May 2021 Q1

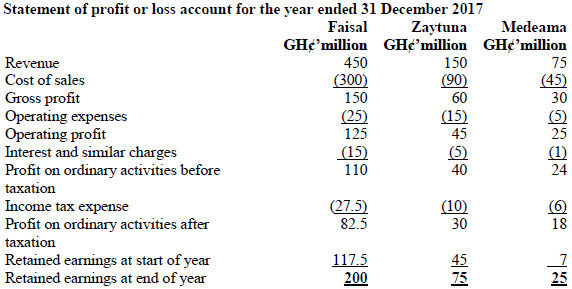

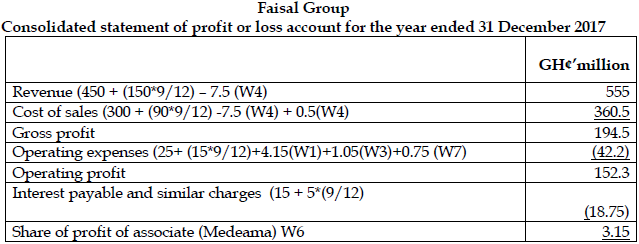

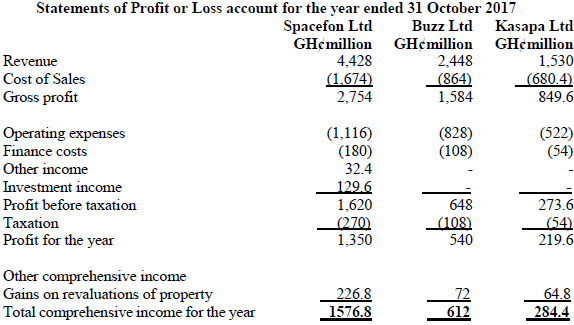

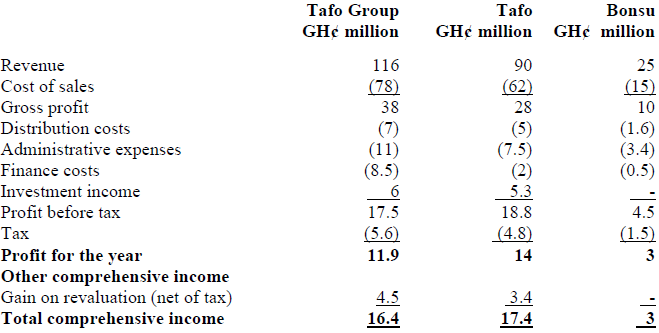

Tafo group is a key player in the food processing industry made up only of Tafo Ltd (Tafo) and Abirem Ltd (Abirem). Below are the consolidated statement of comprehensive income of Tafo Group and the separate statements of comprehensive income of Tafo and Bonsu Ltd (Bonsu), respectively, for the year ended 31 December 2020:

Statements of comprehensive income for the year ended 31 December 2020

Additional information

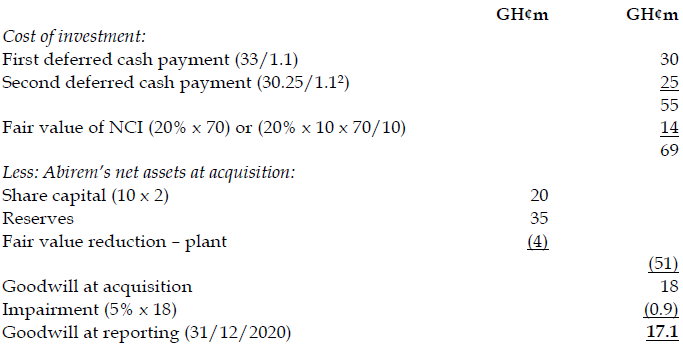

i) Tafo purchased 80% of the 10 million ordinary shares (all issued at GH¢2 each) of Abirem on 1 January 2020 when the balance of Abirem’s reserves was GH¢35 million. Tafo agreed to settle the consideration in two unconditional instalments as follows:

- Cash payment of GH¢33 million on 1 January 2021; and

- Cash payment of GH¢30.25 million on 1 January 2022.

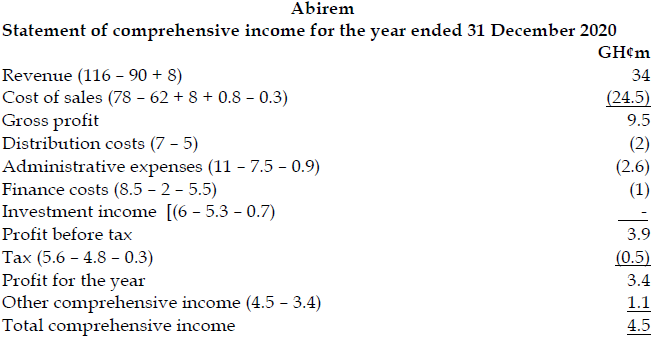

The policy of the group is to value any non-controlling interests at fair value. For this purpose, it was agreed to use the share price of Abirem as an approximation of its fair value. Abirem’s market capitalisation figures at 1 January 2020 and 31 December 2020 stood at GH¢70 million and GH¢75 million, respectively. The appropriate discount rate for Tafo is 10%. The required unwound discount has been included in the group’s (but not Tafo’s) finance costs.

ii) On 1 January 2020, a fair value exercise was carried out on Abirem’s net assets. The exercise results showed that the book value of the depreciable plant was higher than their fair value by GH¢4 million. Post-acquisition depreciation adjustment of GH¢0.8 million is required.

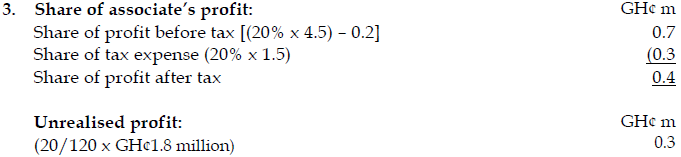

iii) For several years, Tafo has also held a 20% equity interest in Bonsu. On 31 December 2020, impairment loss of GH¢0.2 million was estimated for the investment in associate. The group’s policy is to present the share of the associate’s profit before tax and share of the associate’s tax expense separately within the consolidated statement of comprehensive income. The investment income of the group shown above includes the group’s share of associate’s profit before tax (including effects of the GH¢0.2 million impairment loss).

iv) Sales from Abirem to Tafo occurring evenly throughout the year amounted to GH¢8 million. By 31 December 2020, Tafo had sold all these goods except for items worth GH¢1.8 million. Abirem applies a cost plus 20% on all sales.

v) At 31 December 2020, it was concluded that 5% of the goodwill in Abirem had been impaired. Impairment has been charged to administrative expenses.

vi) Assume that all the necessary consolidation adjustments are correctly included in the above consolidated statement of comprehensive income.

Required:

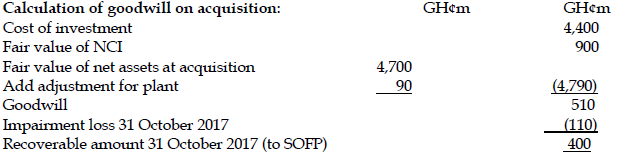

a) Calculate the goodwill in Abirem at acquisition and reporting. (5 marks)

View Solution

b) Prepare the statement of comprehensive income of Abirem for the year ended 31 December 2020. (10 marks)

View Solution

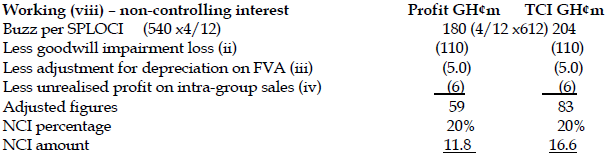

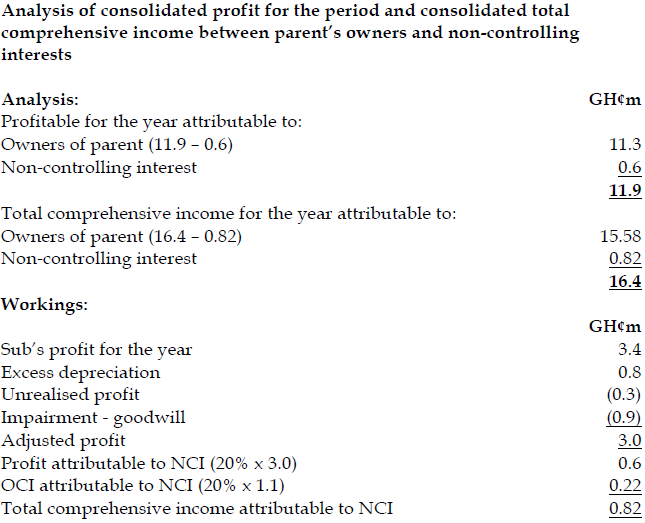

c) Show an analysis of consolidated profit for the period and total comprehensive income attributable to non-controlling interest and parent’s equity holders. (5 marks)

View Solution

View All Workings

- Group Structure

Tafo – Parent

Tafo% in Abirem 80%

NCI% in Abirem 20%

Tafo% in Bunso 20%

Abirem – 80% subsidiary

Bunso – 20% interest is evidence of significant influence exerted. Therefore, Bunso is an associated undertaking and must have been accounted for under equity accounting. - Unwound interest or discount

=> 10% x GH¢55m = GH¢5.5m