May 2021 Q3 c&d

c) What is a factoring Agency? (2 marks)

View Solution

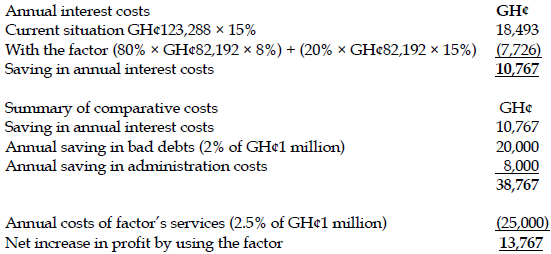

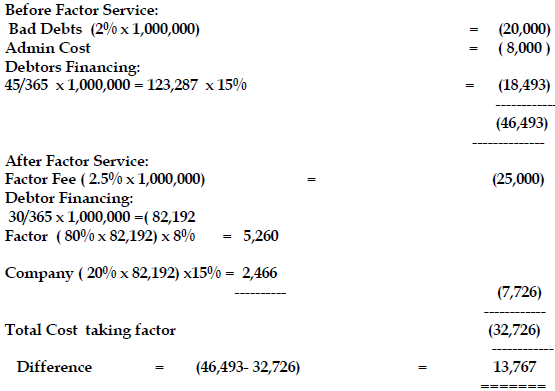

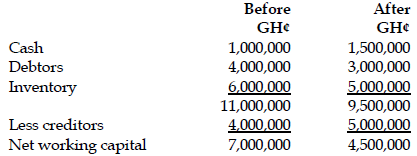

A debt factoring agency can assist the company in managing and financing its receivables. In particular, the company may engage the factoring agency to assist in administering the accounts receivables ledger and provide short-term finance secured by the receivables.

d) Discuss ONE (1) merit and ONE (1) demerit of engaging the services of a debt factoring agency. (3 marks)

View Solution

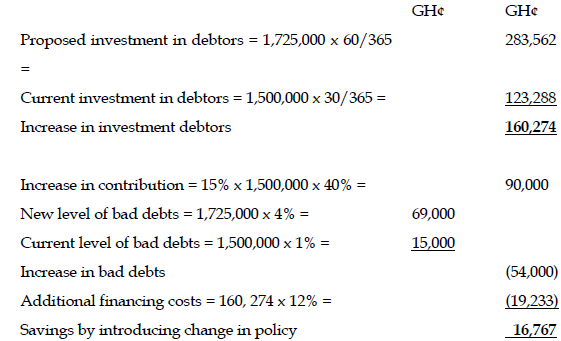

Using a factor may present some benefits to the company. A notable advantage of using the services of a factor is the reduction in internal debt administration costs. This is because the factor bears the collection cost in return for fees. As the factor is a specialist in debt administration, it can administer debt more efficiently and charge client companies a relatively lower fee than they would incur if they administered the debt internally. Another benefit is that the factor may be a source of finance for receivables. The company may seek an advance from the factor using its receivables as security.

Using the services of a factor may come with some demerits. One, a factor may charge a higher interest rate on advances than other lenders would charge. Two, the use of a factor might have a negative effect on customer goodwill. This might occur as the factor might not treat customers with the same level of care that the company would treat them when it comes to debt collection. Three, a factor may send a wrong signal to stakeholders that the company may be experiencing financial distress. Consequently, the reputation of the company may be adversely affected.