May 2021 Q2

Kwaafi and Sons Ltd operates a newspaper business. The business has various segments, namely: traditional media, online news, events and printing. The company’s new strategy is to concentrate on online news, outsource its printing services and discontinue the printing segment.

The printing segment is one of the company’s cash cows, generating 30% of its revenue of GH¢28,000,000 annually. The company aims to take advantage of the Continental Free Trade Agreement to serve other African countries.

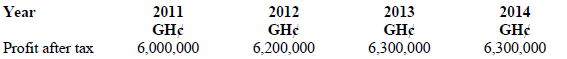

Before deciding to concentrate on online news, the company undertook an extensive retooling of its printing segment. The Finance Director has produced the following information:

i) A new coloured printer was purchased to replace a 15-year-old printer, which was purchased for GH¢3,000,000 and is now obsolete but can be sold as scrap for GH¢15,000;

ii) The new coloured printer was purchased two years ago at GH¢8,000,000 and has a useful life of six years.

iii) A contract has been signed for the servicing of the equipment at a retainer fee of GH¢755,250 per annum over the life of the equipment;

iv) The stock of toners and rollers for the old printer worth GH¢280,000 is obsolete at no cost.

v) Replacement parts for the new equipment, which are enough for the useful life of the equipment is valued at GH¢300,000;

vi) Special carbonated tonners for the old printer costing GH¢230,000 is unusable and has to be disposed of at a residual value of GH¢13,000 as soon as possible;

vii) Eighteen (18) rolls of printing sheets and twenty-five (25) boxes of metal plates are valued at GH¢240,000 and GH¢420,000, respectively. These need replacement every year at similar costs;

viii) Annual rent and rates of GH¢800,000, payable at the end of each year, increases by 10% every 2 years.

ix) Other operating expenses of GH¢3,200,000, payable at the end of the year, increases at 10% annually until year 3.

x) It is estimated that the printing segment will now generate 10% more revenue per annum for the New Printer’s remaining life. Depreciation is based on the straight-line method;

xi) For valuation purposes, an expected rate of return of 30% has been agreed upon among the parties. Ignore taxation and inflation.

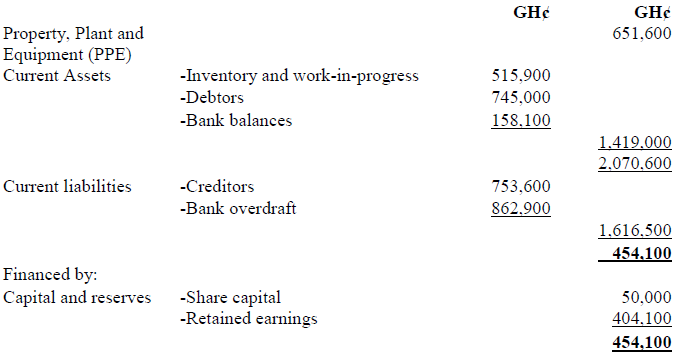

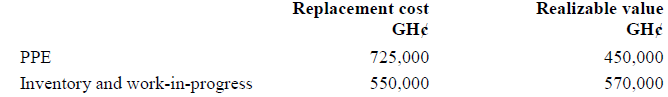

Following the announcement to discontinue the printing segment, the senior staff of the segment proposed to raise funds to buy the assets of the segment. They obtained invoices of similar assets and used the prices to make an offer to the Board of Directors.

The Finance Director disagreed and suggested that an expert valuer value the assets of the company and its operations. The senior staff have objected to the valuation proposals arguing that valuations are subjective and may not reflect the accurate value of the assets to be disposed off by the company.

Required:

a) Distinguish between market price and value in the context of business valuation. (3 marks)

View Solution

Price

- Price is determined by the market forces and it is obtained by the interplay of demand and supply;

- Price again is the amount that a willing buyer is ready to pay, and a willing seller is prepared to accept for the exchange of an item;

- Price is always expressed in monetary terms except in the case of barter where the price of a commodity is quoted in reference to the quantity of another commodity;

- The price of an asset can also be determined as the present value of all future cash flows of the stated asset;

- Price can be higher than the value of an item when a premium is paid or lower when a discount is granted.

Value

- Value, on the other hand, is the allocation of monetary worth to an item or a subject of valuation;

- Unlike price, value can be tangible or intangible;

- Everything has a value, which may be different from the price; though the price can be used as a measure of the value of an item;

- Whereas price is agreed is fixed between a buyer and a seller for a given item, the value of the item in question may differ among the parties;

- Processes to establish a common value of an item is often the starting point to determine the price.

(1 mark for any correct point up to 3 marks)

b) Explain why a valuation process is described as subjective. (2 marks)

View Solution

- Valuation methods apply several assumptions that may vary in future;

- Different methods produce different values, which can create disagreement on the appropriate method to apply;

- Several elements for the valuation are based on estimation (future cash flow), which may vary materially from the actual results;

- Different perspectives of interested parties influence their choice of valuation method. For instance, valuation for taxation purposes may consider factors for computation of capital gain, which may be different from valuation for accessing credit facility, which will focus on collateral value;

- Some methods, such as the discounted cash flow, have been described as subjective;

- The quality of information and completeness thereof influence the competence of the valuation process;

One mark for any correct point up to two marks

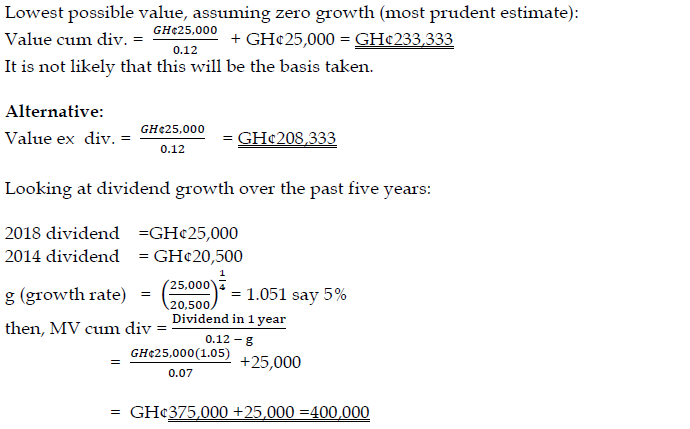

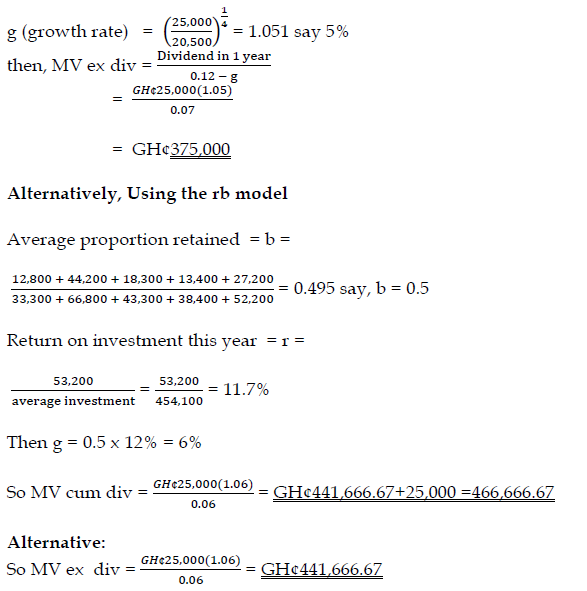

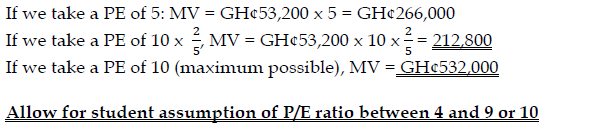

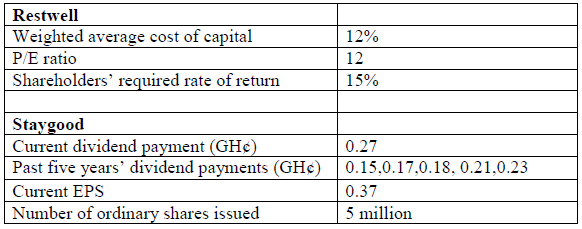

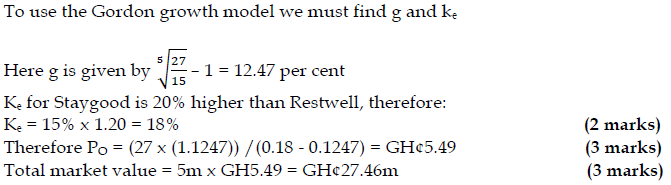

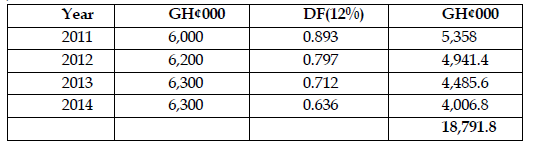

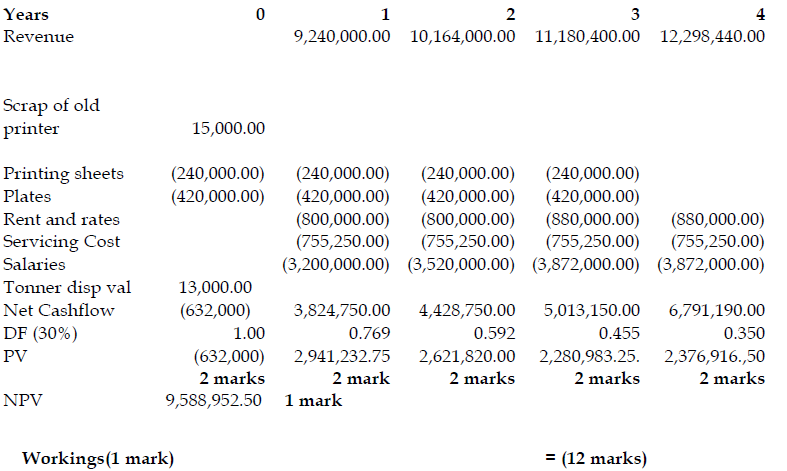

c) Calculate the value of the printing segment using the discounted cash flow method. (12 marks)

View Solution

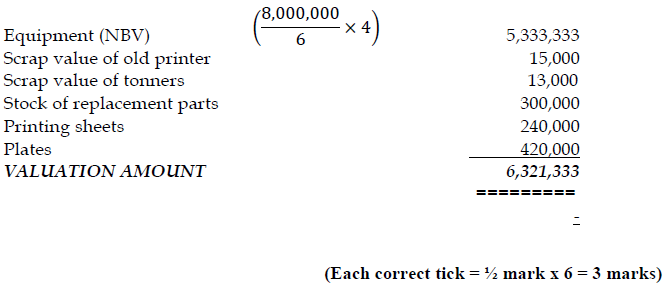

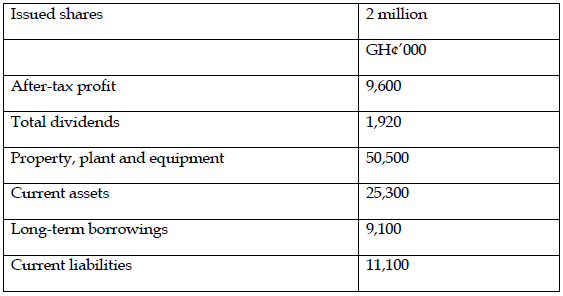

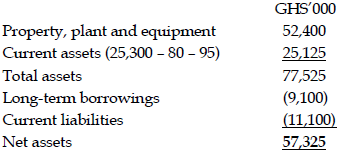

d) Calculate the value of the printing segment using the assets-based method. (3 marks).

View Solution