Nov 2019 Q4 b,c&d

b) Apagya Ltd has two product lines AB and CD. Time rate and piece rate labour rewarding systems are used for AB and CD products respectively.

Required:

Explain the terms time rate and piece rate, clearly outlining their differences and giving examples of business setting where each could be applied. (4 marks)

View Solution

PIECE RATE:

This a wage reward system where labour is paid based on the volume of work done. Here, the output recorded is the reference point for measuring the wages payable to the employee but not the time spent. Examples of production settings where this rate system is applicable may include, construction, manufacturing, food processing, etc.

TIME RATE:

This is a reward system that relates wages to the time spent by the employee. Example, hourly, daily, weekly, fortnightly or monthly, depending on the nature of skill of the employee. This is usually used in service firms such accounting firms, hospitality services, law firms etc.

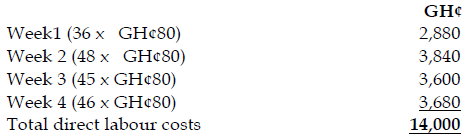

c) AB Ltd operates a 40-hour weekly work regime and rewards labour for all overtime worked at time and one-half.

The wage rate is GH¢80 per hour.

The following details are recorded for the month of October 2019 for an employee (Adamu):

Week Hours Worked

1 36

2 48

3 45

4 46

Required:

i) Compute the total direct labour costs for Adamu for the month of October 2019. (4 marks)

View Solution

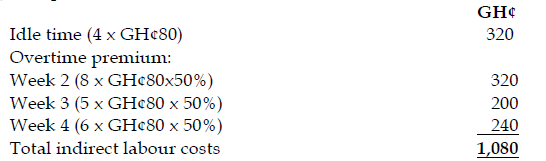

ii) Calculate the total indirect labour costs for Adamu for the month of October 2019. (4 marks)

View Solution

d) Explain the treatment of overtime premium in accounting for labour costs. (2 marks)

View Solution

Overtime premium is generally accounted for as indirect labour costs. However, where overtime payments result from customer specific requirements for the production of a product or job, then such overtime premium may be accounted for as direct labour.