May 2021 Q5 c.

Explain TWO (2) advantages to a company dealing with a currency risk exposure using a forward market hedge as against a futures market hedge. (5 marks)

View Solution

Advantages of using forward market hedge against using futures market hedge

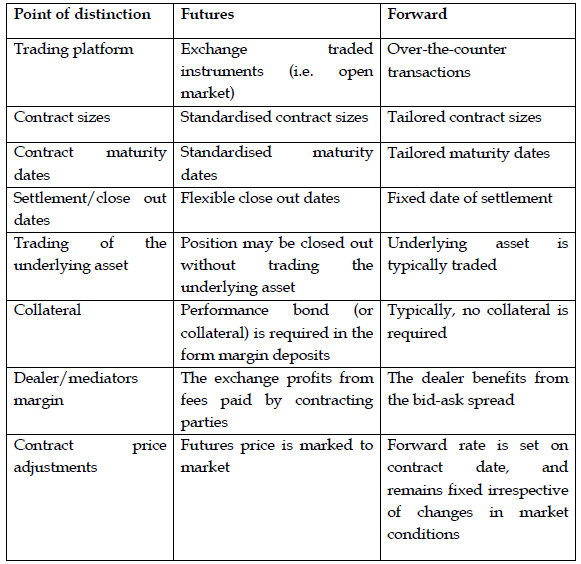

As the underlying risk exposure is a transaction exposure to currency risk, forward market hedge and futures market hedge are options for dealing with the risk. However, using a forward market hedge to deal with the currency risk exposure would present to the company the following advantages as gainst using a futures market hedge to deal with the same:

Perfect hedge

As a typical over-the-counter arrangement, forward contracts can be tailored to the requirements of the company. The company can arrange for the exact quantity of the foreign currency it wants to hedge against and a contract maturity that matches the maturity of the underlying exposure. Thus, it is much easier to create a hedge that perfectly protects an underlying exposure when a forward contract is used. However, it is somewhat challenging to create a perfect hedge with a futures contract as futures contracts are standardised in terms of the underlying asset, the contract size, and contract maturity. Thus, it is common to have situations where an entity must manage with a contract underlying asset different from the asset that is exposed to risk, a number of contracts that either overcovers or undercovers the underlying exposure, and contract maturity that differs from the underlying exposure maturity date.

No margin requirements

Unlike futures contract arrangements, entering a forward contract does not typically require margin deposits against potential counterparty risk. Thus, the company will not have to deposit money or equivalent value in securities with a clearing house that could otherwise be used to finance operational or other needs.

Guaranteed outcome

In a typical forward contract, the forward price is set at the commencement of the contract, and it remains fixed over the contract maturity period. This feature guarantees the outcome of the forward as the proceeds or cost of the trade is known in advance. In the case of futures contract, the futures price is marked-to-the-market and so is permitted to vary as the underlying asset value varies in the spot market. This leaves the futures contract to an uncertain outcome.

(Marks allocation: a maximum of 2.5 marks for each of two advantages = 5)