Nov 2019 Q4

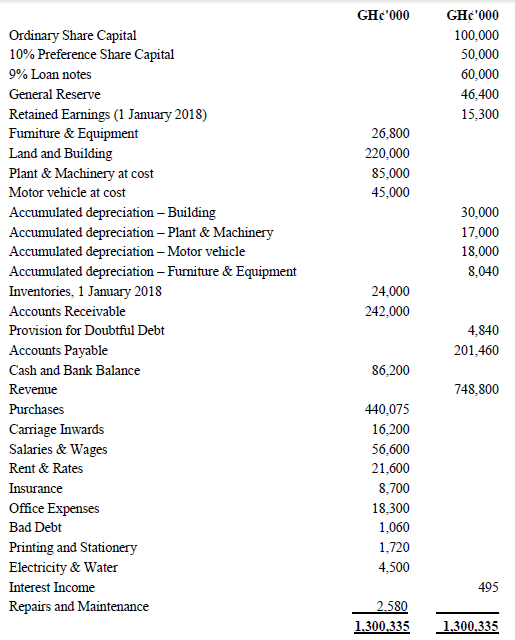

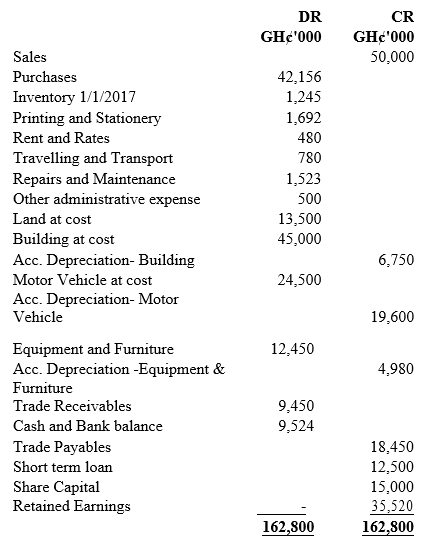

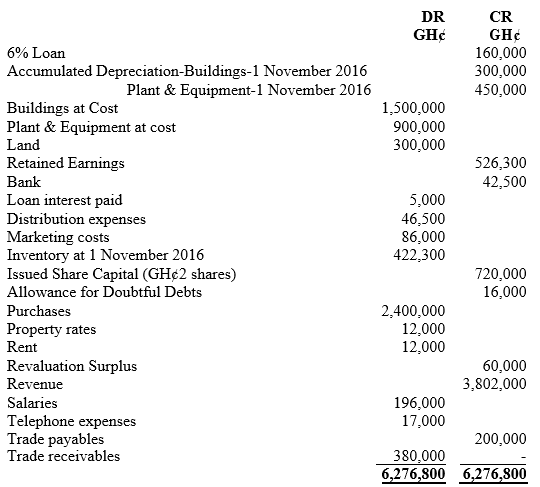

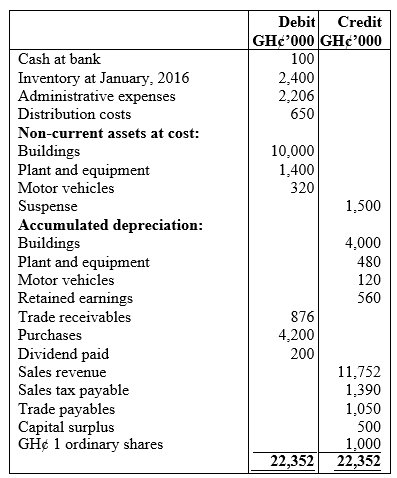

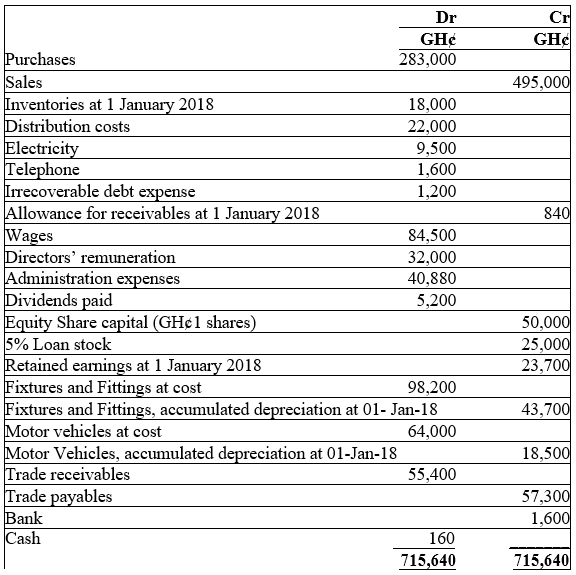

The following balances were extracted from the books of Tudu Ltd on 31 December 2018.

Additional information:

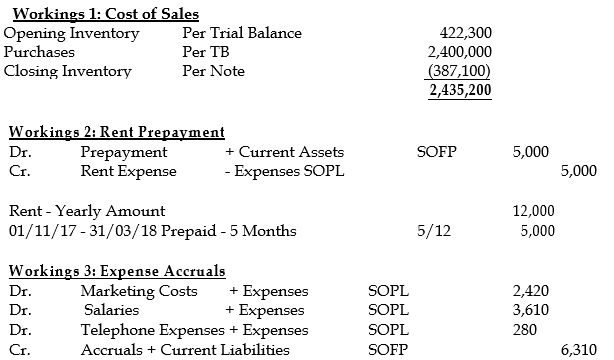

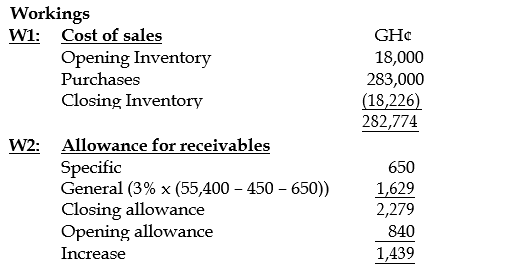

i) Inventories at 31 December 2018 was valued at GH¢18,226.

ii) Directors’ bonuses for the year ended 31 December 2018 calculated at GH¢1,160 have not been accounted for.

iii) Distribution costs include a payment of GH¢3,750 for rent for the three months to 28 Feb-ruary 2019.

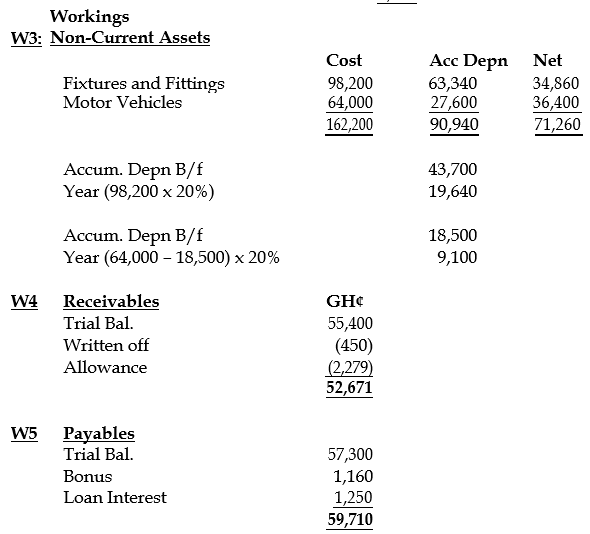

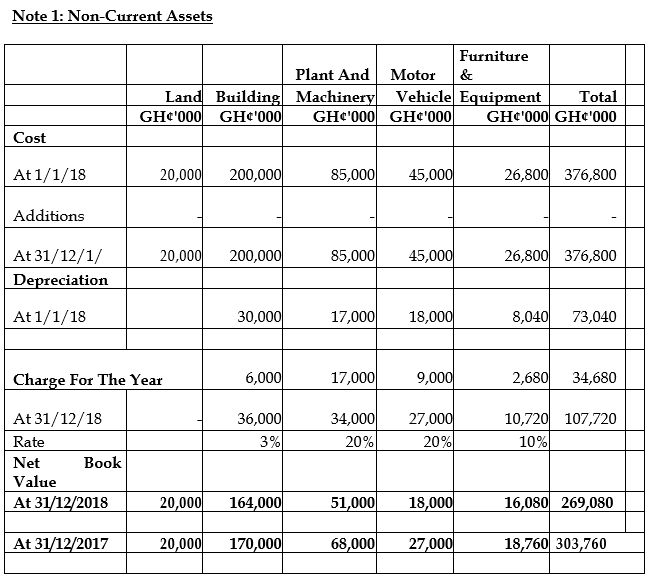

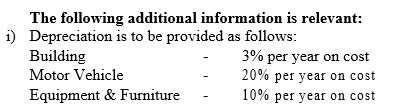

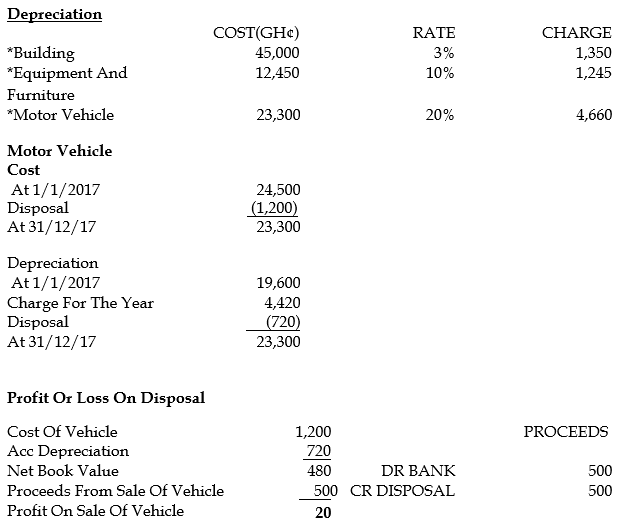

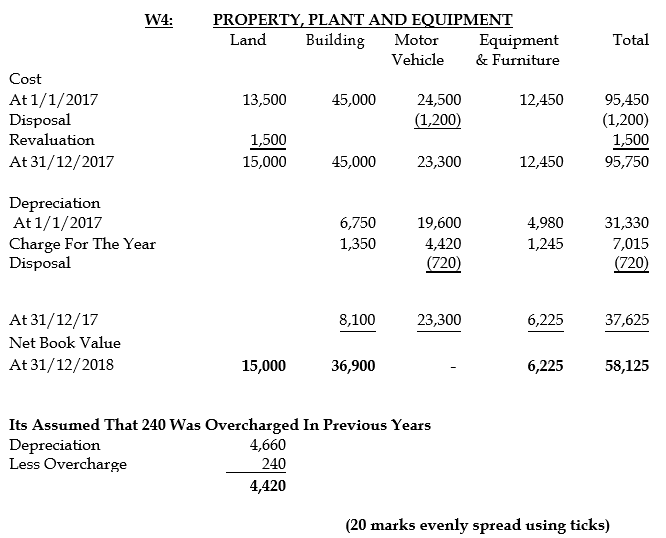

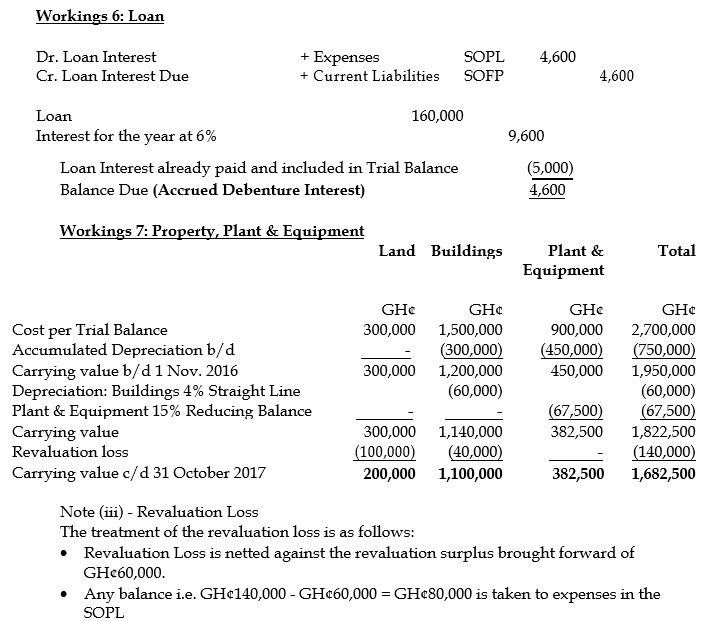

iv) The company’s depreciation policies are as follows:

- Fixtures and Fittings – Straight line over 5 years.

- Motor vehicles – Reducing balance method at 20% per annum.

- All non-current asset residual values are estimated at zero.

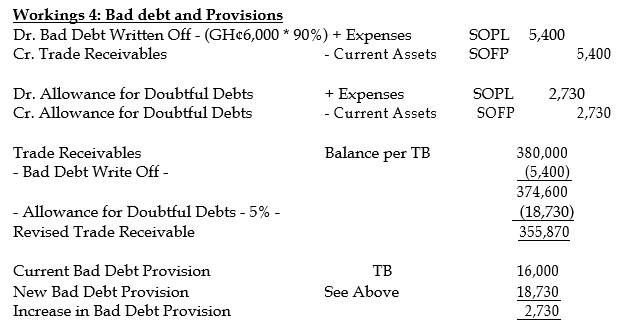

v) The company reviewed the trade receivables at 31 December 2018, and the following ad-justments are required:

- Irrecoverable debts of GH¢450 in addition to those already written off.

- Specific allowance for receivables of GH¢650.

- General allowance of 3% against the remaining receivables.

vi) The interest on the loan stock is outstanding at the year end.

Required:

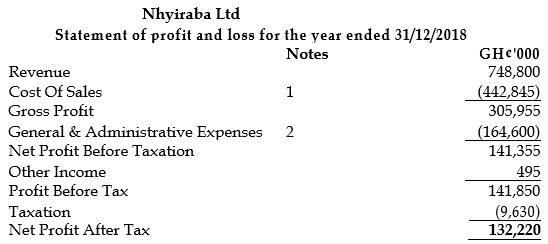

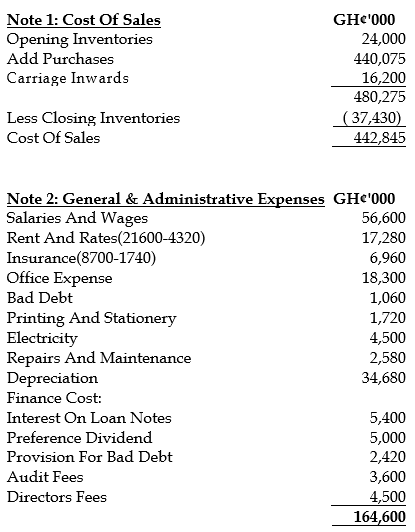

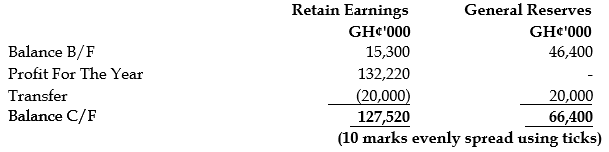

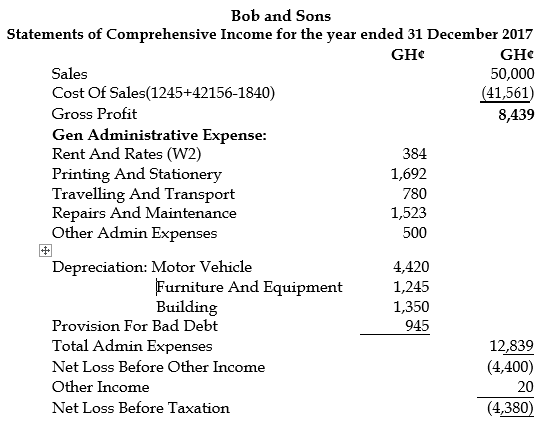

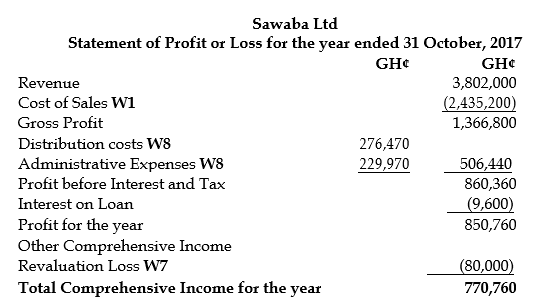

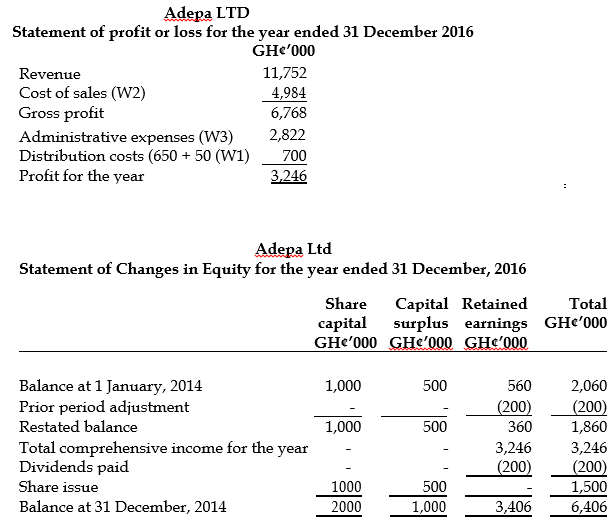

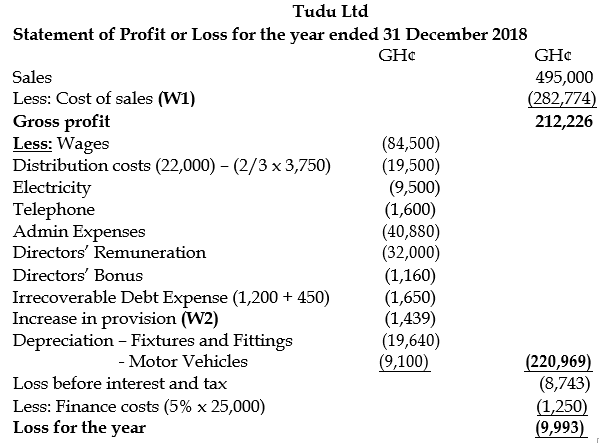

a) Prepare a Statement of Profit or Loss account for Tudu Ltd for the year ended 31 December 2018. (10 marks)

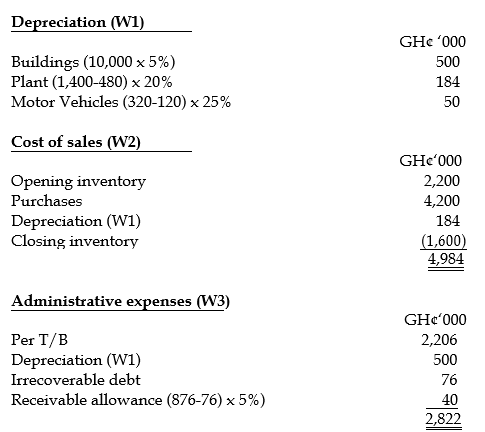

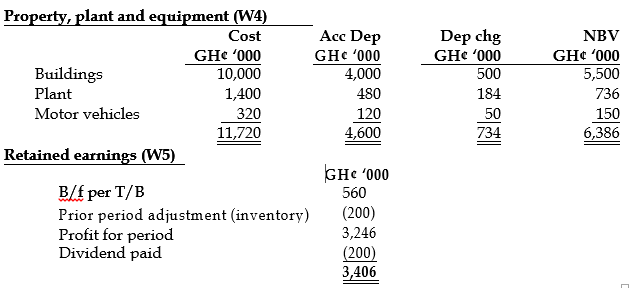

View Solution

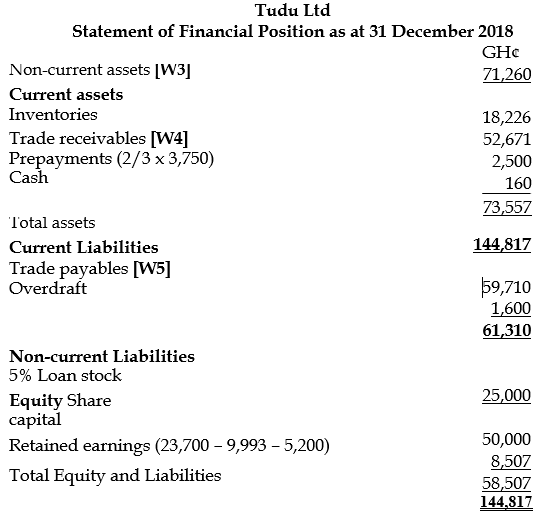

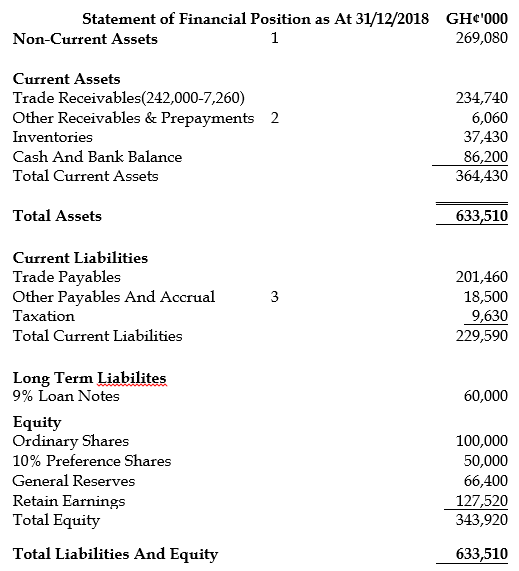

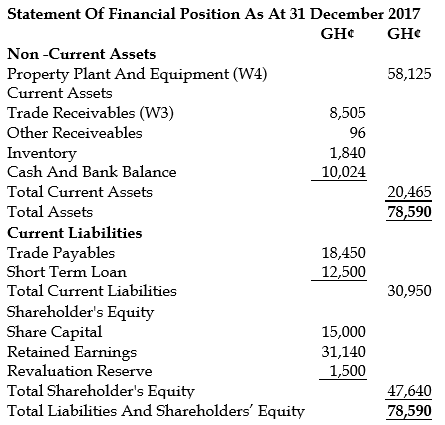

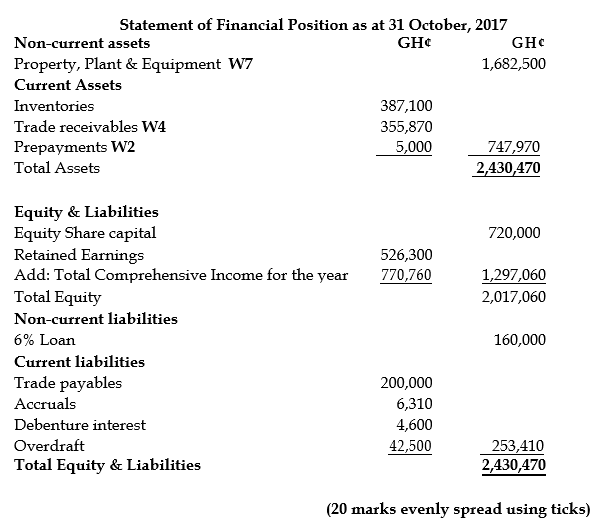

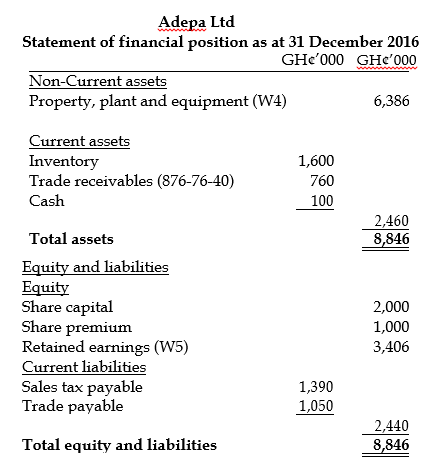

b) Prepare a Statement of Financial Position for Tudu Ltd as at 31 December 2018. (10 marks)

View Solution