May 2021 Q4 b.

Most large companies maintain a treasury department to handle some specialised functions in finance. One of such functions is the Management of financial risk, which includes interest rate risk.

Required:

Explain interest rate risk and suggest two ways of managing an entity’s exposure to interest rate risk. (5 marks)

View Solution

Interest rate risk is the risk of uncertainty of a possible loss that could arise due to movements or changes in interest rates. If interest rates rise, the value of bonds or financial assets drops and vice versa. Borrowers at fixed interest rates tend to suffer or lose when interest rates vice versa.

( 2 marks)

Ways of managing interest rate risk:

Interest rate risk can be managed using a variety of strategies. Internal strategies that may be used include the following:

- Interest matching, which involves matching the interest type on the borrowing with the interest type on the investment to be financed. For instance, an investment that will return constant cash flows is financed with a fixed-rate loan.

- Interest netting involves setting off interest receivables and interest payables to reduce the underlying exposure to a lower amount that may be hedged using external strategies.

- Interest smoothing, which involves balancing the amount of fixed-rate loans with variable-rate loans. With fairly equal proportions of fixed-rate and variable-rate loans, any movement in interest rates will bring both losses and gains of fairly equal amounts that would net off.

External strategies for managing interest rate risks include the following:

- Forward rate agreement, which involves hedging the interest rate exposure with a forward contract with a bank.

- Interest rate futures involve hedging the underlying interest rate exposure by borrowing in futures (i.e., selling futures contract) or lending in futures (i.e., buying futures contract). As a result, the entity might earn some gains from futures, which can be used to offset interest rate losses from the underlying exposure.

- Option on interest rate futures, which involves buying a right to borrow or lend in futures. This permits the entity to enjoy gains upside when the option’s strike interest rate tends to be more favourable than the futures interest rate.

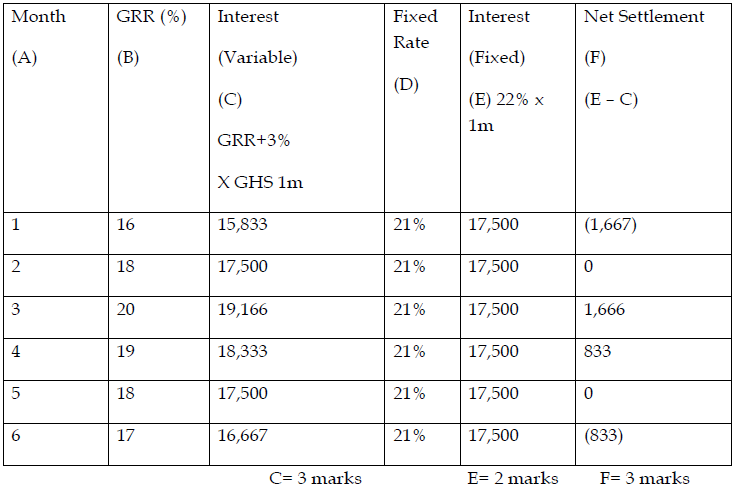

- Interest rate swap, which involves swapping fixed interest payments for variable interest payments.

(Marks allocation: 1.5 marks for each of two strategies = 3 marks)