May 2019 Q6 a&b

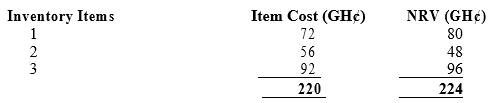

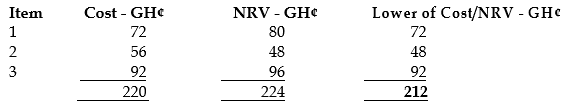

a) Alex Azugu, the managing director of Tojo Ltd has a number of specific queries in relation to Inventory and has asked you for advice in relation to IAS 2: Inventories. As part of its overall inventory, Tojo Ltd has three items of inventories whose costs and Net Realisable Values (NRV) are as follows:

Required:

In the context of IAS 2: Inventories, prepare a report for Mr. Alex Azugu on:

i) The closing value of each item of inventory and hence the total value of closing inventory for these items for Tojo Ltd at the year-end. (2 marks)

View Solution

REPORT

To: Mr. Alex Azugu, managing director – Tojo limited

From: future financial Accountant

Re: IAS 2 – Inventories

Date: May 2019

The comparison should be made for each item of inventory and thus a value of GH¢212 would be attributed to inventories i.e.

ii) The items that comprise inventory. (2 marks)

View Solution

- Merchandise

- Production supplies Materials

- Work in Progress

- Finished goods

iii) THREE (3) examples of costs which are specifically excluded from the costs of inventories and instead are recognised as expenses in the period in which they are incurred. (3 marks)

View Solution

(Paragraph 16 of IAS 2 outlines examples of costs which are excluded from the cost of inventories and instead recognised as expenses in the period in which they are incurred i.e.

- Abnormal amounts of wasted materials, labour or other production costs;

- storage costs unless these costs are necessary in the production process before a further production stage;

- Administrative overheads that do not contribute to bringing inventories to their present location and condition; and selling costs.

iv) THREE (3) situations in which net realisable value is likely to be less than cost. (3 marks)

View Solution

The principal situations in which net realisable value is likely to be less than cost is where there has been;

- An increase in costs or a fall in selling price

- Physical deterioration of inventories

- Obsolescence of products

- A decision as part of a company’s marketing strategy to manufacture and sell products at a loss due to errors in production or purchasing.

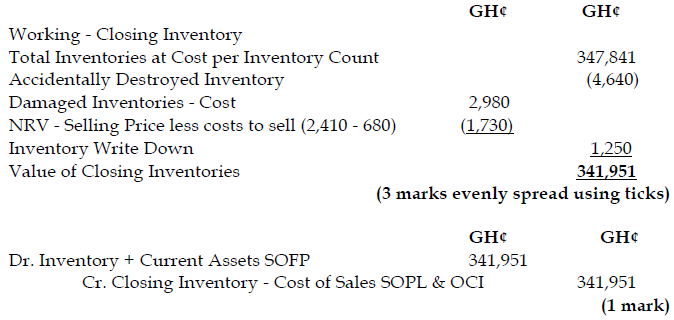

b) Davis Ltd’s closing inventory as at 31 December 2018 is GH¢347,841. This includes GH¢4,640 for items accidentally destroyed on 31 December 2018 after the count was completed. Also included is GH¢2,980 which relates to the cost of inventory damaged in October 2018, which can be reworked at a cost of GH¢680 and which can then be sold for GH¢2,410.

Required:

Calculate the closing value of inventory at the year-end.

View Solution