Nov 2018 Q3 a.

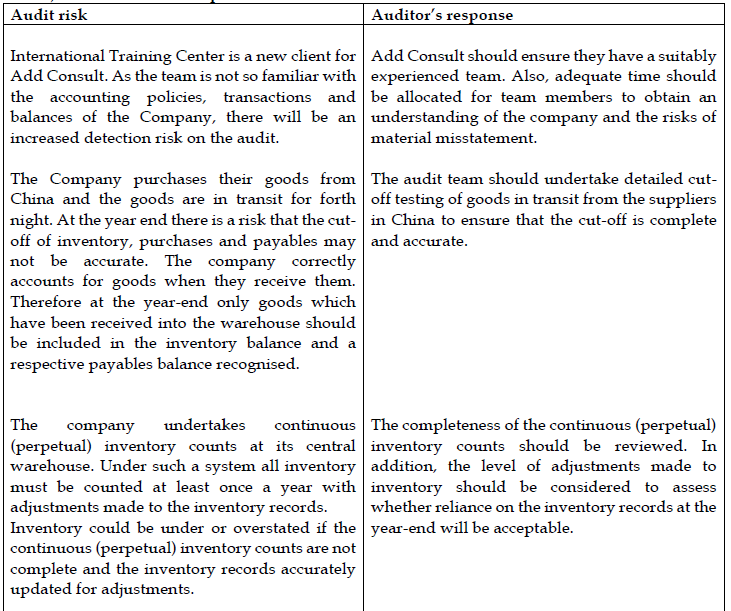

International Training Center (ITC) is a large company limited by shares which operates a network of teaching centers in countries across West Africa. The Company was incorporated under the requirements of the Companies Act, 1963 (Act 179) on 19 January 1990 and domiciled in Ghana. Students who register with the Center pay 30% during initial registration and the remaining 70% over the course period. You are the senior Associate of Add Consult. ITC is a new client and you are currently planning the audit with the audit manager to audit the company for the year ended 31 December 2017.

You have been provided with the following planning notes from the audit partner following his meeting with the Finance Director.

- ITC purchases stationery from a supplier in China and these goods are shipped to the company’s central warehouse. The goods are usually in transit for a fortnight and the company correctly records the goods when received. ITC does not undertake a year-end inventory count, but carries out monthly continuous (perpetual) inventory counts and any errors identified are adjusted in the inventory system for that month.

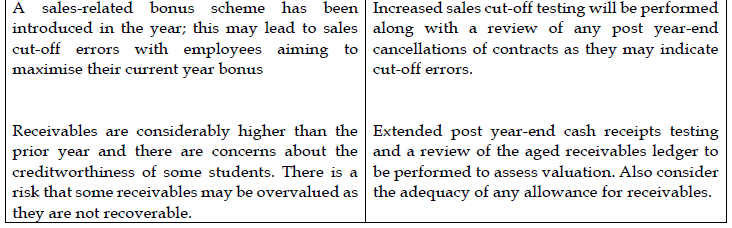

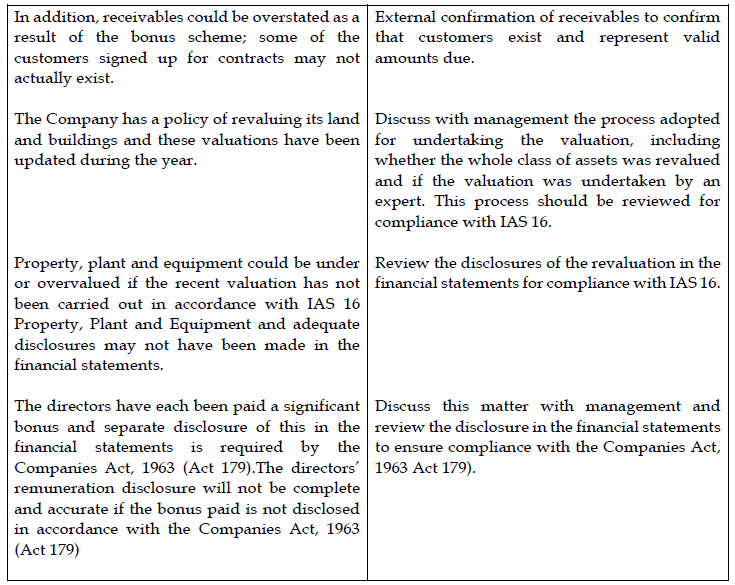

- During the year the directors of the Company have each been paid a significant bonus, and they have included this in wages and salaries expenses. Separate disclosure of the bonus is required by the Companies Act.

- ITC has a policy of revaluing its land and buildings and this year has updated the valuations of all land and buildings.

- During the year the company introduced a bonus based scheme on sales for its sales persons. The bonus target was based on increasing the number of students signing up for 6-month courses by the school for individuals running accountancy examinations. This has been successful and revenue has increased by 25%, especially in the last few months of the year. The level of receivables is considerably higher than last year and there are concerns about the creditworthiness of some students.

Required:

a) Describe FIVE (5) audit risks, and explain the auditor’s response to each risk, in planning the audit of International Training Center. (10 marks)

View Solution