May 2019 Q3 a(iv)

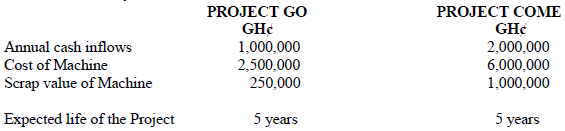

ASANTA Ghana Ltd is considering investing in the following projects which are considered mutually exclusive:

ASANTA Ghana Ltd uses the straight line method of depreciation. However, tax-allowable depreciation is 30% on straight line basis. The cost of capital for the company is 20% per annum.

(Note: Advise the Company on which of the projects to implement or undertake.)

Required:

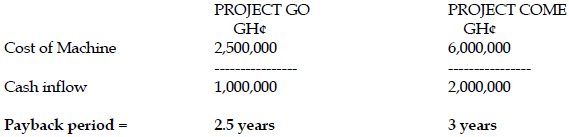

Compute the Payback period for each project. (3 marks)

View Solution

Decision: Project GO gives the lowest payback period and should be selected.