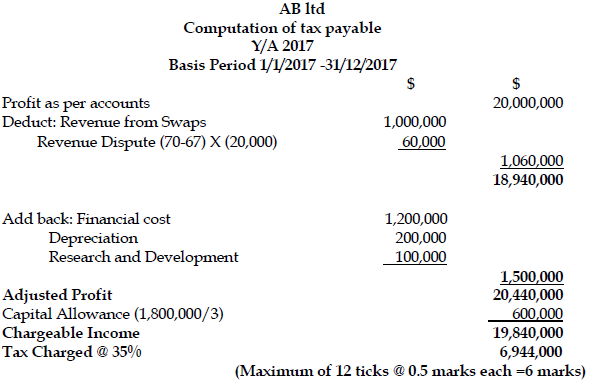

The following is relevant for the operation of AB Ltd, operating in the upstream petroleum sector for 2017 year of assessment.

The following additional information forms part of the above:

- The revenue above includes financial gain from swaps of $1,000,000

- The financial cost of $1,200,000 was added to cost

- The cost includes a depreciation of $200,000

- Research and development of $100,000 incurred was added to the cost of operation

- Revenue on 20,000 barrels of oil sold was added to revenue. It came to light that the disputed price used on the 20,000 barrels was $70 in its tax returns. What has finally been agreed now is put at $67 and this has been certified by the Petroleum Unit of the Ghana Revenue Authority.

- Written down value as of 31/12/2016 was $1,800,000 after granting capital allowance the second time as of 2016 year end. This information is yet to be adjusted.

Required:

i) Compute tax payable. (6 marks)

View Solution

ii) Comment on the deductibility of financial cost in petroleum operations. (2 marks)

View Solution

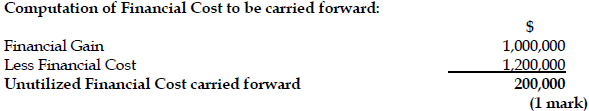

Commentary:

- The deduction of the financial cost from the revenue was not correct as the provision of the law allows a unique treatment as demonstrated below.

- Financial cost incurred shall be deducted from financial gain. Any financial cost incurred which cannot be deducted from financial gain shall be carried forward for the next five (5) years. The amount of $ 200,000 shall be carried forward.

- It shall continue to be matched against financial gain if any. If for the next five years, there is no financial gain, it shall be abandoned and ignored.

- It is not used as an allowable deductions and financial gain is not added to income. They are both reversed.

(Any 2 points for 1 mark)