May 2021 Q5 a&b

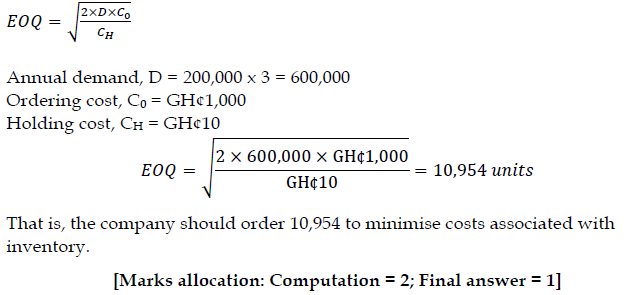

Adom Furniture Ltd is a reputable producer of office desks. A key material that is used in the production of office desks is processed wood boards. The company produces 200,000 units of office desks annually. The production of one unit of office desk requires three units of the processed wood board. The current production level and requirements will apply going forward.

Currently, the company buys 100,000 units of the processed wood board whenever it runs out of wood. The cost price of a processed wood board is GH¢120. It costs GH¢1,000 to place an order to replenish the inventory of processed wood board. On average, it costs GH¢10 to hold one processed wood board per annum.

The company has been financing each round of inventory purchase with short-term borrowing from a bank. The loan is typically granted for three months at an annual nominal interest rate of 24%. The bank charges a loan processing fee of 1.5% of the principal, which is paid upfront. The local distributor of the processed wood board is now willing to sell the product on credit terms 2/10 net 30.

Required:

a) With respect to inventory purchases and holding:

i) Compute the optimal quantity of the processed wood board the company should order whenever it places an order. (3 marks)

View Solution

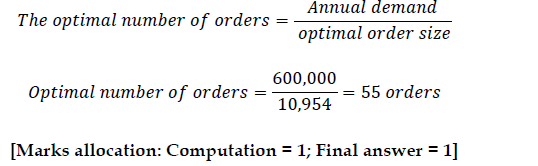

ii) Compute the optimal number of orders to place. (2 marks)

View Solution

If the optimal order size is placed, the company would have to place about 55 orders to meet its annual requirement:

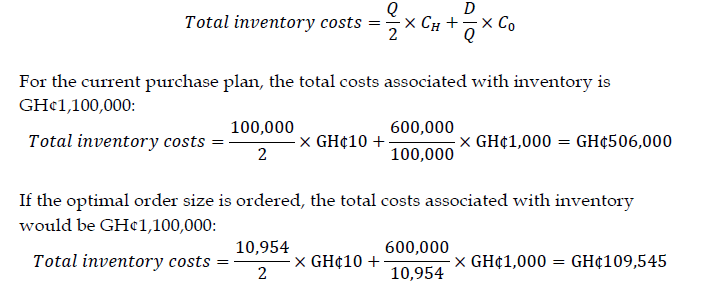

iii) Compute the average costs associated with the current purchase plan of 100,000 units per order and the cost if the optimal quantity is ordered instead. (4 marks)

View Solution

[Marks allocation: Computation of cost for the current plan = 2; Computation of cost for the optimal order size = 2]

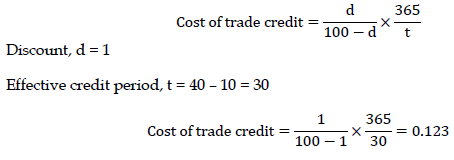

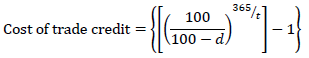

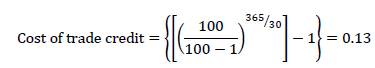

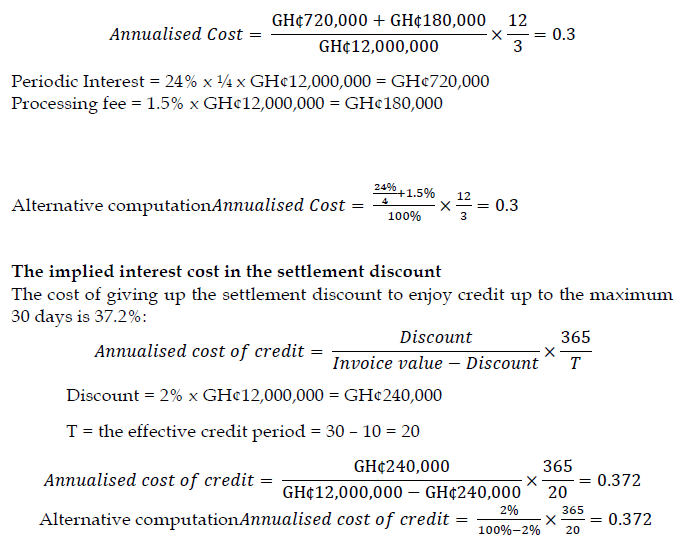

b) Would you advise the company to continue to take the bank loan to pay for the cost of inventory purchases within the discount period to enjoy the supplier’s early settlement discount? Support your answer with relevant computations. (6 marks)

View Solution

Financing method

The company should continue to take the bank loan to pay for inventory purchases within the discount period to enjoy the discount. This is because the annualised cost of the bank borrowing is 30%, which is lower than the annualised implied interest cost of trade credit (i.e., 37.2%). The company will save about 7.2% in financing costs if it borrows to pay for purchases early to take the discount rather than give up the discount to enjoy the full credit period.

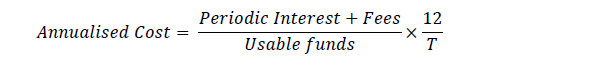

The annualised cost of the bank loan

As a short-term borrowing, the annualised cost of the bank loan can be computed as under:

Assuming the company continues with its current purchase plan of buying 100,000 units at the purchase cost of GH¢120, the company would have to borrow GH¢12,000,000, and the annualised cost of the loan will be 30%:

[Marks allocation: Computation of the annualised cost of borrowing = 2.5; Computation of the annualised implied interest cost of credit =2.5; Advise = 1]