Nov 2019 Q5 a&b

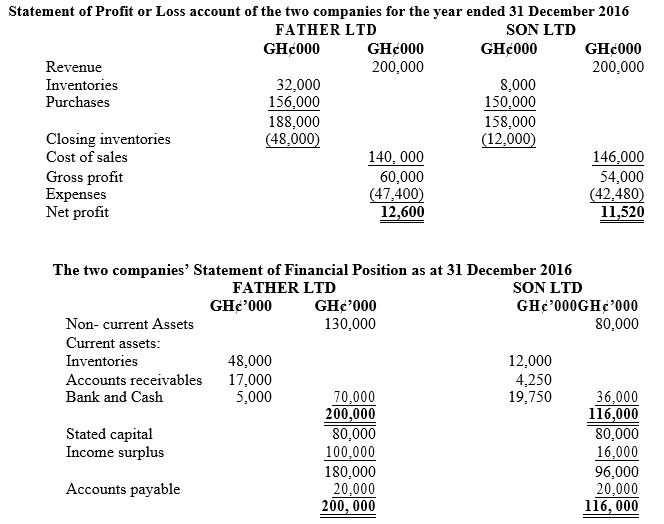

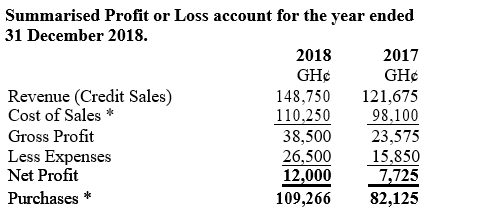

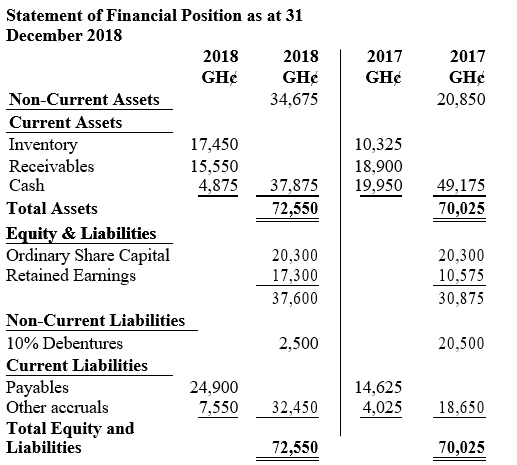

The following Profit or Loss Account and Statement of Financial Position relates to Dombo Ltd for the year ended 31 December, 2018 (with comparative figures for the year ended 31 December 2017 where relevant).

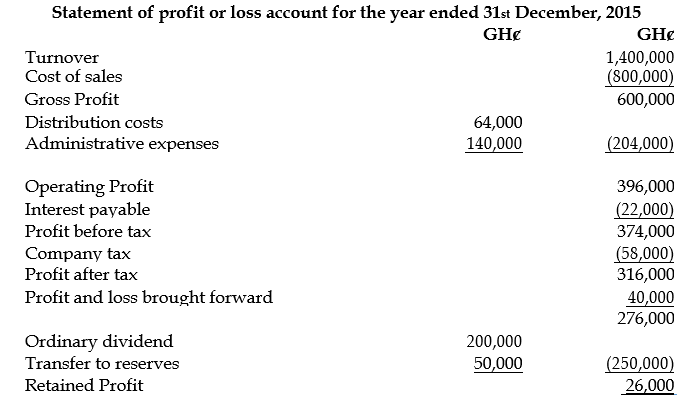

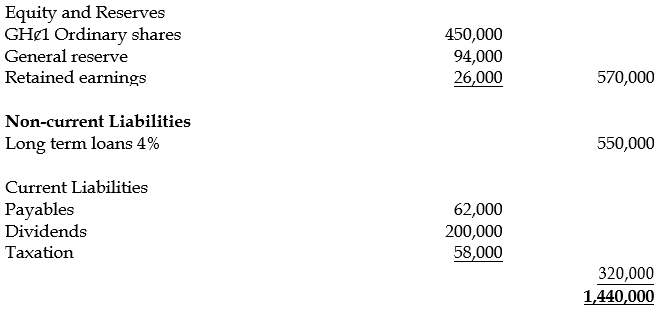

Summarised Profit or Loss account for the year ended 31 December 2018.

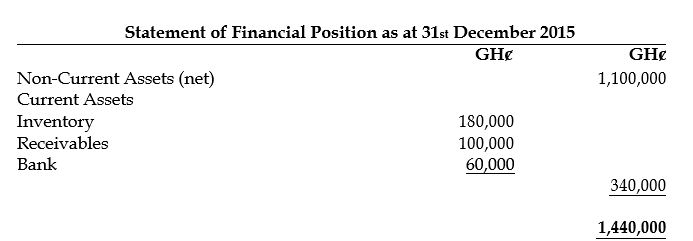

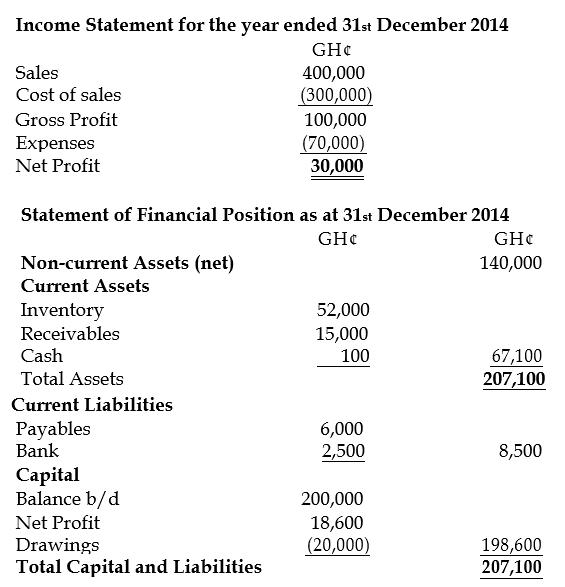

Statement of Financial Position as at 31 December 2018.

Required:

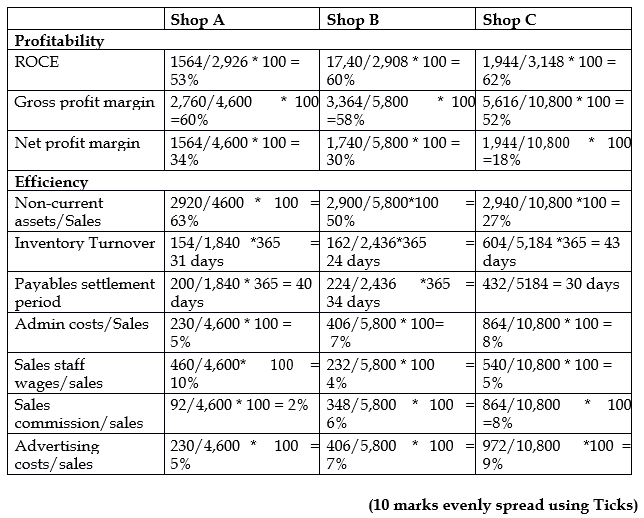

a) Calculate TWO (2) ratios each for the year ended 31 December 2018 and 2017 respectively of the categories of ratio:

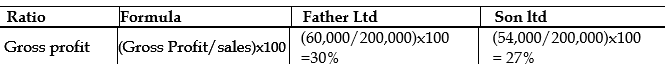

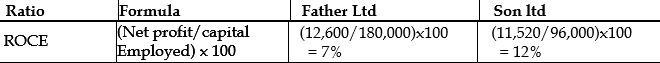

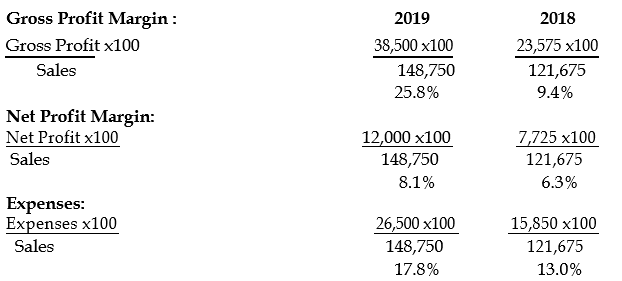

i) Profitability

View Solution

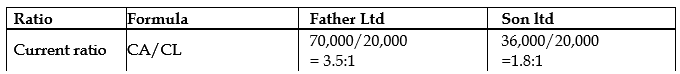

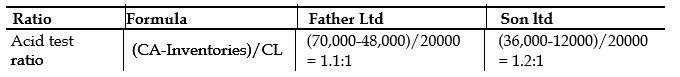

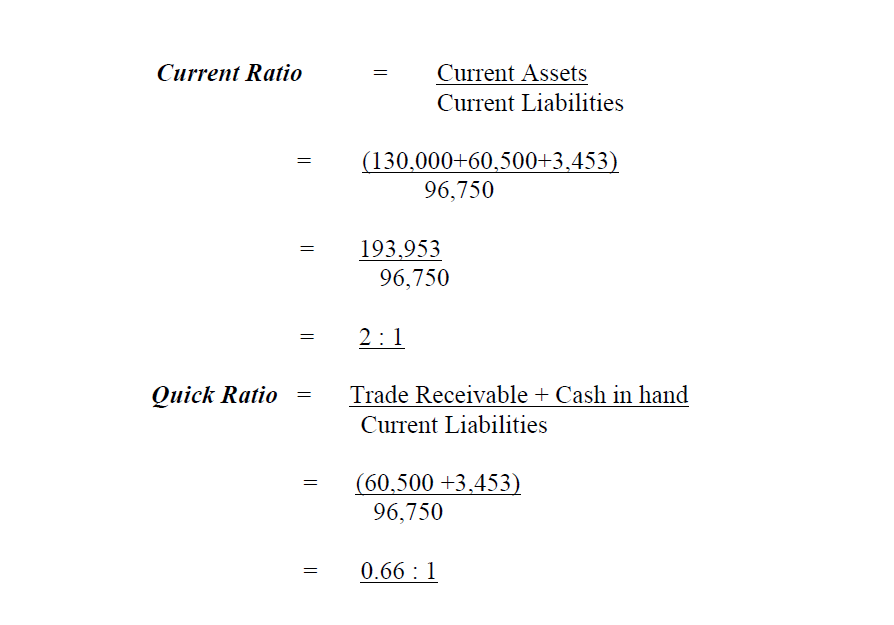

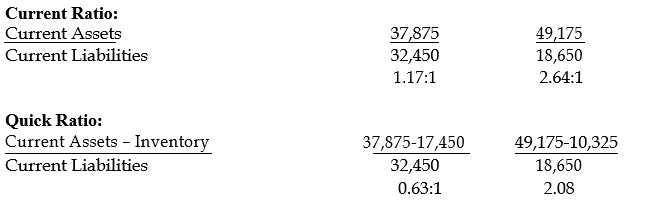

ii) Liquidity

View Solution

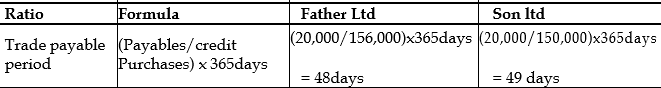

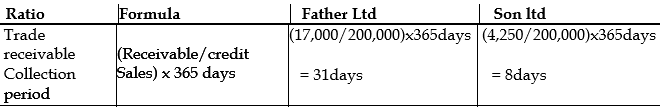

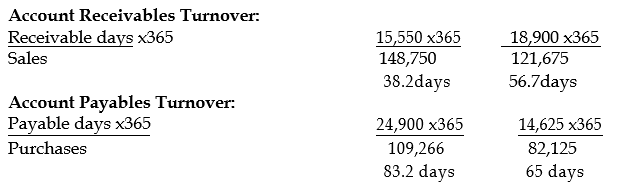

iii) Efficiency

View Solution

b) State FOUR (4) advantages and TWO (2) disadvantages of ratio analysis. (6 marks)

View Solution

Advantages:

- Ratio analysis will help validate or disprove the financing, investment and operating decisions of a firm.

- They summarize the financial statement into comparative figures, thus helping the management to compare and evaluate the financial position of the firm and the results of their decisions.

- It simplified complex accounting statements and financial data into simple ratios of operating efficiency, financial efficiency, solvency, long term positions etc.

- Ratio analysis help identify problem areas and bring the attention of the management to such areas. Some of the information is lost in the complex accounting statements and ratios will pinpoint such problems.

- Allows the company to conduct comparisons with other firms, industry standards, intra-firm comparisons etc. This will help the organization better understand its fiscal position in the economy. (Any 4)

Disadvantages:

- The firm can make some year end changes in their financial statements, to improve their ratios. Then the ratios end up being nothing but window dressing.

- Ratios ignore the price level changes due to inflation. Many ratios are calculated using historical costs, and they overlook the changes in price level between the periods. This does not reflect the correct financial situation.

- Accounting ratios completely ignore the qualitative aspects of the firm. They only take into consideration the monetary aspects (quantitative).

- There are no standard definitions of ratios. So firms may be using different formu-las for the ratios. One of such example is Current Ratio, where some firms take into consideration all liabilities but others ignore bank overdraft from current liabilities while calculating current ratio.

- Accounting ratio do not resolve any financial problems of the company. They are a means to the end not the actual solution. (Any 2)