May 2021 Q1 b.

Puma Beverages Plc currently operates a single processing plant in Tema. The company plans to install and run processing plants in four other regions in Ghana.

The Finance Manager has presented an investment and financing strategy for this expansion project to the Board of Directors for their study. The proposed investment strategy is that the company sets up the four processing plants in turns. Specifically, the company will install the first plant at the end of the fifth year from now, the second at the end of the sixth year from now, and the rest follow annually in that order.

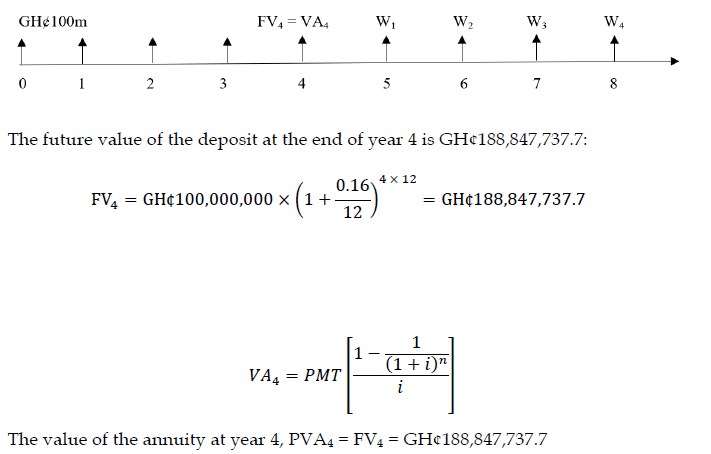

The proposed financing strategy is that the company finances the expansion project with its retained earning. To do this, the company should deposit GH¢100 million into an investment account today. The account will earn interest at an annual nominal interest rate of 16%, with monthly compounding through the account’s life. The company will withdraw even amounts from the account at the end of each year starting from the end of year five until the account is closed at the end of year eight (i.e., four withdrawals in all) to finance the installation of each of the four processing plants in line with the investment strategy.

Required:

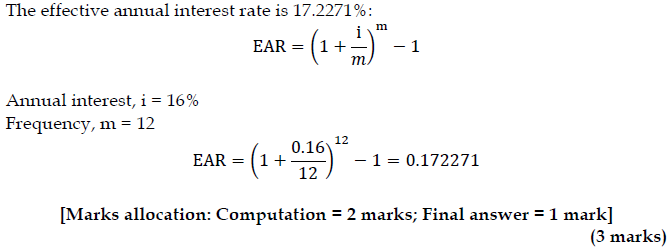

i) Compute the effective annual interest rate on the investment account. (3 marks).

View Solution

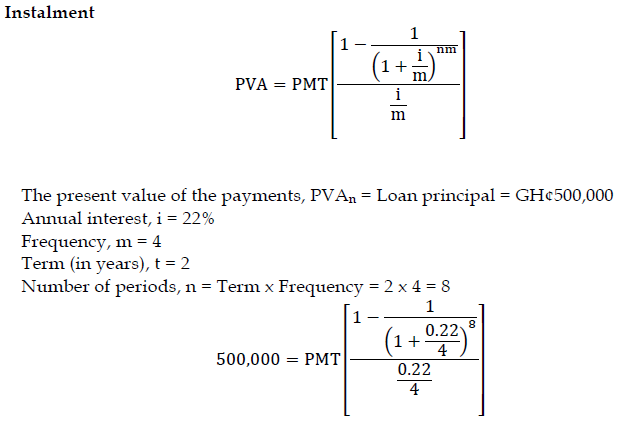

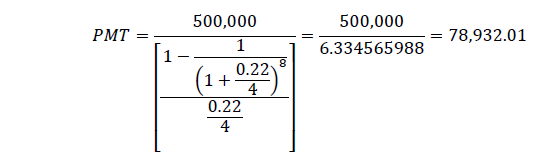

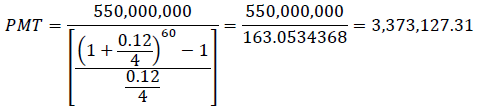

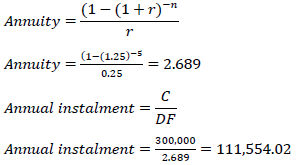

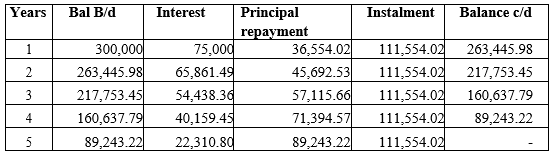

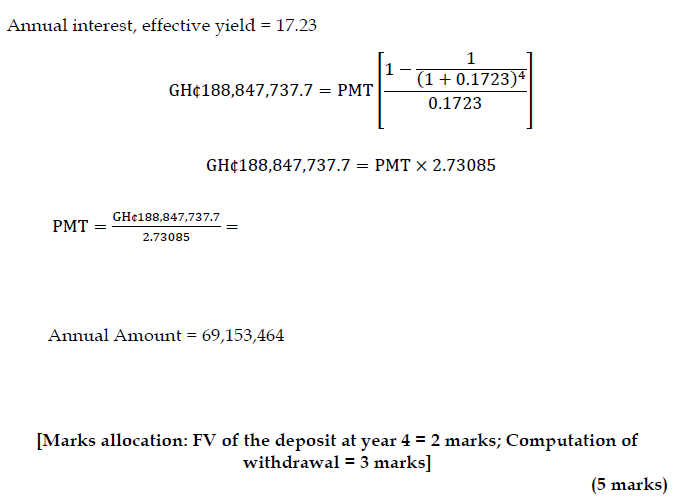

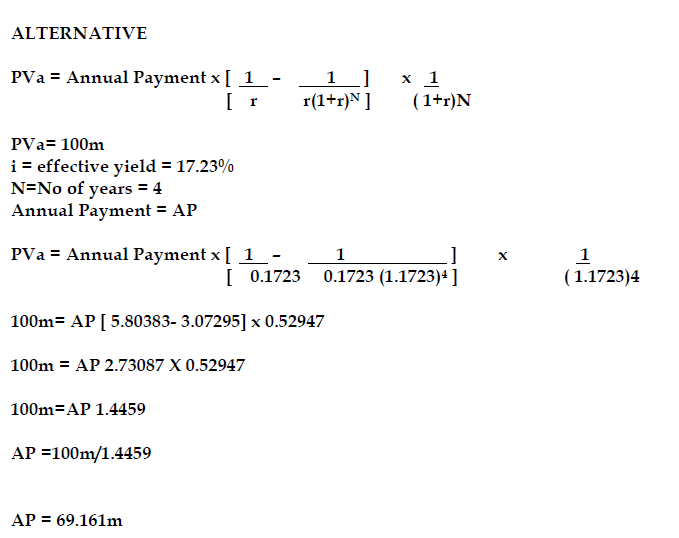

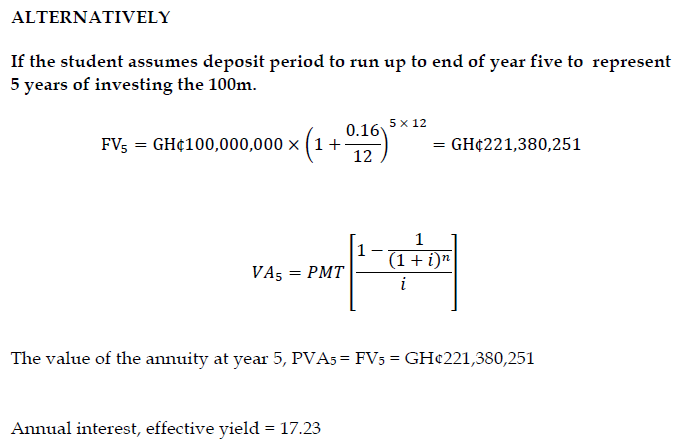

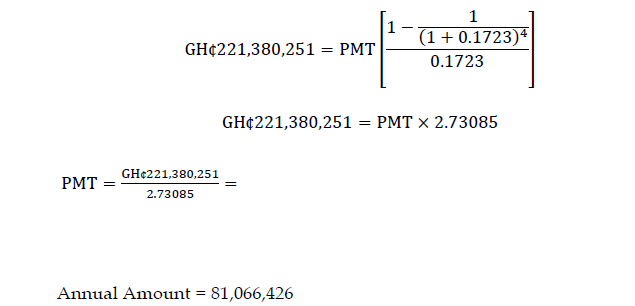

ii) Compute the even amount that should be withdrawn from the account at the end of each year from the fifth year to the eighth year such that the account balance reduces to zero upon the last withdrawal at the end of the eighth year. (5 marks)

View Solution

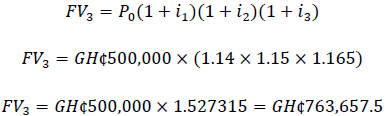

The investment period’s withdrawal phase may be considered a 4-year ordinary annuity starting from the fifth year to the eighth year. Therefore, the discounted value of all the withdrawals at the beginning of the annuity (i.e., beginning of year 5, which is the same as the end of year 4) will be the future value of the deposit of GH¢100 million at the end of year 4.

iii) Distinguish between annuity due and ordinary annuity. (2 marks)

View Solution

Annuity due and ordinary annuity are both series of equal payments. The difference between them is that each payment in an annuity due occurs at the beginning of each period, whereas each payment in an ordinary annuity occurs at the end of each period.