Nov 2019 Q2 b.

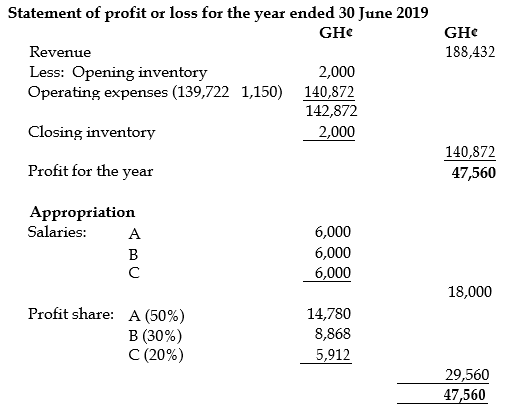

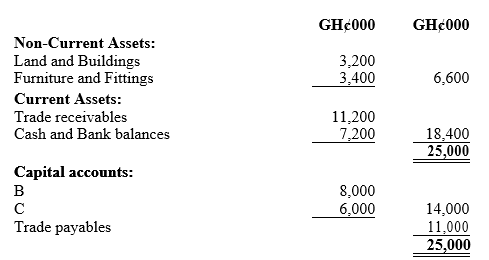

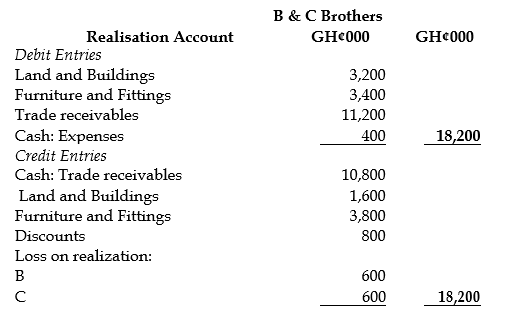

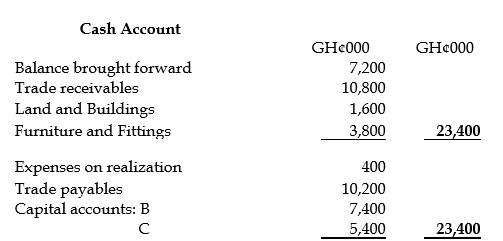

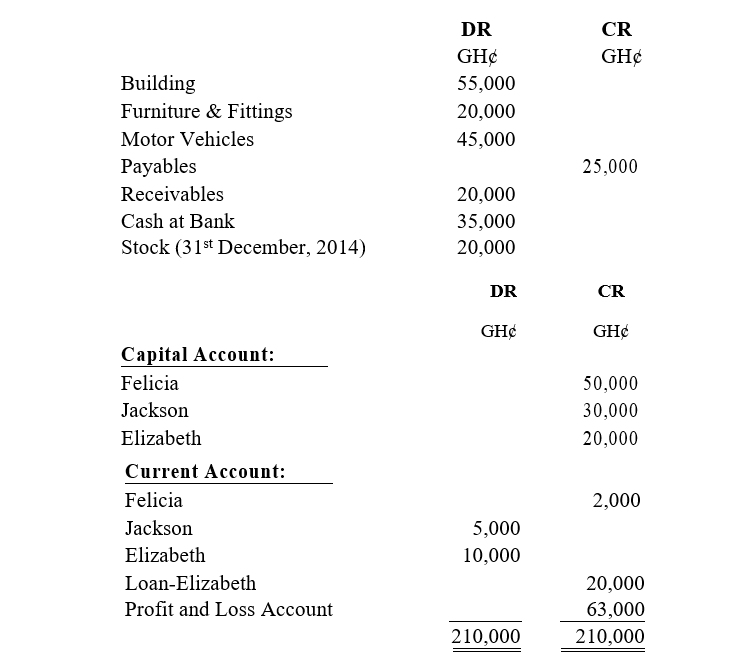

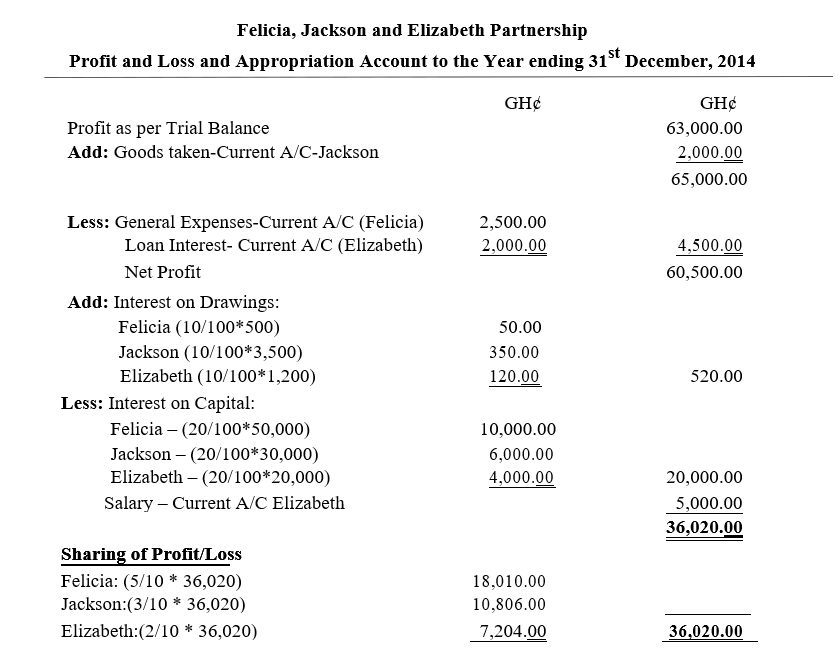

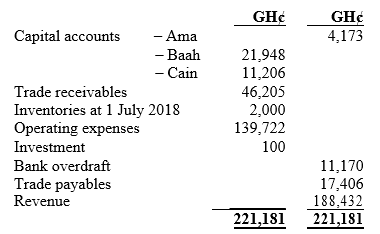

Ama, Baah and Cain are in partnership, providing management services, sharing profits in the ratio 5:3:2 after charging annual salaries of GH¢6,000 each. Current accounts are not maintained. On 30 June 2019, Ama retired and Doh was admitted into the partnership. Doh is entitled to 30% of the profits of the new partnership with the balance being shared equally between Baah and Cain. The old partnership trial balance as at 30 June 2019 was as follows:

The following information is relevant:

i) For the purposes of the accounts, inventory is to remain at GH¢2,000.

ii) Full provision is required at 30 June 2019 against a bad debt of GH¢1,150.

iii) It was agreed between the partners that the following adjustments are to be made:

- The investment is to be included in the books of the new partnership at a valuation of GH¢1,500.

- Goodwill, which is to be kept in the books of the new partnership, is to be valued at GH¢24,000.

iv) On 1 July 2019, GH¢10,000 of the amount due to Ama from the old partnership was trans-ferred to Doh. The balance due to Ama is to be repaid over three years, commencing on 1 July 2019.

v) On 1 July 2019 Doh introduced cash of GH¢7,500 to the partnership.

Required:

Prepare the Statement of Profit or Loss account and appropriation account of the OLD partnership for the year ended 30 June 2019. (10 marks)

View Solution