May 2019 Q4 a.

Preprah is a dealer in spare parts who has not kept proper books of accounts. As at 31 December 2017, the following balances were available:

Description of Assets GH¢

Cash in hand 1,500

Cash at bank 15,000

Inventories 17,440

Trade receivables 8,540

Trade payables 9,520

Motor Vehicle (at valuation) 45,000

Furniture and Fittings 14,500

The following activities took place during 2018 accounting year.

- His drawings amounted to GH¢47,400. Wining from a lottery of GH¢5,000 was put into the business.

- He bought extra Furniture for GH¢2,000.

- Furniture and Fittings is to be depreciated at GH¢2,175 for the year.

As at 31 December 2018 his assets and liabilities apart from Furniture and Fittings were as follows:

GH¢

Cash in hand 1,000

Bank overdraft 12,000

Inventory 12,845

Trade receivables 5,750

Trade payables 5,290

Motor Vehicle to be valued at 40,000

Prepaid 10,000

Required:

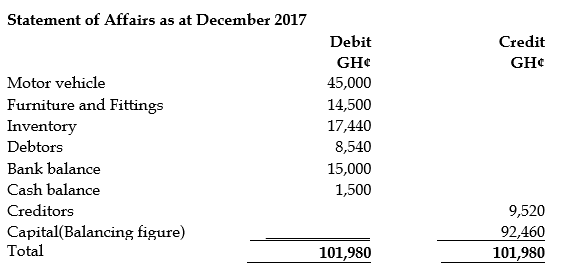

i) Prepare the Statement of affairs for December 2017. (2 marks)

View Solution

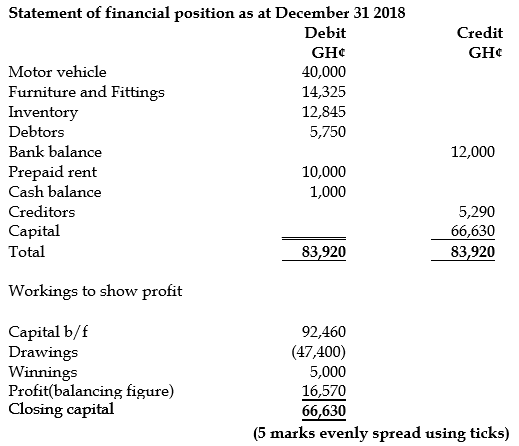

ii) Prepare the statement of financial position (showing the movements in retained earnings made by Mr Preprah) as at 31 December 2018.

View Solution