May 2021 Q4 a.

CVD Ghana Ltd, which is into the production and sale of COVID 19 vaccine in Ghana and abroad, plans to buy a new machine to expand the scope of its operations due to increased demand in both the local and the International markets.

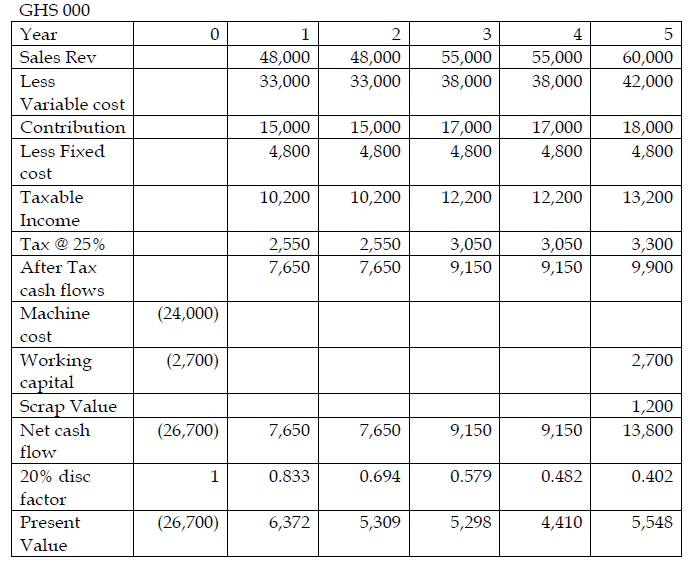

The cost of the machine is GH¢ 24,000,000 and has a useful life of five years. The machine will require additional investment in working capital of GH¢ 2,700,000 at the beginning of the first year of operations. At the end of year five, the machine will be sold for scrap, with the scrap value expected to be 5% of the machine’s initial purchase cost. The company has no intention to replace the machine. Production and sales from the new machine are expected to be 1,000,000 packs per year.

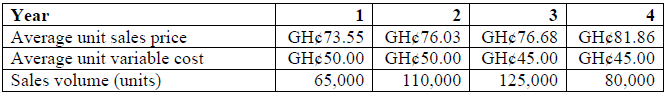

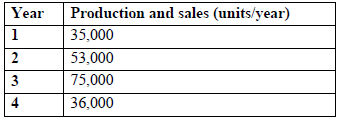

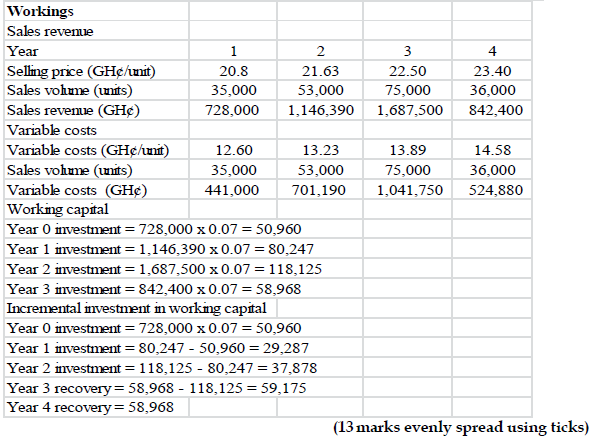

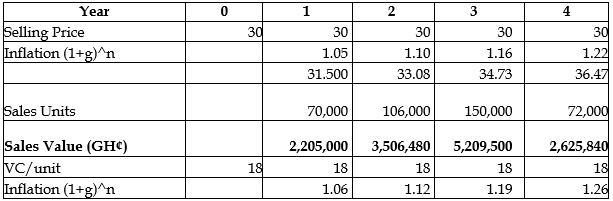

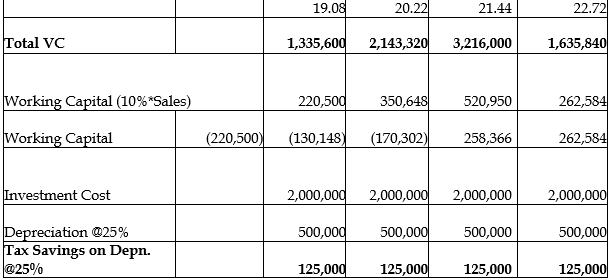

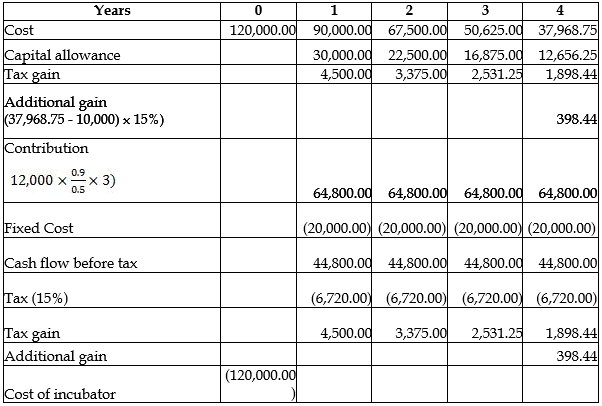

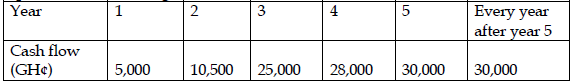

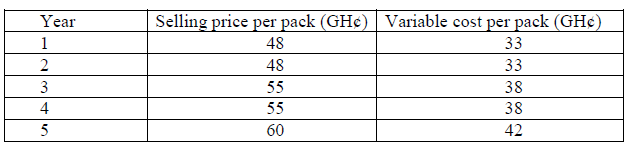

The selling price per pack and variable cost per pack are as follows:

It is also estimated that incremental fixed cost arising from the machine’s operations will be GH¢4,800,000 per year. CVD Ghana Ltd has an after-tax cost of capital of 20%, which it uses as a discount rate in its investment appraisal. The company pays corporate tax at an annual rate of 25% per year. Capital allowance should be ignored.

Required:

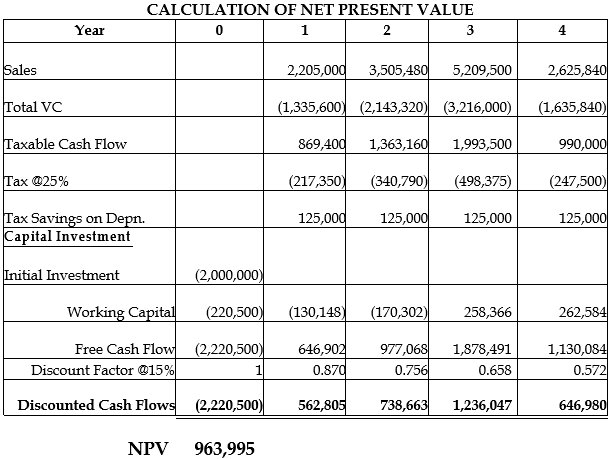

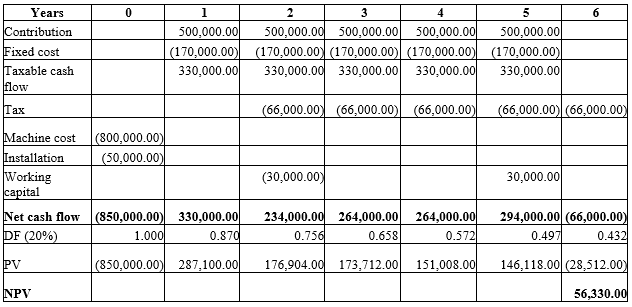

i) Compute the Net Present Value of this project and advice CVD Ghana Ltd whether the investment is financially viable. (8 marks)

View Solution

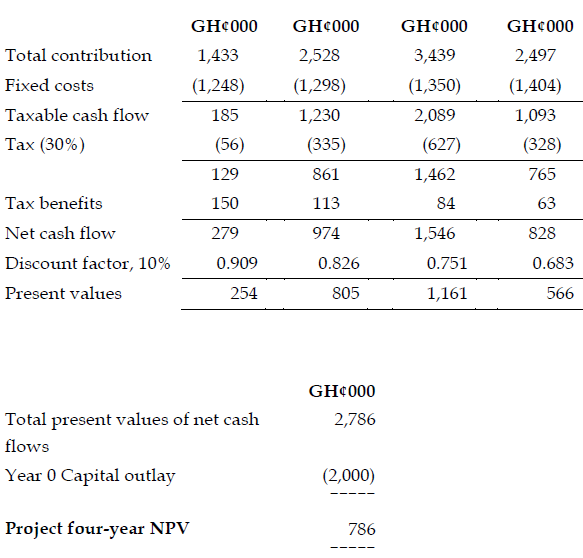

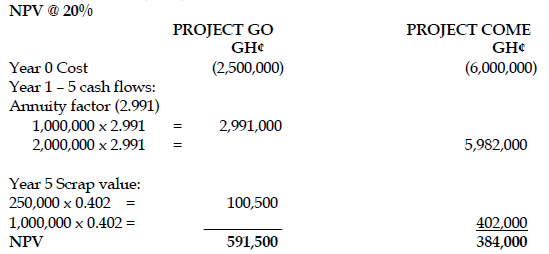

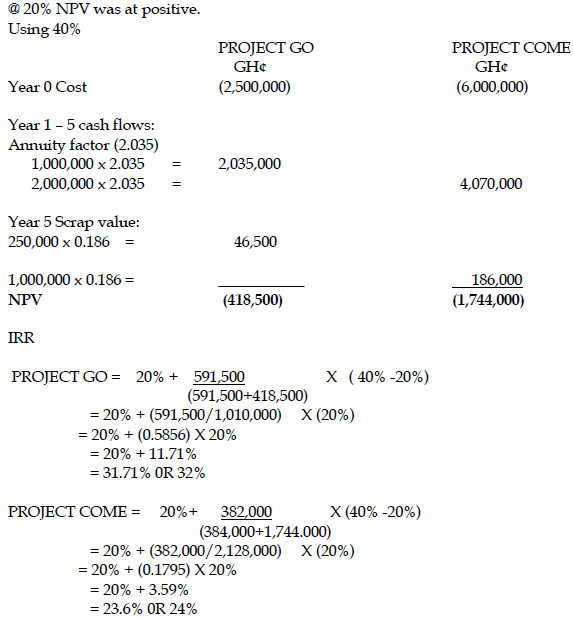

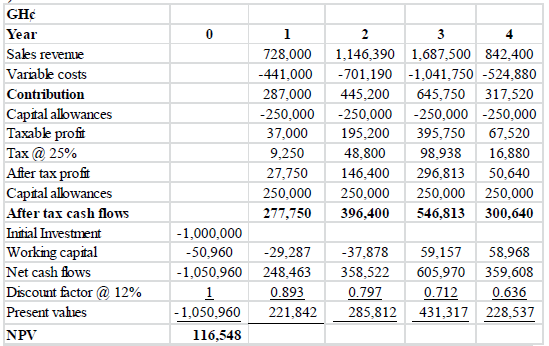

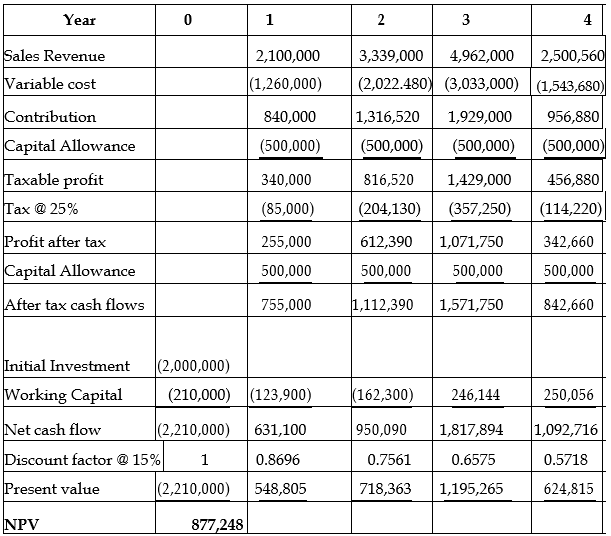

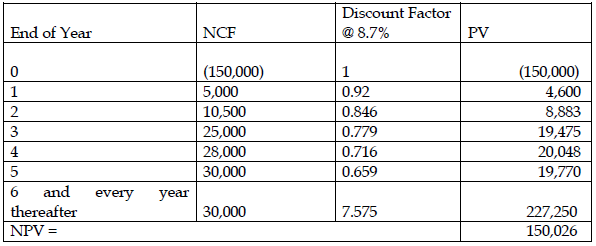

NPV = -26,700+6,372+5,309+5,298+4,410+5,548 = 237

Since NPV is positive it should be accepted

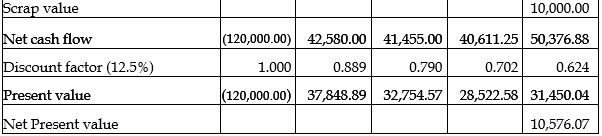

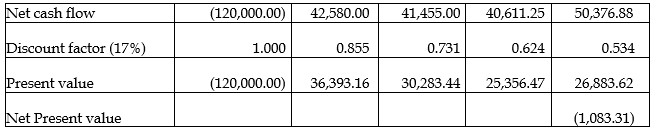

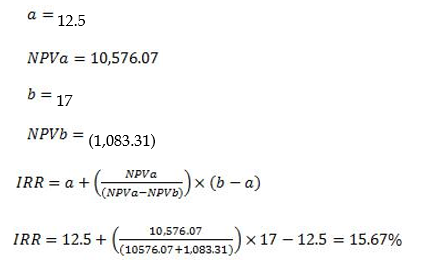

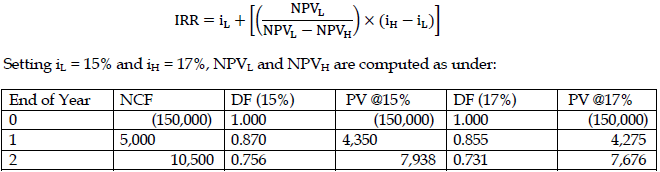

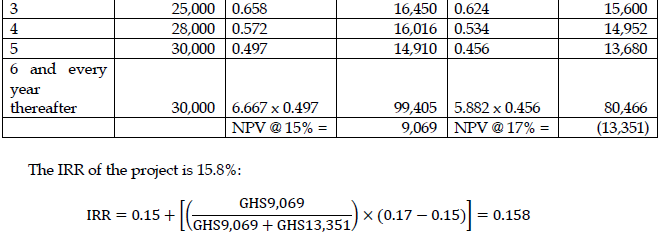

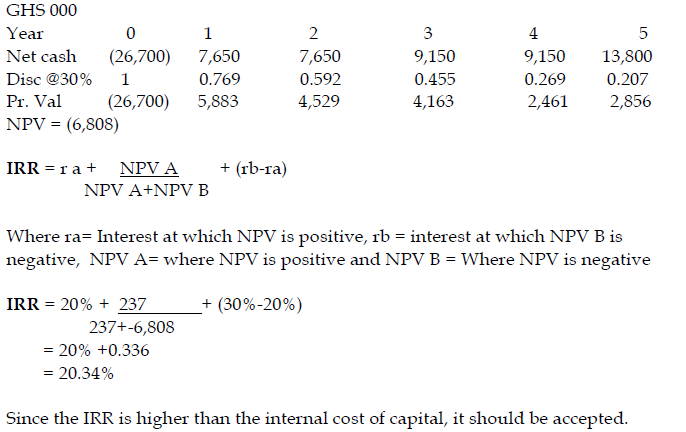

ii) Calculate the Internal Rate of Return of Investing in the machine and advice whether it is financially viable. (5 marks)

View Solution

iii) Explain the meaning of the term “sensitivity analysis” in the context of investment. (2 marks)

View Solution

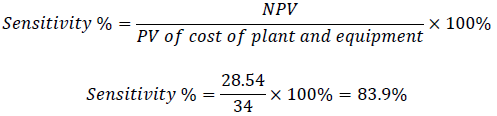

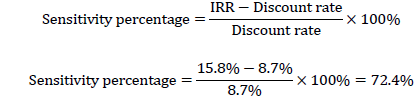

Sensitivity analysis is a way of measuring the risk of a project or an investment to determine how responsive the NPV is to changes in the variables from which it has been based or calculated. The variables could be selling price, variable cost etc. How sensitive the NPV to percentage changes in the variables.