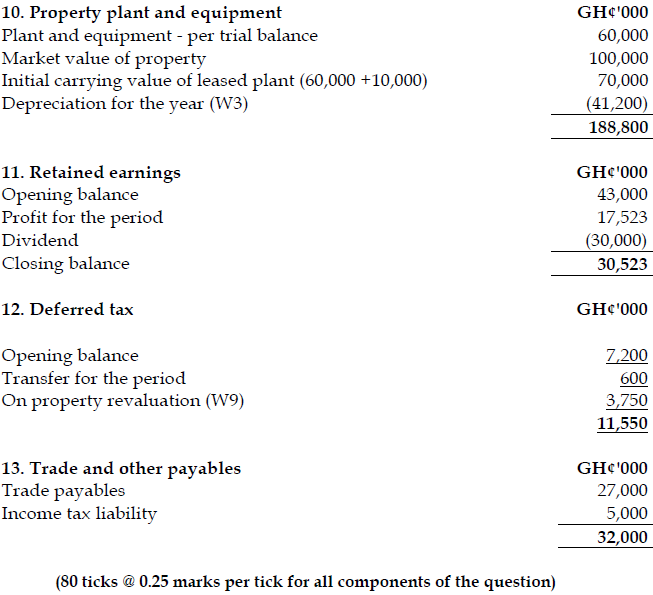

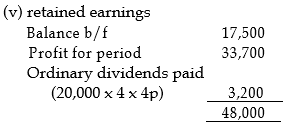

On 1 January, 2020 the directors of Koli Ltd decided to revalue its property (Land and Building) to its market value of GH¢40 million, including GH¢19.5 million for the Land. The original estimate of the useful economic life of the property was still considered valid. The directors wish to make an annual transfer of excess depreciation from the revaluation reserve to realised profits following the revaluation.

Required:

Prepare for Koli Ltd,

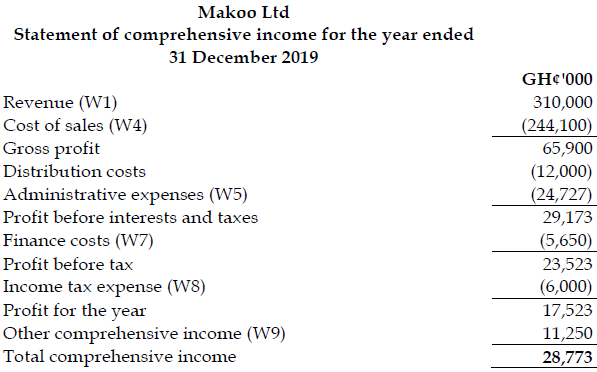

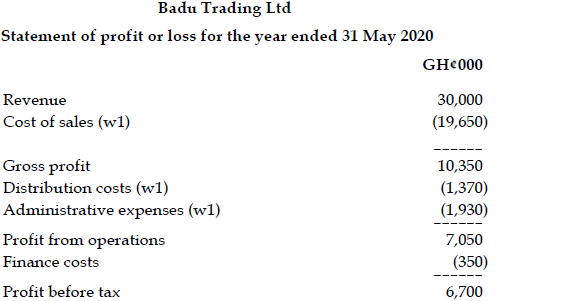

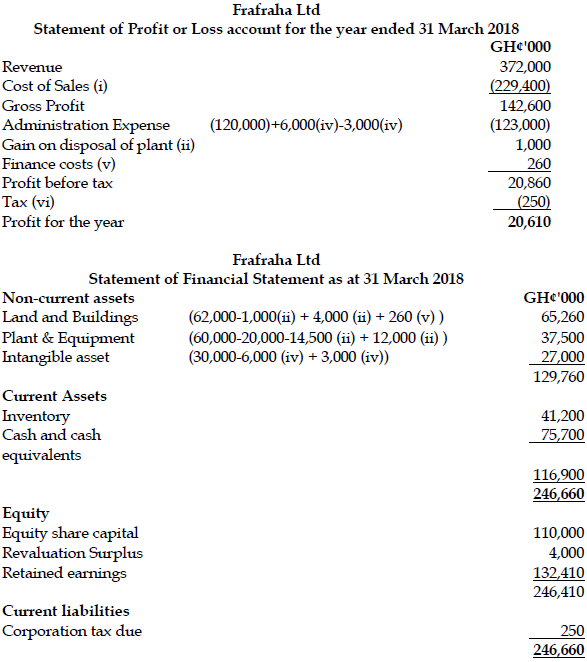

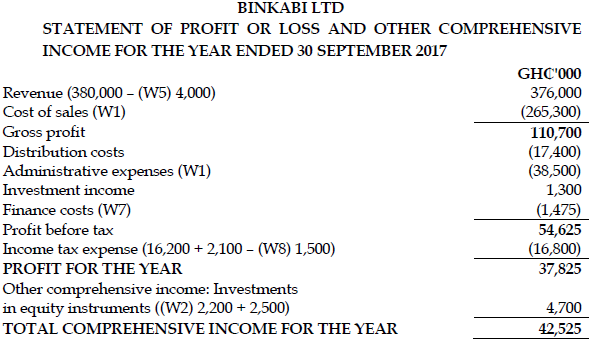

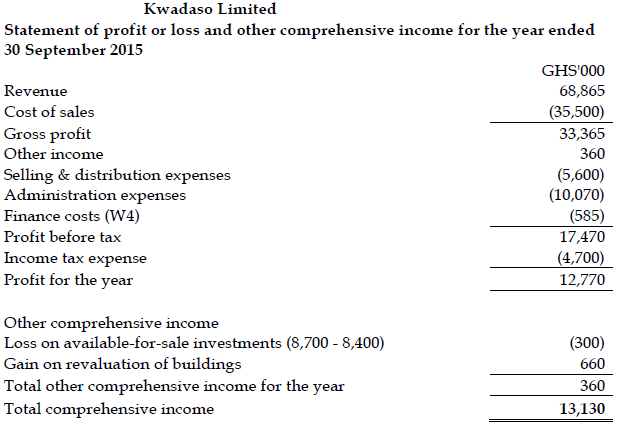

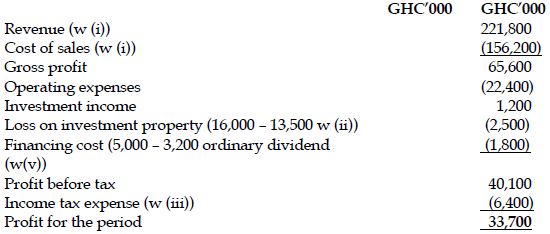

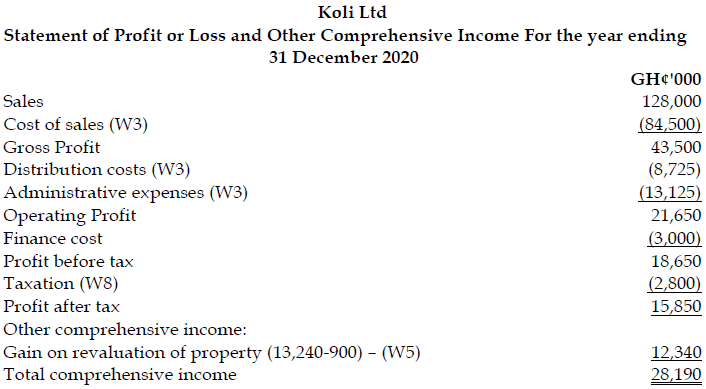

a) The Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. (8 marks)

View Solution

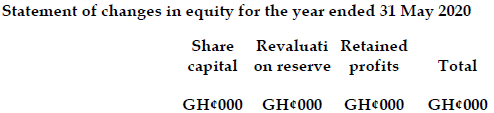

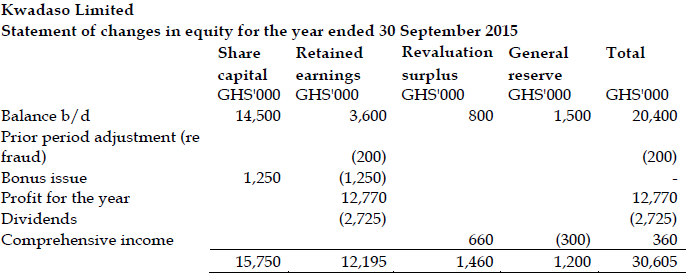

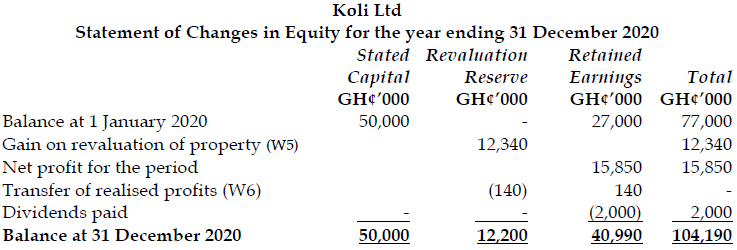

b) The Statement of Changes in Equity for the year ended 31 December 2020. (4 marks)

View Solution

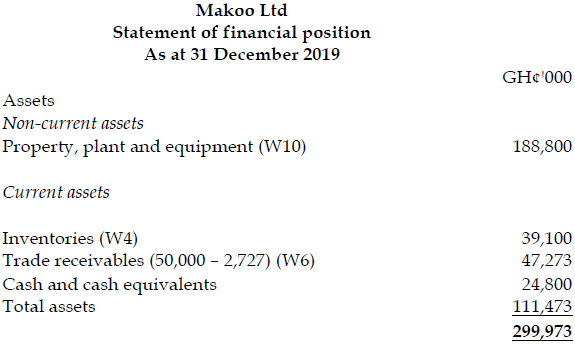

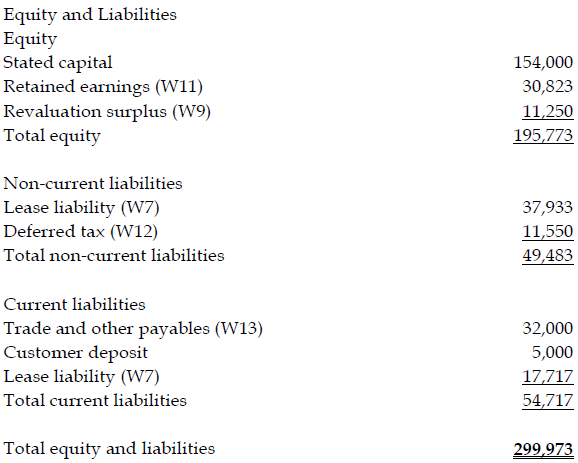

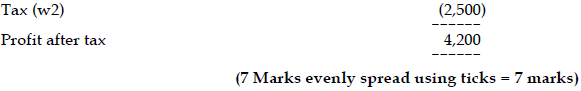

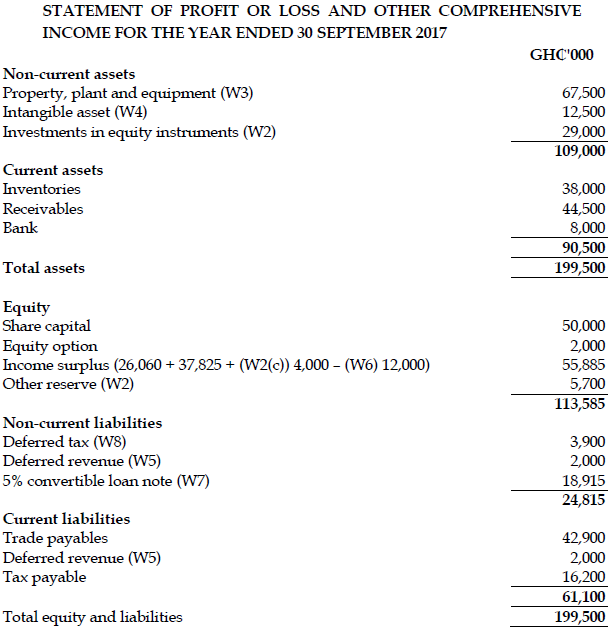

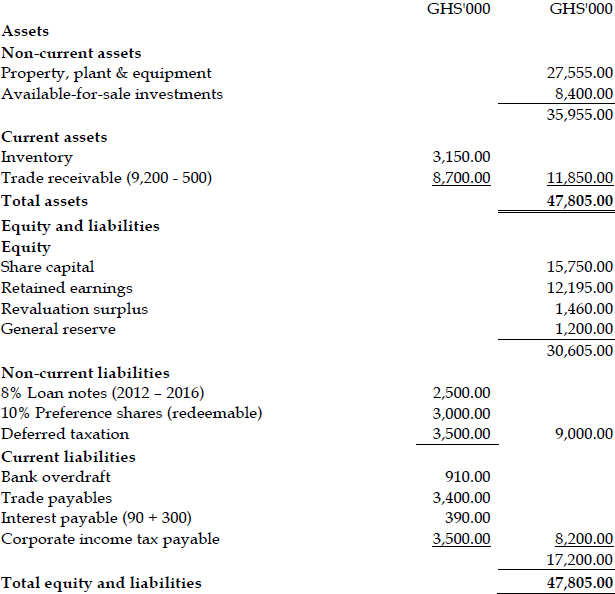

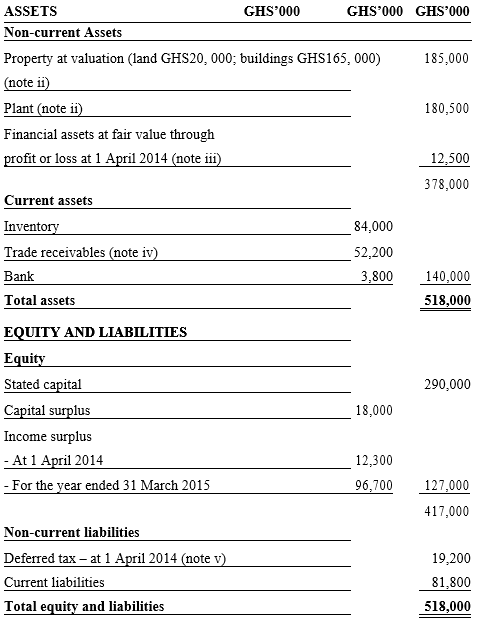

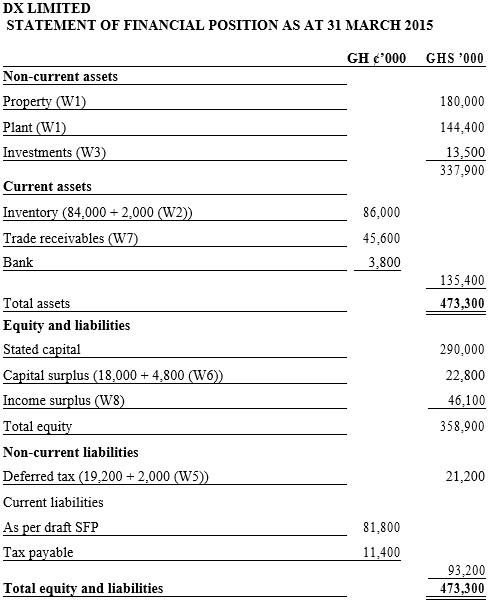

c) The Statement of Financial Position as at 31 December 2020. (8 marks)

View Solution

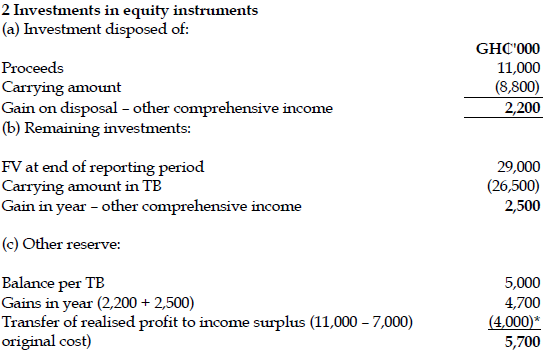

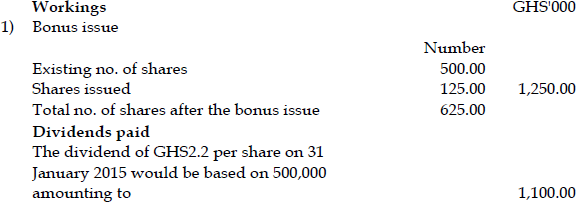

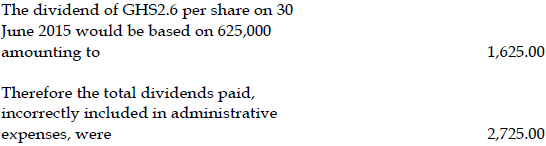

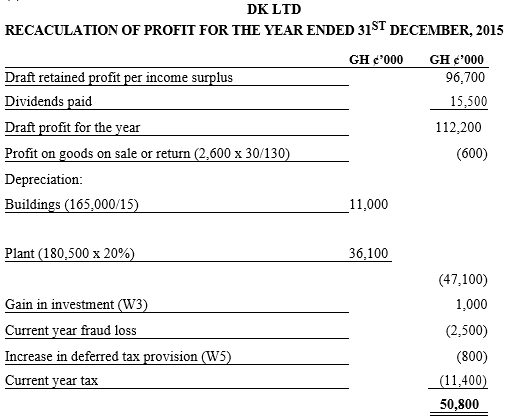

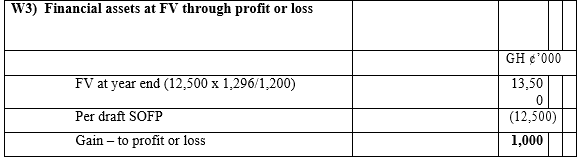

View All Workings

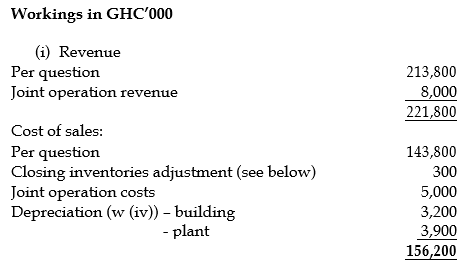

1. In accordance with IAS 38: Intangible assets, the GH¢5 million paid for the export license should be capitalised at cost as an intangible non-current asset and amortised over its useful economic life of 10 years. Therefore, there should be a charge to income of GH¢500,000 in the current year.

2. The provision for the legal costs of GH¢9.6 million sought by the customer is only a present obligation arising out of a past event if the case goes against Koli Ltd. Based on the scenario in the question, it is improbable that the case will be lost so the recognition criteria laid down in IAS 37: Provisions, Contingent Liabilities and Contingent Assets – are not met. Therefore, the GH¢400,000 is possibly recoverable from the customer, but IAS 37 only allows recognition of potential reimbursements if the reimbursement is virtually certain. Thus, GH¢400,000 should remain in administrative expenses, and GH¢9.6 million should be reversed.

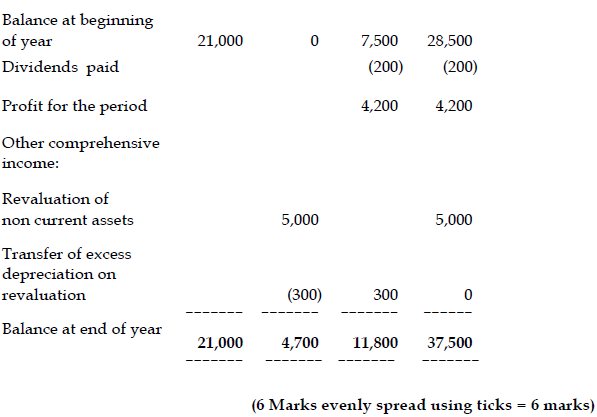

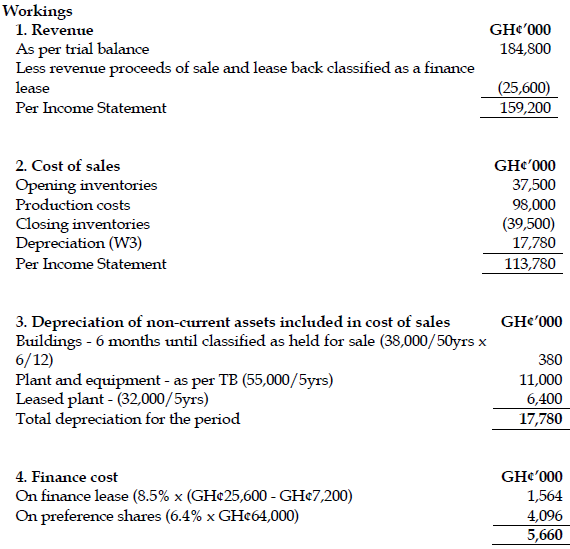

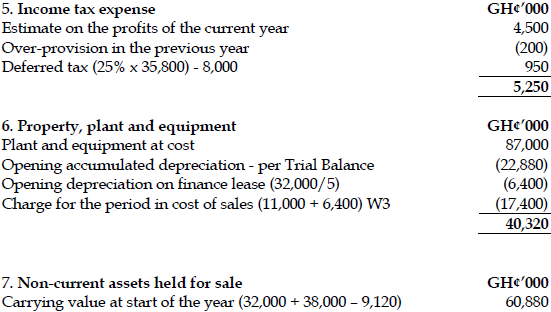

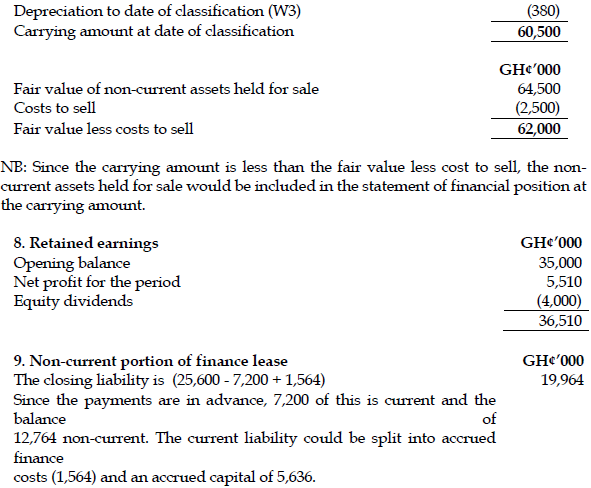

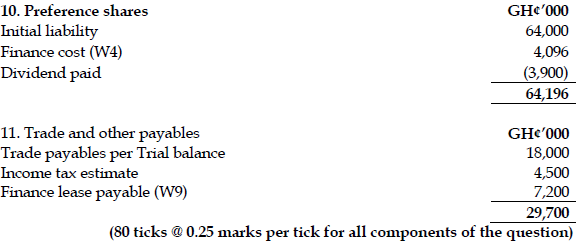

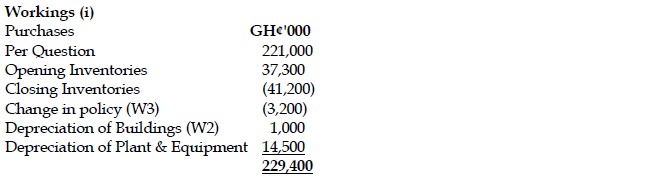

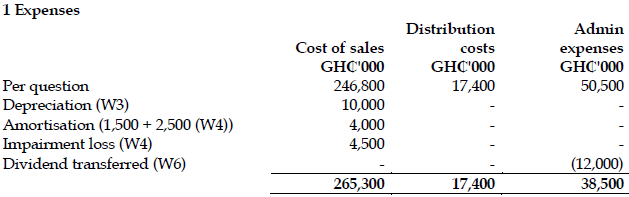

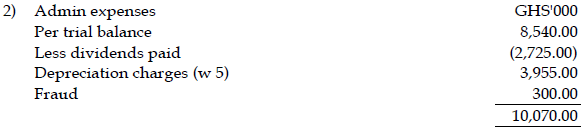

3. Allocation of operating expenses

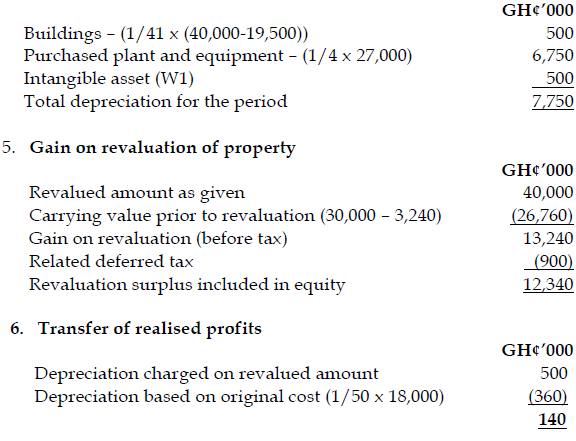

4. Depreciation of non-current assets

NB: The building was purchased on 1 January 2011 and revalued on 31 December 2019, so it was nine years old when it was revalued. The remaining useful economic life at the revaluation date is estimated at 50–9 = 41 years. Depreciation after the revaluation is charged on the revalued amount.